Lexmark 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

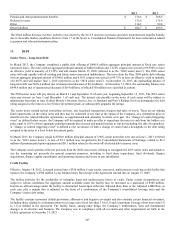

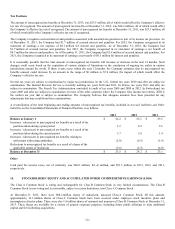

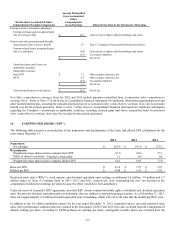

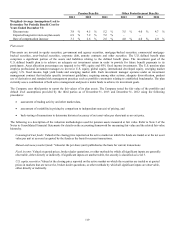

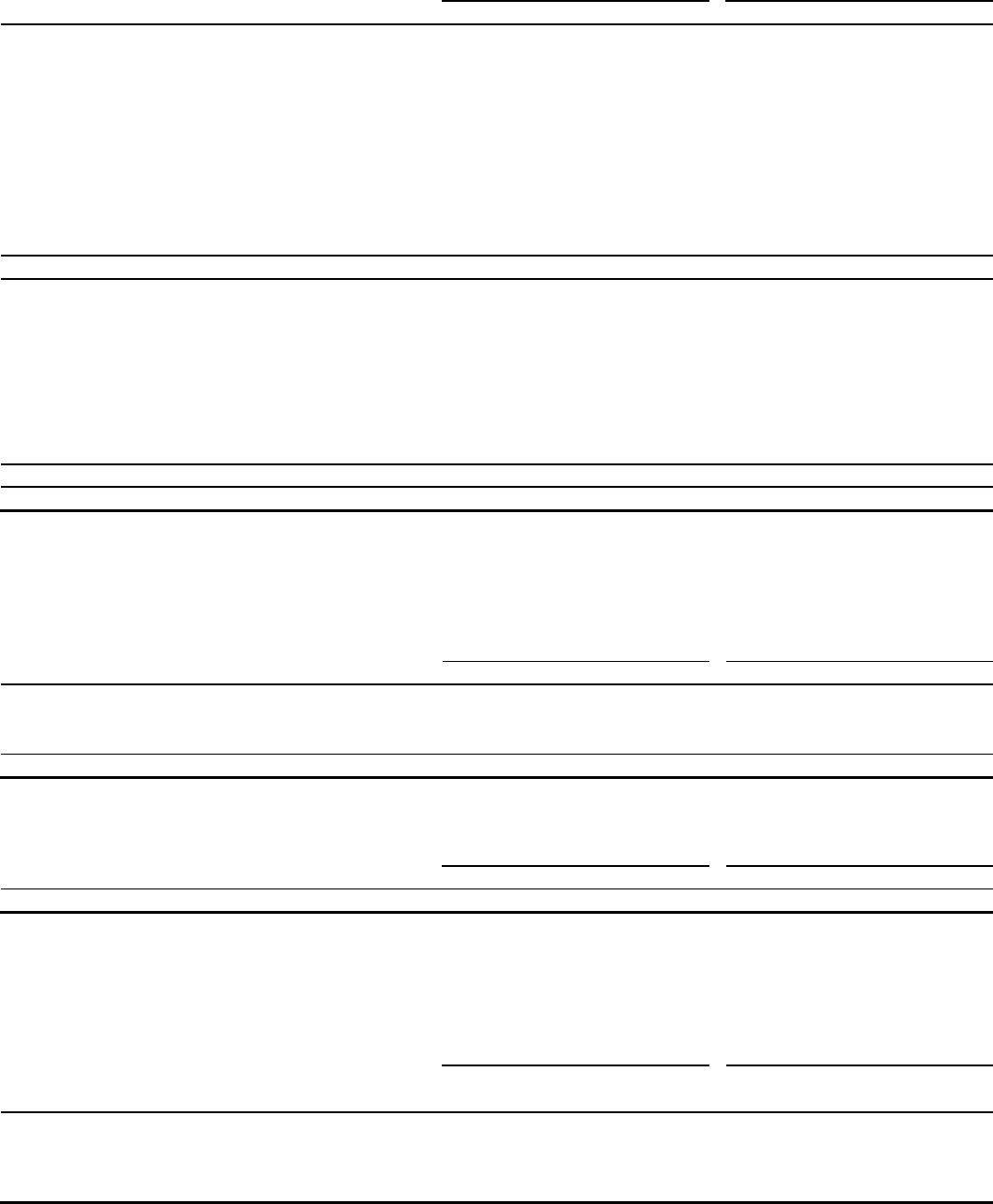

Obligations and funded status at December 31:

Pension Benefits Other Postretirement Benefits

2013 2012 2013 2012

Change in Benefit Obligation:

Benefit obligation at beginning of year $ 883.2 $ 817.3 $ 37.9 $ 40.7

Service cost 4.8 3.6 0.7 0.8

Interest cost 32.3 34.0 1.1 1.4

Contributions by plan participants 2.7 2.7 3.7 3.4

Actuarial (gain) loss (63.3) 63.7 (2.4) (1.6)

Benefits paid (57.0) (52.7) (7.4) (7.6)

Foreign currency exchange rate changes 4.1 5.3 – –

Plan amendments and adjustments (0.2) 2.6 (2.7) 0.1

Settlement, curtailment or termination benefit loss – 6.7 – 0.7

Benefit obligation at end of year 806.6 883.2 30.9 37.9

Change in Plan Assets:

Fair value of plan assets at beginning of year 660.6 587.2 – –

Actual return on plan assets 60.3 83.5 – –

Contributions by the employer 21.1 35.2 3.7 4.2

Benefits paid (57.0) (52.7) (7.4) (7.6)

Foreign currency exchange rate changes 3.9 4.6 – –

Plan adjustments 0.5 0.1 – –

Contributions by plan participants 2.7 2.7 3.7 3.4

Fair value of plan assets at end of year 692.1 660.6 – –

Unfunded status at end of year $ (114.5) $ (222.6) $ (30.9) $ (37.9)

For 2012, the Settlement, curtailment or termination benefit loss in the table above were primarily due to restructuring related

activities in the U.S. and France.

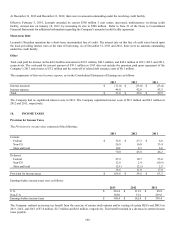

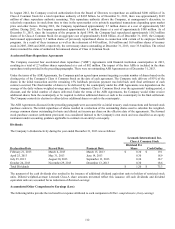

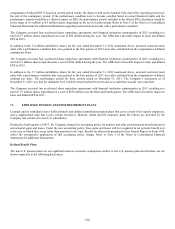

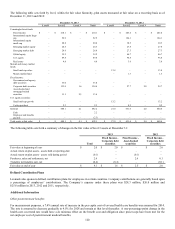

Amounts recognized in the Consolidated Statements of Financial Position:

Pension Benefits Other Postretirement Benefits

2013 2012 2013 2012

Noncurrent assets $ 8.3 $ 5.7 $ – $ –

Current liabilities (1.4) (1.4) (3.7) (4.5)

Noncurrent liabilities (121.4) (226.9) (27.2) (33.4)

Net amount recognized $ (114.5) $ (222.6) $ (30.9) $ (37.9)

Amounts recognized in Accumulated Other Comprehensive Income and Deferred Tax Accounts:

Pension Benefits Other Postretirement Benefits

2013 2012 2013 2012

Prior service credit (cost) $ 0.5 $ (0.2) $ 2.0 $ –

The accumulated benefit obligation for all of the Company’s defined benefit pension plans was $798.5 million and $873.8 million at

December 31, 2013 and 2012, respectively.

Pension plans with a benefit obligation in excess of plan assets at December 31:

2013 2012

Benefit

Obligation Plan Assets

Benefit

Obligation Plan Assets

Plans with projected benefit obligation in excess of plan

assets $ 767.8 $ 645.0 $ 846.9 $ 618.6

Plans with accumulated benefit obligation in excess of

plan assets 760.8 645.0 839.3 618.6

117