Lexmark 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

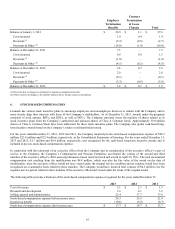

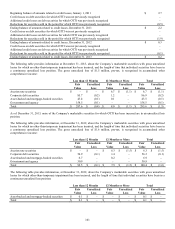

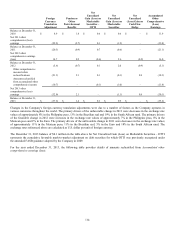

business combinations occurring during 2013, 2012, and 2011, as well as information related to divestitures. The Company does not

have any accumulated impairment charges as of December 31, 2013.

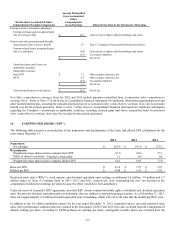

Intangible Assets

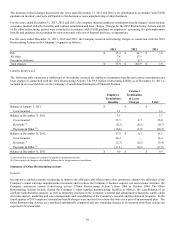

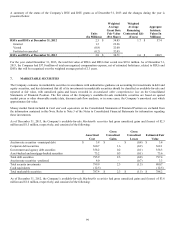

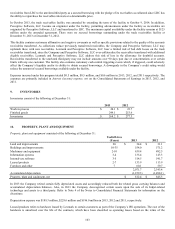

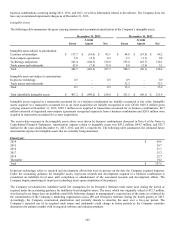

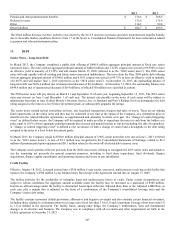

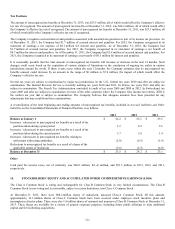

The following table summarizes the gross carrying amounts and accumulated amortization of the Company’s intangible assets.

December 31, 2013 December 31, 2012

Accum Accum

Gross Amort Net Gross Amort Net

Intangible assets subject to amortization:

Customer relationships $ 117.7 $ (34.6) $ 83.1 $ 84.0 $ (19.8) $ 64.2

Non-compete agreements 2.8 (2.3) 0.5 2.5 (1.7) 0.8

Technology and patents 243.4 (104.5) 138.9 193.8 (65.7) 128.1

Trade names and trademarks 42.8 (7.8) 35.0 8.0 (2.9) 5.1

Total 406.7 (149.2) 257.5 288.3 (90.1) 198.2

Intangible assets not subject to amortization:

In-process technology 0.5 – 0.5 0.9 – 0.9

Trade names and trademarks – – – 32.3 – 32.3

Total 0.5 – 0.5 33.2 – 33.2

Total identifiable intangible assets $ 407.2 $ (149.2) $ 258.0 $ 321.5 $ (90.1) $ 231.4

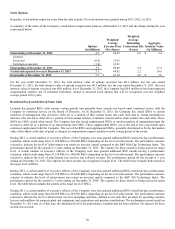

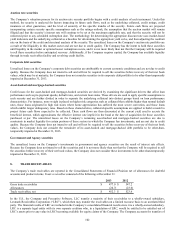

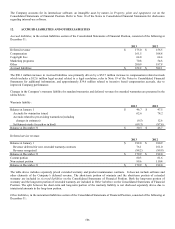

Intangible assets acquired in a transaction accounted for as a business combination are initially recognized at fair value. Intangible

assets acquired in a transaction accounted for as an asset acquisition are initially recognized at cost. Of the $407.2 million gross

carrying amount at December 31, 2013, $385.7 million were acquired in transactions accounted for as business combinations, $0.7

million consisted of negotiated non-compete agreements recognized separately from a business combination and $20.8 million were

acquired in transactions accounted for as asset acquisitions.

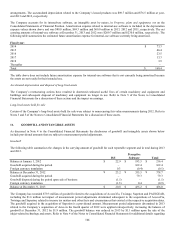

The year-to-date increases in the intangible assets above were driven by business combinations discussed in Note 4 of the Notes to

Consolidated Financial Statements. Amortization expense related to intangible assets was $59.2 million, $44.3 million, and $23.7

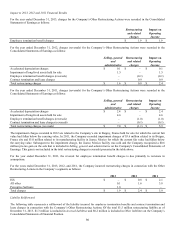

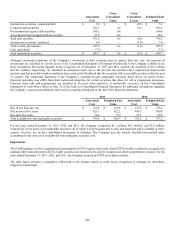

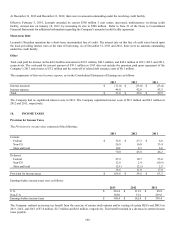

million for the years ended December 31, 2013, 2012, and 2011, respectively. The following table summarizes the estimated future

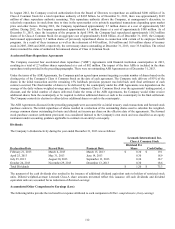

amortization expense for intangible assets that are currently being amortized.

Fiscal year:

2014 $ 69.6

2015 59.7

2016 51.1

2017 35.2

2018 22.7

Thereafter 19.2

Total $257.5

In-process technology refers to research and development efforts that were in process on the date the Company acquired Saperion.

Under the accounting guidance for intangible assets, in-process research and development acquired in a business combination is

considered an indefinite lived asset until completion or abandonment of the associated research and development efforts. The

Company begins amortizing its in-process technology assets upon completion of the projects.

The Company reevaluated the indefinite useful life assumption for its Perceptive Software trade name asset during the period as

required under the accounting guidance for indefinite-lived intangible assets. The asset, which was originally valued at $32.3 million,

was deemed to no longer have an indefinite useful life following changes in management’s expected use of the name as evidenced by

the centralization of the Company’s marketing organization across ISS and Perceptive Software during the fourth quarter of 2013.

Accordingly, the Company commenced amortization and currently intends to amortize the asset over a five-year period. The

Company’s expected use of its acquired trade names and trademarks could change in future periods as the Company considers

alternatives for going to market with its acquired software and solutions products.

105