Lexmark 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

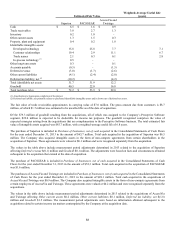

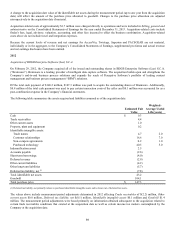

The fair value of trade receivables approximated the carrying value of $4.4 million. The gross amount due from customers is $10.0

million, of which $5.6 million was estimated to be uncollectible as of the date of acquisition.

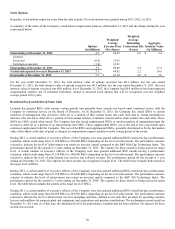

The total estimated fair value of intangible assets acquired was $62.0 million, with a weighted-average useful life of 5.3 years.

The Company assumed $4.0 million of short term debt in the acquisition. The debt was repaid in the first quarter of 2012 after the

acquisition date and is included in Repayment of assumed debt in the financing section of the Company’s Consolidated Statements of

Cash Flows for the year ended December 31, 2012. There was no gain or loss recognized on the extinguishment of the debt.

Goodwill of $104.1 million arising from the acquisition was assigned to the Perceptive Software segment. The goodwill recognized

comprises the value of expected synergies arising from the acquisition that are complementary to the Perceptive Software business.

None of the goodwill recognized is expected to be deductible for income tax purposes.

The acquisition of Brainware is included in Purchase of businesses, net of cash acquired in the investing section of the Consolidated

Statements of Cash Flows for the year ended December 31, 2012 in the amount of $147 million, which is the total purchase price less

cash acquired of $0.3 million.

During the first quarter of 2012, certain employees of Brainware were granted restricted stock units by the Company. Because the

Company was not obligated to issue replacement share-based payment awards to the employees, the awards are accounted for as a

separate transaction and recognized as post-combination expense over the requisite service period. These awards are not material for

separate disclosure.

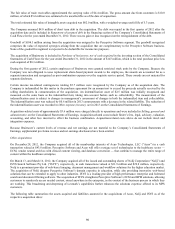

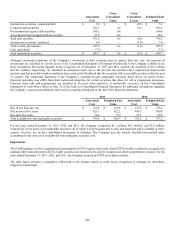

Certain income tax-related contingencies totaling $5.7 million were recognized by the Company as of the acquisition date. The

Company is indemnified for this matter in the purchase agreement for an amount not to exceed the proceeds actually received by the

selling shareholders in consummation of the acquisition. An indemnification asset of $2.5 million was initially recognized and

measured on the same basis as the indemnified item, taking into account factors such as collectability. The measurement of the

indemnification asset is subject to changes in management’s assessment of changes in both the indemnified item and collectability.

The indemnification asset was reduced by $0.6 million in 2013 commensurate with a decrease in the related liability. The reduction of

the indemnification asset was recorded in Other expense (income), net in 2013 on the Consolidated Statements of Earnings.

Acquisition-related costs of approximately $3.6 million were charged directly to operations and were included in Selling, general and

administrative on the Consolidated Statements of Earnings. Acquisition-related costs include finder’s fees, legal, advisory, valuation,

accounting, and other fees incurred to effect the business combination. Acquisition-related costs above do not include travel and

integration expenses.

Because Brainware’s current levels of revenue and net earnings are not material to the Company’s Consolidated Statements of

Earnings, supplemental pro forma revenue and net earnings disclosures have been omitted.

Other Acquisitions

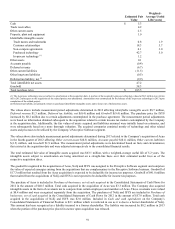

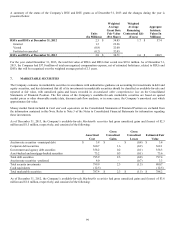

On December 28, 2012, the Company acquired all of the membership interests of Acuo Technologies, LLC (“Acuo”) in a cash

transaction valued at $43.8 million. Perceptive Software and Acuo will offer a unique set of technologies to the healthcare sector —

ECM, vendor neutral archives with clinical content viewing, and database conversion — that combine to manage the entire range of

content within the healthcare enterprise.

On March 13, and March 16, 2012, the Company acquired all of the issued and outstanding shares of Nolij Corporation (“Nolij”) and

ISYS Search Software Pty Ltd. (“ISYS”), respectively, in cash transactions valued at $31.9 million and $29.8 million, respectively.

Nolij is a prominent provider of web-based imaging, document management and workflow solutions for the higher education market.

The acquisition of Nolij deepens Perceptive Software’s domain expertise in education, while also providing innovative web-based

solutions that can be extended to apply to other industries. ISYS is a leading provider of high performance enterprise and federated

search and document filtering software. The acquisition of ISYS strengthens Perceptive Software’s ECM and BPM solutions, allowing

customers to seamlessly access needed content, stored anywhere in the enterprise, in the context of the business process in which they

are working. This broadening and deepening of Lexmark’s capabilities further enhances the solutions expertise offered to its MPS

customers.

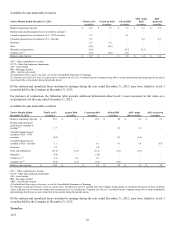

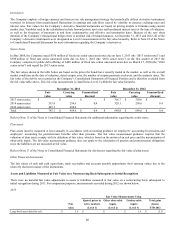

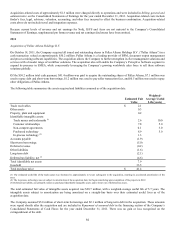

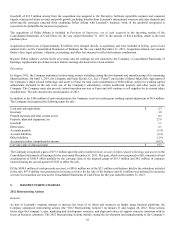

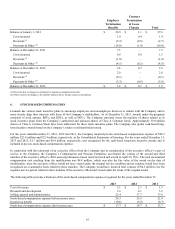

The following table summarizes the assets acquired and liabilities assumed in the acquisitions of Acuo, Nolij and ISYS as of the

respective acquisition dates:

90