Lexmark 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

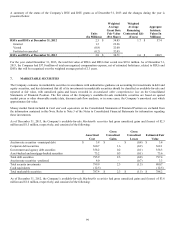

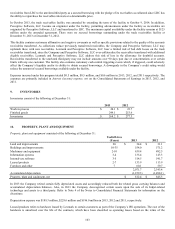

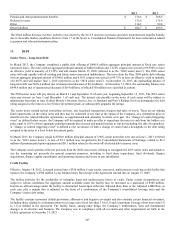

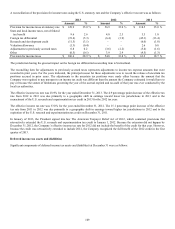

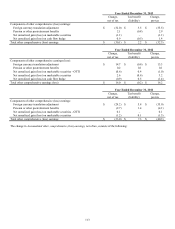

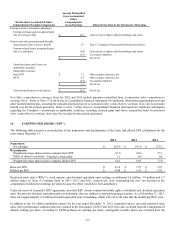

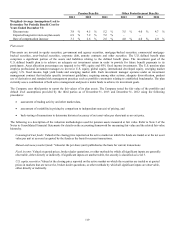

A reconciliation of the provision for income taxes using the U.S. statutory rate and the Company’s effective tax rate was as follows:

2013 2012 2011

Amount % Amount % Amount %

Provision for income taxes at statutory rate $ 128.9 35.0 % $ 56.9 35.0 % $ 118.5 35.0 %

State and local income taxes, net of federal

tax benefit 9.6 2.6 4.0 2.5 3.3 1.0

Foreign tax differential (19.4) (5.3) (6.4) (3.9) (45.3) (13.4)

Research and development credit (11.5) (3.1) – – (6.0) (1.8)

Valuation allowance (1.3) (0.4) – – 2.6 0.8

Adjustments to previously accrued taxes 0.8 0.2 (3.6) (2.2) (5.4) (1.6)

Other (0.5) (0.1) 3.9 2.4 (4.5) (1.3)

Provision for income taxes $ 106.6 28.9 %$ 54.8 33.8 % $ 63.2 18.7 %

The jurisdiction having the greatest impact on the foreign tax differential reconciling item is Switzerland.

The reconciling item for adjustments to previously accrued taxes represents adjustments to income tax expense amounts that were

recorded in prior years. For the years indicated, the principal reason for these adjustments was to record the release of uncertain tax

positions accrued in prior years. The adjustments to the uncertain tax positions were made either because the amount that the

Company was required to pay pursuant to an income tax audit was different than the amount the Company estimated it would have to

pay or because the statute of limitations governing the year of the accrual expired and no audit of that year was ever conducted by the

local tax authorities.

The effective income tax rate was 28.9% for the year ended December 31, 2013. The 4.9 percentage point decrease of the effective tax

rate from 2012 to 2013 was due primarily to a geographic shift in earnings toward lower tax jurisdictions in 2013 and to the

reenactment of the U.S. research and experimentation tax credit in 2013 for the 2012 tax year.

The effective income tax rate was 33.8% for the year ended December 31, 2012. The 15.1 percentage point increase of the effective

tax rate from 2011 to 2012 was due primarily to a geographic shift in earnings toward higher tax jurisdictions in 2012 and to the

expiration of the U.S. research and experimentation tax credit on December 31, 2011.

In January of 2013, the President signed into law The American Taxpayer Relief Act of 2012, which contained provisions that

retroactively extended the U.S. research and experimentation tax credit to January 1, 2012. Because the extension did not happen by

December 31, 2012, the Company’s effective income tax rate for 2012 did not include the benefit of the credit for that year. However,

because the credit was retroactively extended to include 2012, the Company recognized the full benefit of the 2012 credit in the first

quarter of 2013.

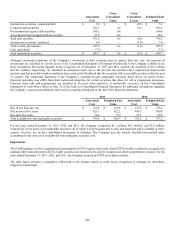

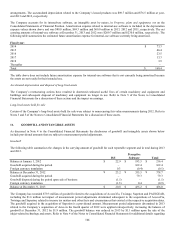

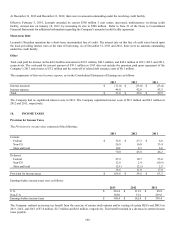

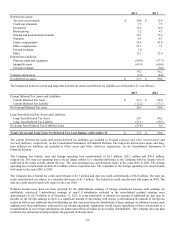

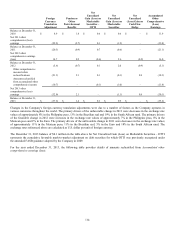

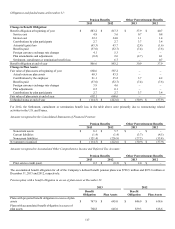

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

109