Lexmark 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

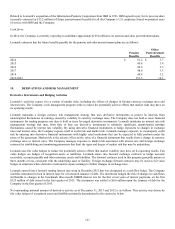

indemnities do not always include limits on the claims, provided the claim is made pursuant to the procedures required in the contract.

Historically, payments made related to these indemnifications have been immaterial.

Contingencies

The Company is involved in lawsuits, claims, investigations and proceedings, including those identified below, consisting of

intellectual property, commercial, employment, employee benefits and environmental matters that arise in the ordinary course of

business. In addition, various governmental authorities have from time to time initiated inquiries and investigations, some of which are

ongoing, including concerns regarding the activities of participants in the markets for printers and supplies. The Company intends to

continue to cooperate fully with those governmental authorities in these matters.

Pursuant to the accounting guidance for contingencies, the Company regularly evaluates the probability of a potential loss of its

material litigation, claims or assessments to determine whether a liability has been incurred and whether it is probable that one or more

future events will occur confirming the loss. If a potential loss is determined by the Company to be probable, and the amount of the

loss can be reasonably estimated, the Company establishes an accrual for the litigation, claim or assessment. If it is determined that a

potential loss for the litigation, claim or assessment is less than probable, the Company assesses whether a potential loss is reasonably

possible, and will disclose an estimate of the possible loss or range of loss; provided, however, if a reasonable estimate cannot be

made, the Company will provide disclosure to that effect. On at least a quarterly basis, management confers with outside counsel to

evaluate all current litigation, claims or assessments in which the Company is involved. Management then meets internally to evaluate

all of the Company’s current litigation, claims or assessments. During these meetings, management discusses all existing and new

matters, including, but not limited to, (i) the nature of the proceeding; (ii) the status of each proceeding; (iii) the opinions of legal

counsel and other advisors related to each proceeding; (iv) the Company’s experience or experience of other entities in similar

proceedings; (v) the damages sought for each proceeding; (vi) whether the damages are unsupported and/or exaggerated;

(vii) substantive rulings by the court; (viii) information gleaned through settlement discussions; (ix) whether there is uncertainty as to

the outcome of pending appeals or motions; (x) whether there are significant factual issues to be resolved; and/or (xi) whether the

matters involve novel legal issues or unsettled legal theories. At these meetings, management concludes whether accruals are required

for each matter because a potential loss is determined to be probable and the amount of loss can be reasonably estimated; whether an

estimate of the possible loss or range of loss can be made for matters in which a potential loss is not probable, but reasonably possible;

or whether a reasonable estimate cannot be made for a matter.

Litigation is inherently unpredictable and may result in adverse rulings or decisions. In the event that any one or more of these

litigation matters, claims or assessments result in a substantial judgment against, or settlement by, the Company, the resulting liability

could also have a material effect on the Company’s financial condition, cash flows, and results of operations.

Legal proceedings

Lexmark v. Static Control Components, Inc.

On December 30, 2002 ("02 action") and March 16, 2004 ("04 action"), the Company filed claims against Static Control Components,

Inc. ("SCC") in the U.S. District Court for the Eastern District of Kentucky (the "District Court") alleging violation of the Company’s

intellectual property and state law rights. SCC filed counterclaims against the Company in the District Court alleging that the

Company engaged in anti-competitive and monopolistic conduct and unfair and deceptive trade practices in violation of the Sherman

Act, the Lanham Act and state laws. SCC has stated in its legal documents that it is seeking approximately $17.8 million to $19.5

million in damages for the Company’s alleged anticompetitive conduct and approximately $1 billion for Lexmark’s alleged violation

of the Lanham Act. SCC is also seeking treble damages, attorney fees, costs and injunctive relief. On September 28, 2006, the District

Court dismissed the counterclaims filed by SCC that alleged the Company engaged in anti-competitive and monopolistic conduct and

unfair and deceptive trade practices in violation of the Sherman Act, the Lanham Act and state laws. On June 20, 2007, the District

Court Judge ruled that SCC directly infringed one of Lexmark’s patents-in-suit. On June 22, 2007, the jury returned a verdict that SCC

did not induce infringement of Lexmark’s patents-in-suit.

Appeal briefs for the 02 and 04 actions were filed with the U.S. Court of Appeals for the Sixth Circuit (“Sixth Circuit”) by SCC and

the Company. In a decision dated August 29, 2012, the Sixth Circuit upheld the jury’s decision that SCC did not induce patent

infringement and the District Court’s dismissal of SCC’s federal antitrust claims. The procedural dismissal of Static Control’s Lanham

Act claim and state law unfair competition claims by the District Court were reversed and remanded to the District Court. A writ of

certiorari was requested by the Company with the U.S. Supreme Court over the Sixth Circuit’s decision regarding the Lanham Act.

On June 3, 2013, the Company was notified that the U.S. Supreme Court granted the Company’s writ of certiorari. Oral argument at

the U.S. Supreme Court for this matter was held on December 3, 2013.

Post trial, SCC also filed motions with the District Court seeking attorneys’ fees, cost as well as at least $7 to $10 million in damages

for the period that the preliminary injunction was in place that prevented SCC from selling certain microchips for some models of the

Company’s toner cartridges. SCC’s motion for these damages, in excess of the $250,000 bond amount, was denied by the District

124