Lexmark 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2013 and December 31, 2012, there were no amounts outstanding under the revolving credit facility.

Effective February 5, 2014, Lexmark amended its current $350 million 5 year senior, unsecured, multicurrency revolving credit

facility, entered into on January 18, 2012, by increasing its size to $500 million. Refer to Note 21 of the Notes to Consolidated

Financial Statements for additional information regarding the Company’s amended credit facility agreement.

Short-term Debt

Lexmark’s Brazilian operation has a short-term, uncommitted line of credit. The interest rate on this line of credit varies based upon

the local prevailing interest rates at the time of borrowing. As of December 31, 2013 and 2012, there were no amounts outstanding

under this credit facility.

Other

Total cash paid for interest on the debt facilities amounted to $39.1 million, $42.3 million, and $42.6 million in 2013, 2012. and 2011,

respectively. The cash paid for interest amount of $39.1 million in 2013 does not include the premium paid upon repayment of the

Company’s 2013 senior notes of $3.2 million and the write-off of related debt issuance costs of $0.1 million.

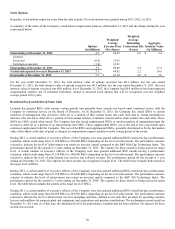

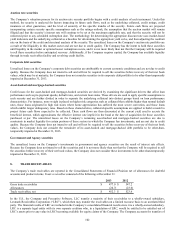

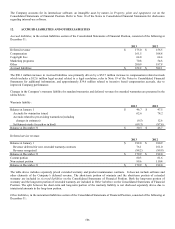

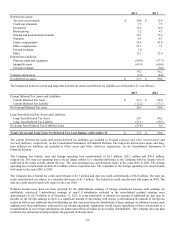

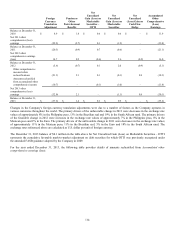

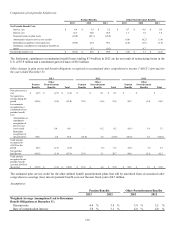

The components of Interest (income) expense, net in the Consolidated Statements of Earnings are as follows:

2013 2012 2011

Interest (income) $ (11.0) $ (13.0) $ (13.4)

Interest expense 44.0 42.6 43.3

Total $ 33.0 $ 29.6 $ 29.9

The Company had no capitalized interest costs in 2013. The Company capitalized interest costs of $0.3 million and $0.3 million in

2012 and 2011, respectively.

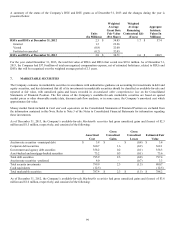

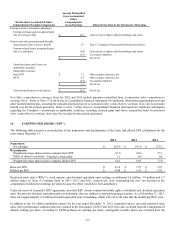

14. INCOME TAXES

Provision for Income Taxes

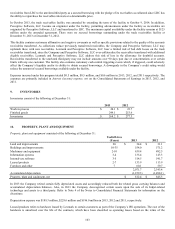

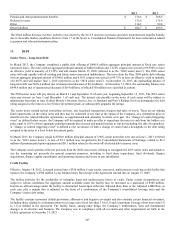

The Provision for income taxes consisted of the following:

2013 2012 2011

Current:

Federal $ 32.9 $ 27.3 $ 6.8

Non-US 26.9 10.0 33.4

State and local 10.2 6.5 6.0

70.0 43.8 46.2

Deferred:

Federal 25.9 10.7 25.0

Non-US 12.8 2.4 (10.5)

State and local (2.1) (2.1) 2.5

36.6 11.0 17.0

Provision for income taxes $ 106.6 $ 54.8 $ 63.2

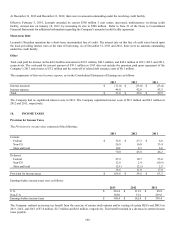

Earnings before income taxes were as follows:

2013 2012 2011

U.S. $ 210.4 $ 111.2 $ 98.8

Non-U.S. 158.0 51.2 239.6

Earnings before income taxes $ 368.4 $ 162.4 $ 338.4

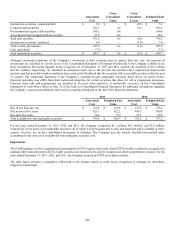

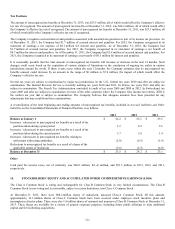

The Company realized an income tax benefit from the exercise of certain stock options and/or vesting of certain RSUs and DSUs in

2013, 2012, and 2011 of $7.0 million, $2.7 million and $2.8 million, respectively. This benefit resulted in a decrease in current income

taxes payable.

108