Lexmark 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

guidance. The guidance requires an entity to measure those obligations as the sum of the amount the reporting entity agreed to pay on

the basis of its arrangement among its co-obligors and any additional amount the reporting entity expects to pay on behalf of its co-

obligors. The amendments in ASU 2013-04 are effective for the Company’s 2014 fiscal year and must be applied retrospectively to

joint and several liability obligations that exist at the beginning of the year of adoption. The Company does not expect the

amendments in ASU 2013-04 to have a material impact to its financial statements.

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters (Topic 830): Parent’s Accounting for the Cumulative

Translation Adjustment Upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment

in a Foreign Entity (“ASU 2013-05”). The amendments in ASU 2013-05 address the diversity in practice about when to release the

cumulative translation adjustment related to a foreign entity. ASU 2013-05 clarifies that if a group of assets or business is sold that

doesn’t constitute the entire foreign entity (transactions occurring within a foreign entity) the cumulative translation adjustment should

not be released until there is a complete or substantially complete liquidation of the foreign entity. However, transactions resulting in

the sale of an investment in a foreign entity (loss of a controlling financial interest) will trigger the release of the cumulative

translation adjustment into earnings under ASU 2013-05. The amendments in ASU 2013-05 are effective prospectively for the

Company’s 2014 fiscal year. The Company does not anticipate a material impact to its financial statements from ASU 2013-05, absent

any material transactions in future periods involving the derecognition of subsidiaries or groups of assets within a foreign entity.

In July 2013, the FASB issued ASU No. 2013-11, Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a

Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (“ASU 2013-11”). ASU 2013-11 requires

that unrecognized tax benefits be presented as a reduction to deferred tax assets for all same jurisdiction loss or other tax

carryforwards that are available and would be used by the entity to settle additional income taxes resulting from disallowance of the

uncertain tax position. The amendments in ASU 2013-11 are effective for the Company’s 2014 fiscal year (and interim periods within)

and will be applied prospectively to all unrecognized tax benefits that exist at the effective date. Although the Company is still

evaluating the impact of ASU 2013-11, it does not expect a significant impact to its statement of financial position at this time.

The FASB issued other guidance during the period that is not applicable to the Company’s current financial statements and disclosures

and, therefore, is not discussed above.

Reclassifications:

Certain prior year amounts have been reclassified to conform to current presentation. Results for all periods presented in this Annual

Report on Form 10-K reflect the retrospective application of the accounting policy change for pension and other postretirement plan

gains and losses described above.

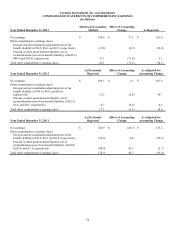

In the fourth quarter of 2013, the Company changed its presentation of Cash flows from operating activities on the Consolidated

Statements of Cash Flows to separately disclose Pension and other postretirement (income) expense and Pension and other

postretirement contributions. Prior year amounts have been reclassified to conform to current presentation. These amounts were

previously included in Other and Other assets and liabilities for the years ended December 31, 2013 and 2012 and in Other, Accrued

liabilities, and Other assets and liabilities for the year ended December 31, 2011.

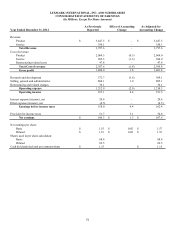

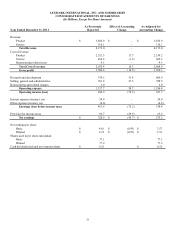

During 2013, service revenue exceeded ten percent of total revenue and is separately stated, along with the associated cost of revenue,

on the Consolidated Statements of Earnings. Service revenue includes extended warranties and professional services performed under

MPS arrangements, as well as software subscriptions, maintenance and support, and other software-related services. Product revenue

includes all hardware, parts, supplies and license revenue. Restructuring-related costs include accelerated depreciation charges and

excess component and other inventory-related charges. In addition, the amortization of developed technology is included as cost of

product revenue. Prior year amounts have been reclassified to conform to current year presentation.

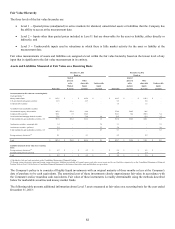

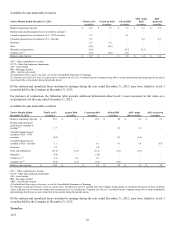

3. FAIR VALUE

General

The accounting guidance for fair value measurements defines fair value, establishes a framework for measuring fair value in

accordance with U.S. GAAP, and requires disclosures about fair value measurements. The guidance defines fair value as the price that

would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

measurement date. As part of the framework for measuring fair value, the guidance establishes a hierarchy of inputs to valuation

techniques used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by

requiring that the most observable inputs be used when available.

81