Lexmark 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

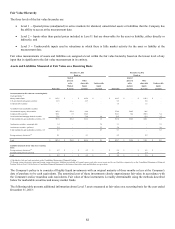

Fair Value Hierarchy

The three levels of the fair value hierarchy are:

Level 1 -- Quoted prices (unadjusted) in active markets for identical, unrestricted assets or liabilities that the Company has

the ability to access at the measurement date;

Level 2 -- Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or

indirectly; and

Level 3 -- Unobservable inputs used in valuations in which there is little market activity for the asset or liability at the

measurement date.

Fair value measurements of assets and liabilities are assigned a level within the fair value hierarchy based on the lowest level of any

input that is significant to the fair value measurement in its entirety.

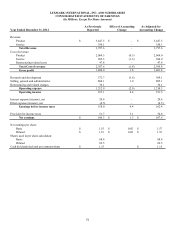

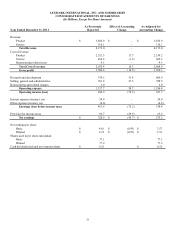

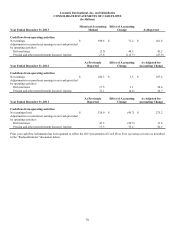

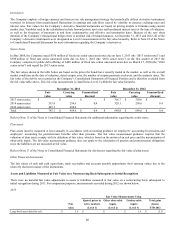

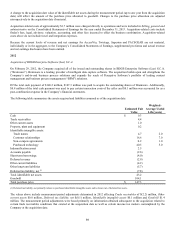

Assets and Liabilities Measured at Fair Value on a Recurring Basis

December 31, 2013 December 31, 2012

Based on Based on

Quoted Quoted

prices in Other prices in Other

active observable Unobservable

active observable Unobservable

Markets Inputs inputs

markets inputs inputs

Fair value (Level 1) (Level 2) (Level 3) Fair value (Level 1) (Level 2) (Level 3)

Assets measured at fair value on a recurring basis:

Cash equivalents (1)

Money market funds $ 162.6 $ – $ 162.6 $ – $ 102.3 $ – $ 102.3 $ –

U.S. government and agency securities 12.5 – 12.5 –

6.0 – 6.0 –

Corporate debt securities – – – –

1.5 – 1.5 –

Available-for-sale marketable securities

Government & agency debt securities 345.8 251.0 94.8 – 334.8 244.2 90.6 –

Corporate debt securities 362.1 7.5 354.6 – 302.1 14.4 282.5 5.2

Asset-backed and mortgage-backed securities 73.6 – 71.8 1.8 56.5 – 53.0 3.5

Total available-for-sale marketable securities - ST 781.5 258.5 521.2 1.8 693.4 258.6 426.1 8.7

Auction rate securities - municipal debt 3.4 – – 3.4 3.3 – – 3.3

Auction rate securities - preferred 3.3 – – 3.3 3.0 – – 3.0

Total available-for-sale marketable securities - LT 6.7 – – 6.7 6.3 – – 6.3

Foreign currency derivatives (2) 0.1 – 0.1 – 0.2 – 0.2 –

Total $ 963.4 $ 258.5 $ 696.4 $ 8.5 $ 809.7 $ 258.6 $ 536.1 $ 15.0

Liabilities measured at fair value on a recurring

basis:

Foreign currency derivatives (2) $ 0.2 $ – $ 0.2 $ – $ 0.6 $ – $ 0.6 $ –

Forward starting interest rate swap – – – – 1.4 – 1.4 –

Total $ 0.2 $ – $ 0.2 $ – $ 2.0 $ – $ 2.0 $ –

(1) Included in Cash and cash equivalents on the Consolidated Statements of Financial Position.

(2) Foreign currency derivative assets and foreign currency derivative liabilities are included in Prepaid expenses and other current assets and Accrued liabilities, respectively, on the Consolidated Statements of Financial

Position. Refer to Note 18 of the Notes to Consolidated Financial Statements for disclosure of derivative assets and liabilities on a gross basis.

The Company's policy is to consider all highly liquid investments with an original maturity of three months or less at the Company's

date of purchase to be cash equivalents. The amortized cost of these investments closely approximates fair value in accordance with

the Company's policy regarding cash equivalents. Fair value of these instruments is readily determinable using the methods described

below for marketable securities and money market funds.

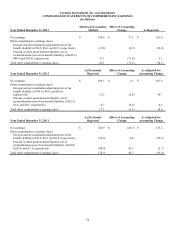

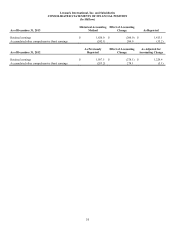

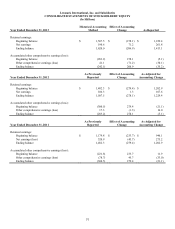

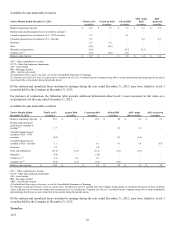

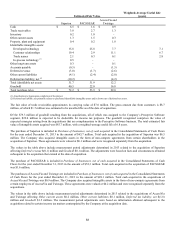

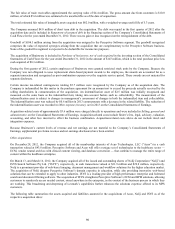

The following table presents additional information about Level 3 assets measured at fair value on a recurring basis for the year ended

December 31, 2013:

82