Lexmark 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

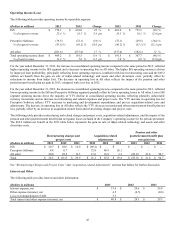

During 2013, total interest and other (income) expense, net, was an expense of $40.8 million, a 40% increase compared to the same

period in 2012. The loss of $3.3 million on extinguishment of debt is comprised of $3.2 million of premium paid upon repayment of

the Company’s 2013 senior notes and $0.1 million related to the write-off of related debt issuance costs.

During 2012, total interest and other (income) expense, net, was an expense of $29.1 million, a 1% decrease compared to the same

period in 2011.

Provision for Income Taxes and Related Matters

The Company’s effective income tax rate was approximately 28.9%, 33.8% and 18.7% in 2013, 2012 and 2011, respectively. Refer to

Part II, Item 8, Note 14 of the Notes to Consolidated Financial Statements for a reconciliation of the Company’s effective tax rate to

the U.S. statutory rate.

The 4.9 percentage point decrease of the effective tax rate from 2012 to 2013 was due primarily to a geographic shift in earnings

toward lower tax jurisdictions in 2013 compared to 2012, and to the reenactment of the U.S. research and experimentation tax credit

for the tax year 2012, which was recorded in 2013, the year of the enactment.

The 15.1 percentage point increase of the effective tax rate from 2011 to 2012 was due primarily to a geographic shift in earnings

toward higher tax jurisdictions in 2012 compared to 2011, and to the lack of the U.S. research and experimentation tax credit in 2012.

In January of 2013, the President signed into law The American Taxpayer Relief Act of 2012, which contained provisions that

retroactively extended the U.S. research and experimentation tax credit to 2012 and 2013. Because the extension did not happen by

December 31, 2012, the Company’s effective income tax rate for 2012 did not include the benefit of the credit for 2012. However,

because the credit was retroactively extended to include 2012, the Company recognized the full benefit of the 2012 credit in the first

quarter of 2013. The amount of the benefit was $6.0 million.

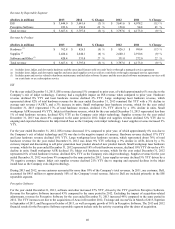

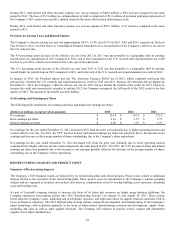

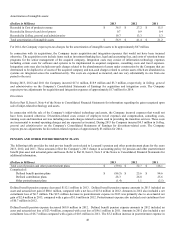

Net Earnings and Earnings per Share

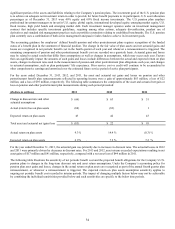

The following table summarizes net earnings and basic and diluted net earnings per share:

(Dollars in millions, except per share amounts) 2013 2012 2011

Net earnings $ 261.8 $ 107.6 $ 275.2

Basic earnings per share $ 4.16 $ 1.57 $ 3.57

Diluted earnings per share $ 4.08 $ 1.55 $ 3.53

Net earnings for the year ended December 31, 2013 increased 143% from the prior year primarily due to higher operating income and

a lower effective tax rate. For 2013, the YTY increase in basic and diluted earnings per share was primarily due to the increase in net

earnings and decrease in the average number of shares outstanding, due to the Company’s share repurchases.

Net earnings for the year ended December 31, 2012 decreased 61% from the prior year primarily due to lower operating income

combined with a higher effective tax rate when compared to the same period in 2011. For 2012, the YTY decrease in basic and diluted

earnings per share was primarily due to the decrease in net earnings partially offset by the decrease in the average number of shares

outstanding, due to the Company’s share repurchases.

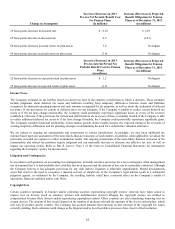

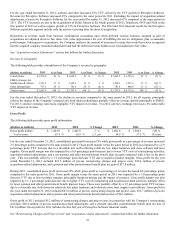

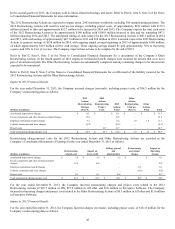

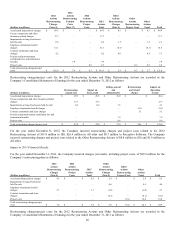

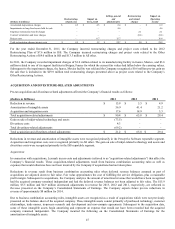

RESTRUCTURING CHARGES AND PROJECT COSTS

Summary of Restructuring Impacts

The Company’s 2013 financial results are impacted by its restructuring plans and related projects. Project costs consist of additional

charges related to the execution of the restructuring plans. These project costs are incremental to the Company’s normal operating

charges and are expensed as incurred, and include such items as compensation costs for overlap staffing, travel expenses, consulting

costs and training costs.

As part of Lexmark’s ongoing strategy to increase the focus of its talent and resources on higher usage business platforms, the

Company announced restructuring actions (the “2012 Restructuring Actions”) on January 31 and August 28, 2012. These actions

better align the Company’s sales, marketing and development resources, and align and reduce its support structure consistent with its

focus on business customers. The 2012 Restructuring Actions include exiting the development and manufacturing of the Company’s

inkjet technology, with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply chain,

marketing and sales as well as other support functions. The Company will continue to provide service, support and aftermarket

supplies for its inkjet installed base.

44