Lexmark 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

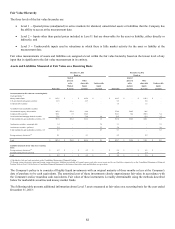

74

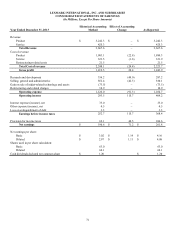

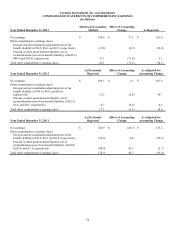

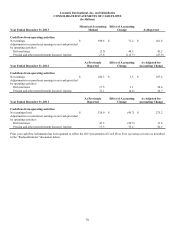

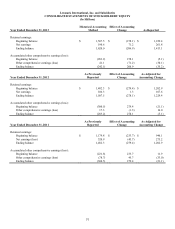

Lexmark International, Inc. and Subsidiaries

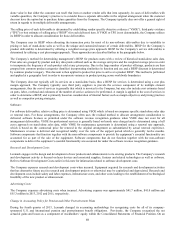

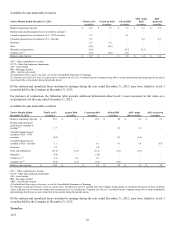

CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS

(In Millions)

Year Ended December 31, 2013

Historical Accounting

Method

Effect of Accounting

Change As Reported

Net earnings $ 190.6 $ 71.2 $ 261.8

Other comprehensive earnings (loss):

Foreign currency translation adjustment (net of tax

benefit (liability) of $3.5, $0.0, and $3.5, respectively) (31.8) (0.2) (32.0)

Pension or other postretirement benefits, net of

reclassifications (net of tax benefit (liability) of $(45.2),

$44.4, and $(0.8), respectively) 73.1 (71.0) 2.1

Total other comprehensive earnings (loss) 41.1 (71.2) (30.1)

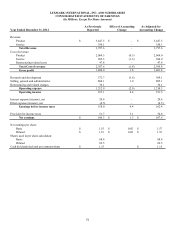

Year Ended December 31, 2012

As Previously

Reported

Effect of Accounting

Change

As Adjusted for

Accounting Change

Net earnings $ 106.3 $ 1.3 $ 107.6

Other comprehensive earnings (loss):

Foreign currency translation adjustment (net of tax

benefit (liability) of $(0.6), $0.0, and $(0.6),

respectively) 15.5 (0.8) 14.7

Pension or other postretirement benefits, net of

reclassifications (net of tax benefit (liability) of $(2.5),

$2.6, and $0.1, respectively) 0.7 (0.5) 0.2

Total other comprehensive earnings (loss) 17.3 (1.3) 16.0

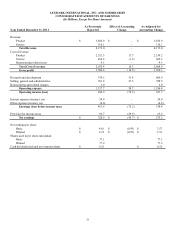

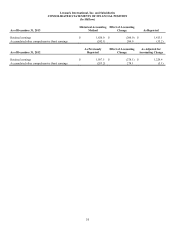

Year Ended December 31, 2011

As Previously

Reported

Effect of Accounting

Change

As Adjusted for

Accounting Change

Net earnings $ 320.9 $ (45.7) $ 275.2

Other comprehensive earnings (loss):

Foreign currency translation adjustment (net of tax

benefit (liability) of $5.8, $0.0, and $5.8, respectively) (29.6) 0.4 (29.2)

Pension or other postretirement benefits, net of

reclassifications (net of tax benefit (liability) of $30.8,

$(29.4), and $1.4, respectively) (48.0) 45.3 (2.7)

Total other comprehensive earnings (loss) (78.7) 45.7 (33.0)

74