Lexmark 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Twistage offers an industry-leading, pure cloud software platform for managing video, audio and image content. Saperion is a

European-based leader in ECM solutions, focused on providing document archive and workflow solutions. PACSGEAR is a leading

provider of connectivity solutions for healthcare providers to capture, manage and share medical images and related documents and

integrate them with existing picture archiving and communication systems and EMR systems.

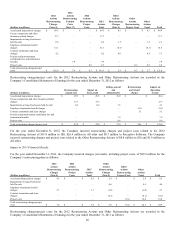

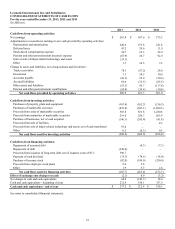

In 2012, cash flow used to acquire businesses was higher than 2011 due to the additional acquisitions of Brainware, ISYS, Nolij, and

Acuo at a total purchase price of $245.4 million compared to Pallas Athena, which was acquired in 2011. Brainware is a leading

provider of intelligent data capture software which builds upon and strengthens Lexmark’s unique, industry-leading end-to-end

products, solutions and services with a broader range of software that enables customers to capture, manage and access information

and business process workflows. ISYS is a leader in high performance enterprise and federated search and universal information

access solutions. Nolij is a prominent provider of Web-based imaging, document management and workflow solutions for the higher

education market. Acuo is a leading provider of software for the healthcare sector, including clinical content management, data

migration, and vendor neutral archives.

Refer to Part II, Item 8, Note 4 of the Notes to Consolidated Financial Statements for additional information regarding business

combinations.

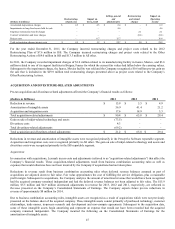

Marketable securities

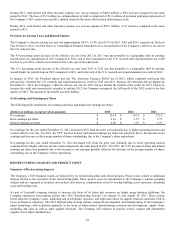

The Company increased its marketable securities investments in 2013 by $94.0 million primarily with proceeds from the debt issuance

and the sale of inkjet-related technology and assets. The Company decreased its marketable securities investments in 2012 and 2011

by $105.4 million and $86.4 million, respectively.

The Company’s investments in marketable securities are classified and accounted for as available-for-sale and reported at fair value.

At December 31, 2013 and December 31, 2012, the Company’s marketable securities portfolio consisted of asset-backed and

mortgage-backed securities, corporate debt securities, preferred and municipal debt securities, U.S. government and agency debt

securities, international government securities, certificates of deposit and commercial paper. The Company’s auction rate securities,

valued at $6.7 million and $6.3 at December 31, 2013 and December 31, 2012, respectively, were reported in the noncurrent assets

section of the Company’s Consolidated Statements of Financial Position.

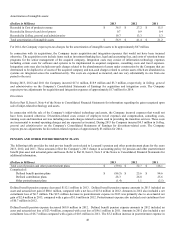

The marketable securities portfolio held by the Company contains market risk (including interest rate risk) and credit risk. These risks

are managed through the Company’s investment policy and investment management contracts with professional asset managers which

require sector diversification, limitations on maturity and duration, minimum credit quality and other criteria. The Company also

maintains adequate issuer diversification through strict issuer limits except for securities issued by the U.S. government or its

agencies. The Company’s ability to access the portfolio to fund operations could be limited by the liquidity in the market as well as

possible tax implications of moving proceeds across jurisdictions.

The Company assesses its marketable securities for other-than-temporary declines in value in accordance with the model provided

under the FASB’s amended guidance, which was adopted in the second quarter of 2009. The Company has disclosed in the Critical

Accounting Policies and Estimates portion of Management’s Discussion and Analysis its policy regarding the factors it considers and

significant judgments made in applying the amended guidance. There were no major developments during 2013 with respect to OTTI

of the Company’s marketable securities. Specifically regarding the Company’s auction rate securities, the most illiquid securities in

the portfolio, Lexmark has previously recognized OTTI on only one security due to credit events involving the issuer and the insurer.

Because of the Company’s liquidity position, it is not more likely than not that the Company will be required to sell the auction rate

securities until liquidity in the market or optional issuer redemption occurs. The Company could also hold the securities to maturity if

it chooses. Additionally, if Lexmark required capital, the Company has available liquidity through its trade receivables facility and

revolving credit facility. Given these circumstances, the Company would only have to recognize OTTI on its auction rate securities if

the present value of the expected cash flows is less than the amortized cost of the individual security.

Level 3 fair value measurements are based on inputs that are unobservable and significant to the overall valuation. Level 3

measurements were 1.1% of the Company’s total available-for-sale marketable securities portfolio at December 31, 2013 compared to

2.1% at December 31, 2012.

Refer to Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for additional information regarding fair value

measurements. Refer to Part II, Item 8, Note 7 of the Notes to Consolidated Financial Statements for additional information regarding

marketable securities.

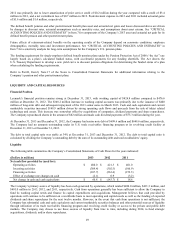

Capital expenditures

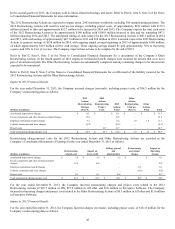

The Company invested $167.4 million, $162.2 million, and $156.5 million into Property, plant and equipment for the years 2013,

2012 and 2011, respectively. Further discussion regarding 2013 capital expenditures as well as anticipated spending for 2014 are

provided near the end of Item 7.

52