Lexmark 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

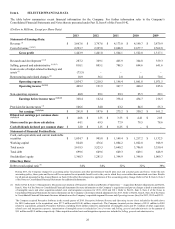

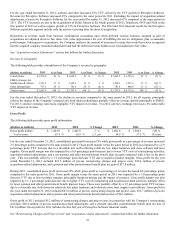

35

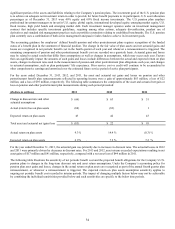

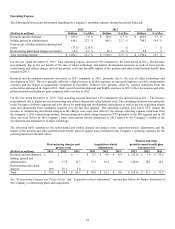

Change in Assumption

Increase (Decrease) in 2013

Pre-tax Net Periodic Benefit Cost

for Pension Plans

(in millions)

Increase (Decrease) in Projected

Benefit Obligation for Pension

Plans as of December 31, 2013

(in millions)

25 basis points decrease in discount rate $ (1.0) $ 14.9

25 basis points increase in discount rate 0.9 (14.3)

50 basis points decrease in actual return on plan assets 3.4 No Impact

50 basis points increase in actual return on plan assets (3.4) No Impact

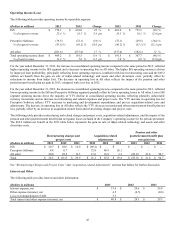

Increase (Decrease) in 2013

Pre-tax Interim Period Net

Periodic Benefit Cost for Pension

Plans

Increase (Decrease) in Projected

Benefit Obligation for Pension

Plans as of December 31, 2013

(in millions)

25 basis points decrease in expected return on plan assets $ 1.2 No Impact

25 basis points increase in expected return on plan assets (1.2) No Impact

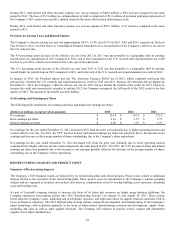

Income Taxes

The Company estimates its tax liability based on current tax laws in the statutory jurisdictions in which it operates. These estimates

include judgments about deferred tax assets and liabilities resulting from temporary differences between assets and liabilities

recognized for financial reporting purposes and such amounts recognized for tax purposes, as well as about the realization of deferred

tax assets. If the provisions for current or deferred taxes are not adequate, if the Company is unable to realize certain deferred tax

assets or if the tax laws change unfavorably, the Company could potentially experience significant losses in excess of the reserves

established. Likewise, if the provisions for current and deferred taxes are in excess of those eventually needed, if the Company is able

to realize additional deferred tax assets or if tax laws change favorably, the Company could potentially experience significant gains.

The Company considers historical profitability, future market growth, future taxable income, the expected timing of the reversals of

existing temporary differences and tax planning strategies in determining the need for a deferred tax valuation allowance.

We are subject to ongoing tax examinations and assessments in various jurisdictions. Accordingly, we may incur additional tax

expense based upon our assessment of the more-likely-than-not outcomes of such matters. In addition, when applicable, we adjust the

previously recorded tax expense to reflect examination results. Our ongoing assessments of the more-likely-than-not outcomes of the

examinations and related tax positions require judgment and can materially increase or decrease our effective tax rate, as well as

impact our operating results. Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for information

regarding the Company’s policy for income taxes.

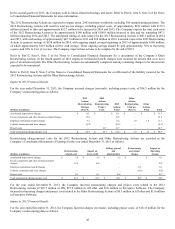

Litigation and Contingencies

In accordance with guidance on accounting for contingencies, Lexmark records a provision for a loss contingency when management

has determined that it is both probable that a liability has been incurred and the amount of loss can be reasonably estimated. Although

the Company believes it has adequate provisions for any such matters, litigation is inherently unpredictable. Should developments

occur that result in the need to recognize a material accrual, or should any of the Company’s legal matters result in a substantial

judgment against, or settlement by the Company, the resulting liability could have a material effect on the Company’s results of

operations, financial condition and/or cash flows.

Copyright Fees

Certain countries (primarily in Europe) and/or collecting societies representing copyright owners’ interests have taken action to

impose fees on devices (such as scanners, printers and multifunction devices) alleging the copyright owners are entitled to

compensation because these devices enable reproducing copyrighted content. Other countries are also considering imposing fees on

certain devices. The amount of fees would depend on the number of products sold and the amounts of the fee on each product, which

will vary by product and by country. The Company has accrued amounts that represent its best estimate of the copyright fee issues

currently pending. Such estimates could change as the litigation and/or local legislative processes draw closer to final resolution.

35

(in millions)