Lexmark 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

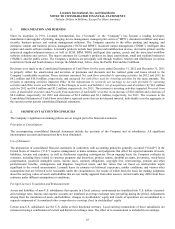

annual basis the net gains and losses (except those differences not yet reflected in the market-related value of plan assets) were

amortized into operating results (to the extent that they exceeded 10% of the higher of the market-related value of plan assets or the

projected benefit obligation of each respective plan) over the average future service period of active employees within the related

plans. Further, the Company previously elected to primarily use the market-related value of plan assets rather than fair value to

determine the expected return on plan assets component of pension expense which, under the accounting guidance, allows gains and

losses to be recognized in a systematic and rational manner over a period of no more than five years. Differences between the

assumed and actual returns were reflected in market-related value on a straight-line basis over a five-year period.

Under the new accounting method, Lexmark immediately recognizes the change in the fair value of plan assets and net actuarial gains

and losses in pension and other postretirement benefit plan costs annually in the fourth quarter of each year and in any quarter during

which a remeasurement is triggered. The remaining components of net periodic benefit cost, primarily net service cost, interest cost

and the expected return on plan assets, are recorded on a quarterly basis as ongoing benefit costs. The expected return on plan assets is

now determined using fair value rather than the market-related value of plan assets. While Lexmark’s historical policy of recognizing

pension and other postretirement benefit plan asset and actuarial gains and losses was considered acceptable under U.S. GAAP, the

Company believes that the new policy is preferable as it eliminates the delay in recognizing changes in the fair value of plan assets

and actuarial gains and losses within operating results. This change also improves transparency within Lexmark’s operating results by

immediately recognizing the effects of economic and interest rate trends on plan investments and assumptions in the year these gains

and losses are actually incurred. This change in accounting policy has been applied retrospectively, adjusting all prior periods

presented.

Lexmark also changed its method of accounting for certain costs included in inventory and capitalized software, effective in the fourth

quarter of 2013. Under the new method, pension and other postretirement benefit plan costs attributable to inactive employees are

charged directly to Cost of revenue or Selling, general and administrative as period costs rather than included in inventoriable costs or

capital amounts. Management believes that it is preferable to allocate to inventory and capitalized software only those pension and

other postretirement benefit plan costs related to active employees whose wages are directly or indirectly allocated to the current

production of inventory and capitalized software, as required under U.S. GAAP. As retrospective application of this change did not

have a material impact on previously reported Inventories, Cost of revenue, Selling, general and administrative, internal-use software,

or financial results or balances in any period presented in this Annual Report on Form 10-K, prior period results have not been

retrospectively adjusted.

In addition, in the fourth quarter of 2013, Lexmark changed its method of allocating the elements of net periodic pension and other

postretirement benefit plan cost to reporting segments. Results for all periods presented in this Annual Report on Form 10-K reflect

the retrospective application of the segment allocation method change. Refer to Note 20 of the Notes to Consolidated Financial

Statements for additional information.

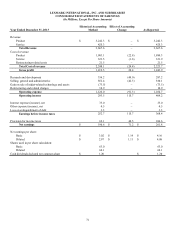

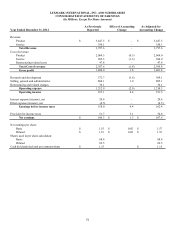

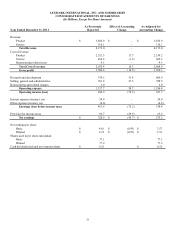

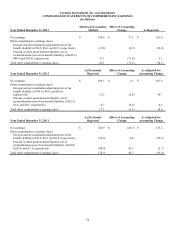

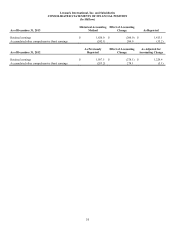

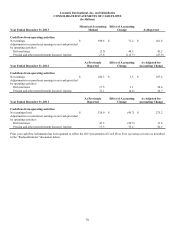

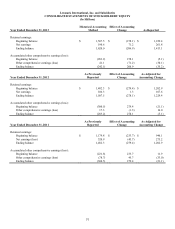

The impact of all adjustments made to the financial statements presented is summarized below (amounts in millions, except per share

data):

70