Lexmark 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

evaluates and revises such estimates based on expenditures against established reserves and the availability of additional information.

The Company’s asset retirement obligations are currently not material to the Company’s Consolidated Statements of Financial

Position.

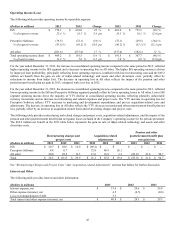

RESULTS OF OPERATIONS

Operating Results Summary

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes thereto.

During the fourth quarter of 2013, the Company changed its accounting policy for the recognition of pension and other postretirement

benefit plan asset and actuarial gains and losses. Under the new accounting policy, these gains and losses will be recognized in net

periodic benefit cost in the year in which they occur rather than amortized over time. Results for all periods presented in this Annual

Report on Form 10-K reflect the retrospective application of this accounting policy change. The Company also changed its method of

accounting for certain pension and other postretirement benefit plan costs included in inventory and capitalized software. Refer to

Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for additional information.

In addition, in the fourth quarter of 2013, Lexmark changed its method of allocating the elements of net periodic pension and other

postretirement plan benefit cost to reporting segments. Historically, total net periodic benefit cost was allocated to reporting segments.

Under the new allocation method, service cost, amortization of prior service cost and credit, and pension and other postretirement

benefit plan settlements and curtailments will continue to be allocated to reporting segments. Interest cost, expected return on plan

assets, and asset and actuarial gains and losses will be included in results for All other. Management believes that interest cost, asset

returns, and actuarial gains and losses are primarily related to corporate financing and treasury decisions regarding the composition of

pension assets and other factors, such as discount rates and actuarial assumptions, which are not related to the operations of Lexmark’s

reportable segments. See “CRITICAL ACCOUNTING POLICIES AND ESTIMATES” in Item 7 for additional information.

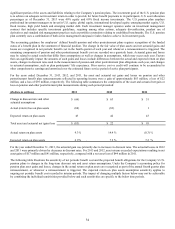

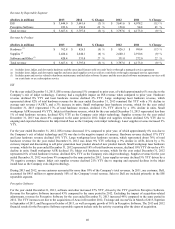

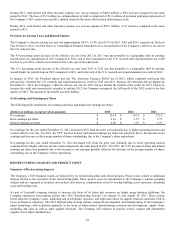

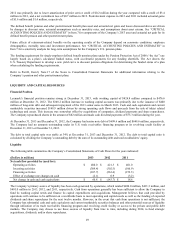

The following table summarizes the results of the Company’s operations for the years ended December 31, 2013, 2012 and 2011:

2013 2012 2011

(Dollars in millions) Dollars % of Rev Dollars % of Rev Dollars % of Rev

Revenue $ 3,667.6 100.0 % $ 3,797.6 100.0 % $ 4,173.0 100.0 %

Gross profit 1,443.9 39.4 % 1,401.8 36.9 % 1,564.1 37.5 %

Operating expense 1,034.7 28.2 % 1,210.3 31.9 % 1,196.4 28.7 %

Operating income 409.2 11.2 % 191.5 5.0 % 367.7 8.8 %

Net earnings 261.8 7.1 % 107.6 2.8 % 275.2 6.6 %

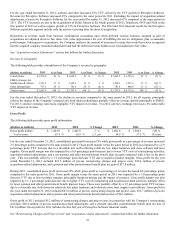

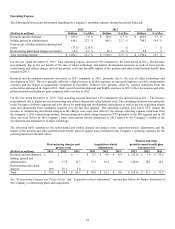

During 2013, consolidated revenue was $3.7 billion, down 3% compared to prior year. Gross profit increased 3%, Operating expense

decreased 15% and Operating income increased 114% when compared to the same period in 2012.

Net earnings for the year ended December 31, 2013 increased 143% from the prior year primarily due to higher operating income.

Operating income for the year ended December 31, 2013 included $54.5 million of pre-tax restructuring charges and project costs as

well as $90.4 million of pre-tax acquisition-related adjustments, $69.2 million of pre-tax divestiture-related benefit, and a pension and

other postretirement benefit plan asset and actuarial net gain of $83.0 million. The Company uses the term “project costs” for

incremental charges related to the execution of its restructuring plans. The Company uses the term “acquisition-related adjustments”

for purchase accounting adjustments and incremental acquisition and integration costs related to acquisitions.

During 2012, consolidated revenue was $3.8 billion, down 9% compared to 2011. Gross profit decreased 10%, Operating expense

increased 1% and Operating income decreased 48% when compared to the same period in 2011.

Net earnings for the year ended December 31, 2012 decreased 61% from the prior year primarily due to lower operating income.

Operating income in 2012 included $121.8 million of pre-tax restructuring charges and project costs, $65.8 million of pre-tax

acquisition-related adjustments, and a pension and other postretirement benefit plan asset and actuarial net loss of $21.8 million.

Revenue

For the year ended December 31, 2013, consolidated revenue decreased 3% YTY, of which approximately 6% was due to the

Company’s exit of inkjet technology. Currency had a negligible impact on consolidated revenue YTY.

39