Lexmark 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

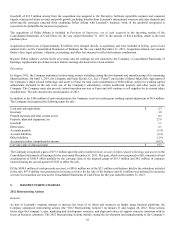

Long-lived assets held for sale

Related to the 2007 restructuring plan, the Company’s Boigny, France site with carrying value of $3 million was written down in 2012

to fair value less cost to sell of approximately $1 million, based on a non-binding indication of value from a potential buyer. This

action resulted in a loss of $1.5 million recorded in Selling, general and administrative on the Company’s Consolidated Statements of

Earnings. The site is included in Property, plant and equipment, net on the Consolidated Statements of Financial Position. The

Company is actively marketing the site for sale. The site has been vacated by the Company and, due to the restructuring action noted

above, is not being employed by the Company in its highest and best use. The site was also subject to a nonrecurring fair value

measurement in 2011.

Related to the August 2012 restructuring plan, certain of the Company’s machinery and equipment assets with carrying value of $0.9

million were written down in 2012 to fair value less cost to sell of $0.3 million due to the company’s receipt of an offer to purchase

the assets at a price that was below the carrying values of the assets. The resulting loss of $0.6 million was recorded in Restructuring-

related costs on the Company’s Consolidated Statements of Earnings. The assets qualified as held for sale in 2012 and were included

in Property, plant and equipment, net on the Company’s Consolidated Statements of Financial Position. The assets were sold in 2013.

4. BUSINESS COMBINATIONS AND DIVESTITURES

2013

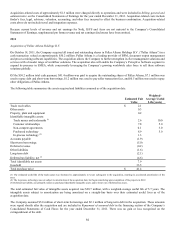

On September 16, 2013 the Company acquired Saperion AG (“Saperion”). Saperion is a European-based leader in ECM solutions,

focused on providing document archive and workflow solutions. The acquisition expands Perceptive Software's European-based

footprint in the ECM market, and will further strengthen the Company’s strategy of providing the platform, products and solutions that

help companies manage their unstructured information challenges. The purchase accounting for the acquisition of Saperion has not

been finalized as certain income tax matters are still being evaluated.

Of the total cash payment of $72.3 million to acquire Saperion, $72.2 million was paid to acquire all of the issued and outstanding

shares of Saperion, while $0.1 million relates to assets acquired by the Company that were recognized separately from the acquisition.

On October 3, 2013 the Company acquired PACSGEAR, Inc. (“PACSGEAR”). PACSGEAR is a leading provider of connectivity

solutions for healthcare providers to capture, manage and share medical images and related documents and integrate them with

existing picture archiving and communication systems and electronic medical records (“EMR”) systems. With this acquisition,

Perceptive Software will be uniquely positioned to offer a vendor-neutral, standards-based clinical content platform for capturing,

managing, accessing and sharing patient imaging information and related documents within healthcare facilities through an EMR and

between facilities via PACSGEAR technology.

Of the total cash payment of $54.1 million, $53.9 million was paid to acquire all of the issued and outstanding shares of PACSGEAR.

Additionally, $0.2 million of the total cash payment was used to pay certain transaction costs and other obligations of the sellers.

On March 1, 2013 the Company acquired AccessVia, Inc. (“AccessVia”) and Twistage, Inc. (“Twistage”). AccessVia provides

industry-leading signage solutions to create and produce retail shelf-edge materials, all from a single platform, which can be directed

to a variety of output devices and published to digital signs or electronic shelf tags. AccessVia, when combined with Lexmark’s MPS

and expertise in delivering print and document process solutions to the retail market, will enable customers to quickly design and

produce in-store signage for better and more timely merchandising in a highly distributed store environment. Twistage offers an

industry-leading, pure cloud software platform for managing video, audio and image content. When combined with Lexmark,

Twistage will enable customers to capture, manage and access all of their content, including rich media content assets, within the

context of their business processes and enterprise applications.

Of the total cash payment of $31.5 million, $29.0 million was paid to acquire all of the issued and outstanding shares of AccessVia

and Twistage. Additionally, $2.3 million of the total cash payment was used to pay certain transaction costs and other obligations of

the sellers and $0.2 million relates to assets acquired by the Company that were recognized separately from the acquisitions.

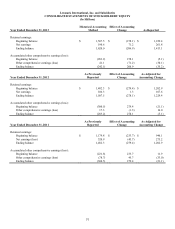

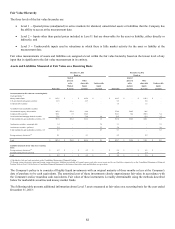

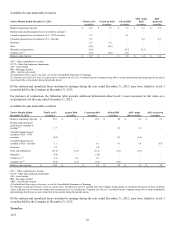

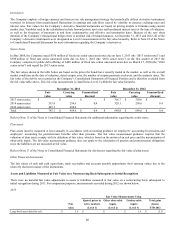

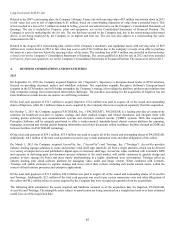

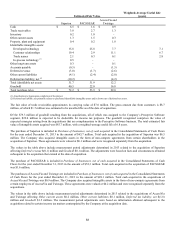

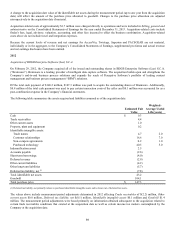

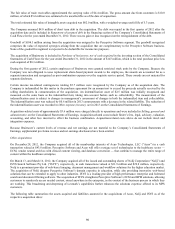

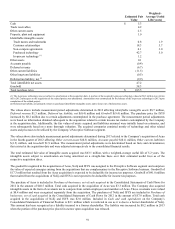

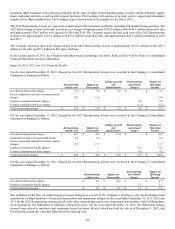

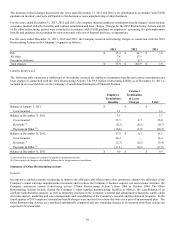

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date for Saperion, PACSGEAR,

AccessVia and Twistage. The intangible assets subject to amortization are being amortized on a straight-line basis over their estimated

useful lives as of the acquisition date:

87