Lexmark 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

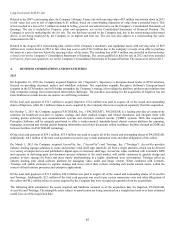

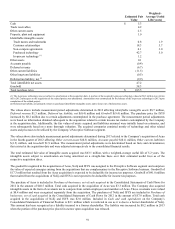

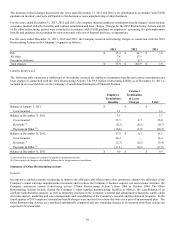

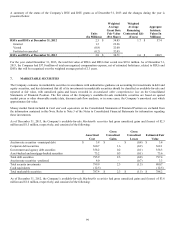

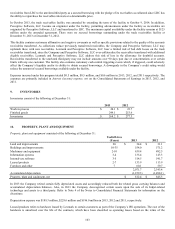

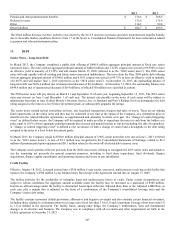

Contract

Employee Termination

Termination & Lease

Benefits Charges Total

Balance at January 1, 2011 $ 26.5 $ 1.1 $ 27.6

Costs incurred 1.0 0.4 1.4

Reversals (1) (2.2) (0.5) (2.7)

Payments & Other (2) (18.0) (1.0) (19.0)

Balance at December 31, 2011 7.3 – 7.3

Costs incurred 0.6 0.9 1.5

Reversals (1) (1.0) – (1.0)

Payments & Other (2) (4.1) (0.2) (4.3)

Balance at December 31, 2012 2.8 0.7 3.5

Costs incurred 2.0 – 2.0

Reversals (1) (0.1) – (0.1)

Payments & Other (2) (3.3) (0.6) (3.9)

Balance at December 31, 2013 $ 1.4 $ 0.1 $ 1.5

(1) Reversals due to changes in estimates for employee termination benefits.

(2) Other consists of changes in the liability balance due to foreign currency translations.

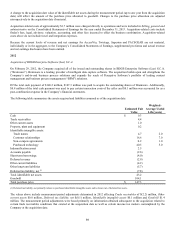

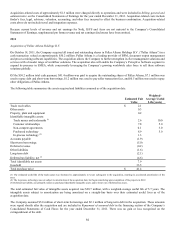

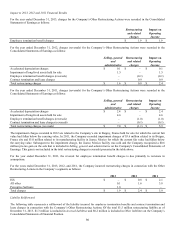

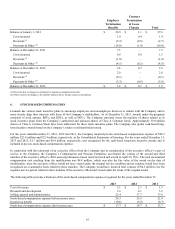

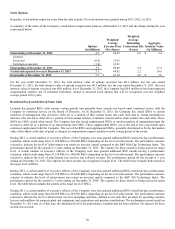

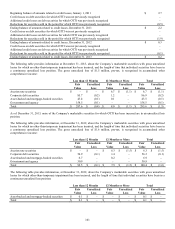

6. STOCK-BASED COMPENSATION

Lexmark has various stock incentive plans to encourage employees and nonemployee directors to remain with the Company and to

more closely align their interests with those of the Company’s stockholders. As of December 31, 2013, awards under the programs

consisted of stock options, RSUs, and DSUs, as well as DEUs. The Company currently issues the majority of shares related to its

stock incentive plans from the Company’s authorized and unissued shares of Class A Common Stock. Approximately 59.0 million

shares of Class A Common Stock have been authorized for these stock incentive plans. The Company also grants cash-based long-

term incentive awards based on the Company’s relative total shareholder return.

For the years ended December 31, 2013, 2012 and 2011, the Company incurred pre-tax stock-based compensation expense of $28.3

million, $23.9 million and $22.4 million, respectively, in the Consolidated Statements of Earnings. For the years ended December 31,

2013 and 2012, $1.7 million and $0.4 million, respectively, was recognized for the cash-based long-term incentive awards and is

included in pre-tax stock-based compensation expense.

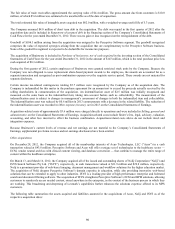

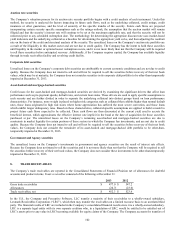

In connection with the retirement of an executive officer from the Company and in consideration of the executive officer’s years of

service to the Company, the Company’s Compensation and Pension Committee accelerated the vesting of the second and third

tranches of the executive officer’s 2010 earned performance-based restricted stock unit award to April 29, 2011. The total incremental

compensation cost resulting from the modification was $4.8 million, which was also the fair value of the award on the date of

modification, since the executive officer would not have vested under the original service condition and no expense would have been

recognized on a cumulative basis related to these tranches. The Company would have incurred total expense of $4.3 million over the

requisite service period related to these tranches if the executive officer had vested under the terms of the original award.

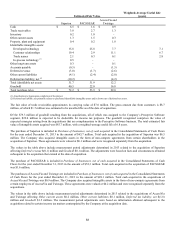

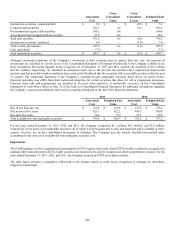

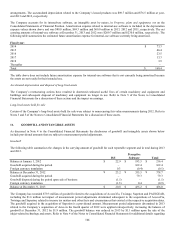

The following table presents a breakout of the stock-based compensation expense recognized for the years ended December 31:

2013 2012 2011

Cost of revenue $ 2.3 $ 2.1 $ 1.3

Research and development 3.6 4.1 3.5

Selling, general and administrative 22.4 17.7 17.6

Stock-based compensation expense before income taxes 28.3 23.9 22.4

Income tax benefit (10.6) (9.2) (8.7)

Stock-based compensation expense after income taxes $ 17.7 $ 14.7 $ 13.7

97