Lexmark 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.not required to render service until they are terminated in order to receive the termination benefits or employees who will not provide

service beyond the minimum retention period, the Company records a liability for the termination benefits at the communication date.

If employees are required to render service until they are terminated in order to receive the termination benefits and will be retained to

render service beyond the minimum retention period, the Company measures the liability for termination benefits at the

communication date and recognizes the expense and liability ratably over the future service period.

For contract termination costs, Lexmark records a liability for costs to terminate a contract before the end of its term when the

Company terminates the agreement in accordance with the contract terms or when the Company ceases using the rights conveyed by

the contract. The liability is recorded at fair value in the period in which it is incurred, taking into account the effect of estimated

sublease rentals that could be reasonably obtained which may be different than company-specific intentions.

Warranty

Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The amounts accrued for product

warranties are based on the quantity of units sold under warranty, estimated product failure rates, and material usage and service

delivery costs. The estimates for product failure rates and material usage and service delivery costs are periodically adjusted based on

actual results. For extended warranty programs, the Company defers revenue in short-term and long-term liability accounts (based on

the extended warranty contractual period) for amounts invoiced to customers for these programs and recognizes the revenue ratably

over the contractual period. Costs associated with extended warranty programs are expensed as incurred. To minimize warranty costs,

the Company engages in extensive product quality programs and processes, including actively monitoring and evaluating the quality

of its component suppliers. Should actual product failure rates, material usage or service delivery costs differ from the Company’s

estimates, revisions to the estimated warranty liability may be required.

Inventory Reserves and Adverse Purchase Commitments

Lexmark writes down its inventory for estimated obsolescence or unmarketable inventory by an amount equal to the difference

between the cost of inventory and the estimated market value. The Company estimates the difference between the cost of obsolete or

unmarketable inventory and its market value based upon product demand requirements, product life cycle, product pricing and quality

issues. Also, Lexmark records an adverse purchase commitment liability when anticipated market sales prices are lower than

committed costs. If actual market conditions are less favorable than those projected by management, additional inventory write-downs

and adverse purchase commitment liabilities may be required.

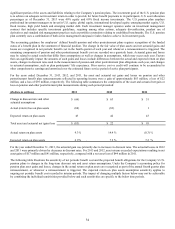

Pension and Other Postretirement Plans

During the fourth quarter of 2013, the Company changed its accounting policy for the recognition of pension and other postretirement

benefit plan asset and actuarial gains and losses. Under the new accounting policy, these gains and losses will be recognized in net

periodic benefit cost in the year in which they occur rather than amortized over time. Results for all periods presented in this Annual

Report on Form 10-K reflect the retrospective application of this accounting policy change. Refer to Part II, Item 8, Note 2 of the

Notes to Consolidated Financial Statements for additional information.

The Company’s pension and other postretirement benefit costs and obligations are dependent on various actuarial assumptions used in

calculating such amounts. The non-U.S. pension plans are not significant and use economic assumptions similar to the U.S. pension

plan, a defined benefit plan. Significant assumptions the Company must review and set annually related to its pension and other

postretirement benefit obligations are:

Expected long-term return on plan assets— based on long-term historical actual asset return information, the mix of

investments that comprise plan assets and future estimates of long-term investment returns by reference to external sources.

The Company also includes an additional return for active management, when appropriate, and deducts various expenses.

The Company has elected to use the fair value rather than the market-related value of plan assets to determine expense.

Discount rate— reflects the rates at which benefits could effectively be settled and is based on current investment yields of

high-quality fixed-income investments. The Company uses a yield-curve approach to determine the assumed discount rate

based on the timing of the cash flows of the expected future benefit payments. Effective December 31, 2012, the Company

changed from using a more broad-based yield curve to a newly developed above-mean yield curve for a more refined

estimate of the benefit obligation.

Rate of compensation increase— Effective April 2006, this assumption is no longer applicable to the U.S. pension plan due

to the benefit accrual freeze in connection with the Company’s 2006 restructuring actions. In addition, some of the non-U.S.

pension plans are also frozen.

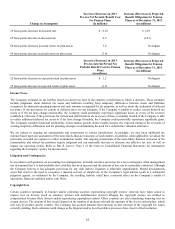

Plan assets are invested in equity securities, government and agency securities, mortgage-backed securities, commercial mortgage-

backed securities, asset-backed securities, corporate debt, annuity contracts and other securities. The U.S. pension plan comprises a

33