Lexmark 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Corporate debt securities

The corporate debt securities in which the Company is invested most often have multiple sources of pricing with relatively low

dispersion. The valuation process described above is used to corroborate the prices of these securities. The fair values of these

securities are generally classified as Level 2. These securities may be classified as Level 3 if the Company is unable to corroborate the

prices of these securities with a sufficient level of observable market data. In addition, certain corporate debt securities are classified

as Level 1 due to trading volumes sufficient to indicate an active market for the securities.

Smaller amounts of commercial paper and certificates of deposit, which generally have shorter maturities and less frequent trades, are

also grouped into this fixed income sector. Such securities are valued via mathematical calculations using observable inputs until such

time that market activity reflects an updated price. The fair values of these securities are typically classified as Level 2 measurements.

Asset-backed and mortgage-backed securities

Securities in this group include asset-backed securities, U.S. agency mortgage-backed securities, and other mortgage-backed

securities. These securities generally have lower levels of trading activity than government and agency debt securities and corporate

debt securities and, therefore, their fair values may be based on other inputs, such as spread data. The valuation process described

above is used to corroborate the prices of these securities. Fair value measurements of these investments are most often categorized as

Level 2; however, these securities are categorized as Level 3 when there is higher variability in the pricing data, a low number of

pricing sources, or the Company is otherwise unable to gather supporting information to conclude that the price can be transacted

upon in the market at the reporting date.

Money market funds

The money market funds in which the Company is invested are considered cash equivalents and are generally highly liquid

investments. Money market funds are valued at the per share (unit) published as the basis for current transactions.

Auction Rate Securities

At December 31, 2013, the Company’s auction rate securities for which recent auctions were unsuccessful were valued by a third

party using a discounted cash flow model based on the characteristics of the individual securities, which the Company believes yields

the best estimate of fair value. The first step in the valuation included a credit analysis of the security which considered various factors

including the credit quality of the issuer (and insurer if applicable), the instrument’s position within the capital structure of the issuing

authority, and the composition of the authority’s assets including the effect of insurance and/or government guarantees. Next, the

future cash flows of the instruments were projected based on certain assumptions regarding the auction rate market significant to the

valuation including (1) the auction rate market will remain illiquid and auctions will continue to fail causing the interest rate to be the

maximum applicable rate and (2) the securities will not be redeemed prior to any scheduled redemption dates. These assumptions

resulted in discounted cash flow analysis being performed through the legal maturity of July 2032 for the municipal airport revenue

bond and the mandatory redemption date of December 2021 for the auction rate preferred stock. The projected cash flows were then

discounted using the applicable yield curve plus a 250 basis point liquidity premium added to the applicable discount rate.

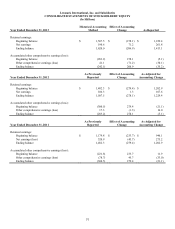

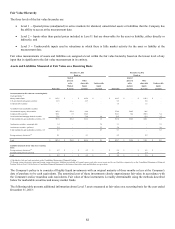

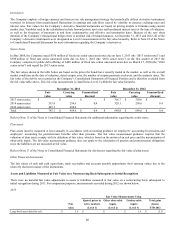

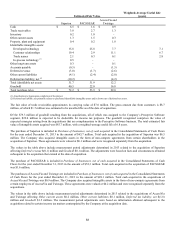

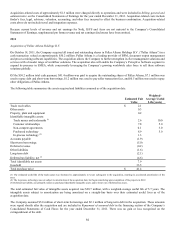

Quantitative disclosures of key unobservable inputs for auction rate securities appear in the table below.

Security type

Range of discount rates (including basis

p

oint li

q

uidit

y

p

remium

)

Range of estimated forward rates

a

pp

lied to contractual cash flows

Minimum Maximum Minimum Maximum

Auction rate securities – municipal debt 2.8% 9.9% 0.1% 7.4%

Auction rate securities – preferred 3.1% 6.9% 0.3% 5.1%

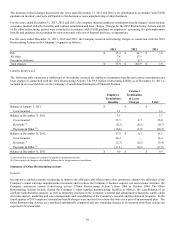

The significant unobservable inputs used in the fair value measurement of the Company’s investments in auction rate securities

include the estimated forward rates and discount rates used in the discounted cash flow analysis as well as the basis point liquidity

premium. A significant increase in the estimated forward rates, in isolation, would lead to a significantly higher fair value

measurement. A significant increase in the basis point liquidity premium or discount rate, in isolation, would lead to a significantly

lower fair value measurement. In certain cases a change in the estimated forward rates could be accompanied by a directionally similar

change in the discount rate or basis point liquidity premium. Each quarter the Company investigates material changes in the fair value

measurements of auction rate securities.

Refer to Note 21 of the Notes to Consolidated Financial Statements for additional information regarding the Company’s auction rate

preferred stock activity occurring subsequent to the date of the financial statements.

85