Lexmark 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

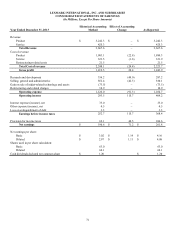

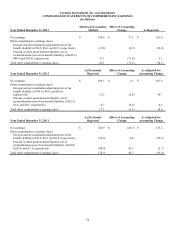

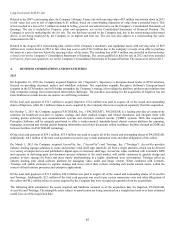

Net Earnings Per Share:

Basic net earnings per share is calculated by dividing net income by the weighted average number of shares outstanding during the

reported period. The calculation of diluted net earnings per share is similar to basic, except that the weighted average number of shares

outstanding includes the additional dilution from potential common stock such as stock options, restricted stock units, and dividend

equivalents.

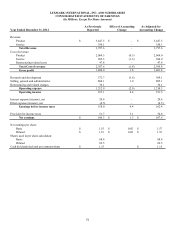

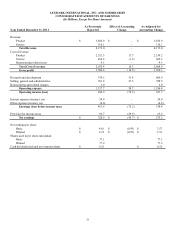

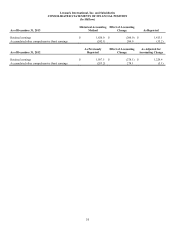

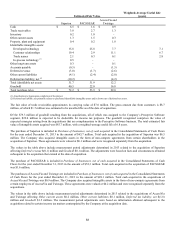

Accumulated Other Comprehensive (Loss) Earnings:

Accumulated other comprehensive (loss) earnings refers to revenues, expenses, gains and losses that under U.S. GAAP are included in

comprehensive (loss) earnings but are excluded from net income as these amounts are recorded directly as an adjustment to

stockholders’ equity, net of tax. Lexmark’s Accumulated other comprehensive (loss) earnings is composed of unamortized prior

service cost or credit related to pension or other postretirement benefits, foreign currency exchange rate adjustments, a forward

starting interest rate swap designated as a cash flow hedge and net unrealized gains and losses on marketable securities including the

non-credit loss component of OTTI. The Company presents each item of other comprehensive (loss) earnings, on a net basis,

and related tax amounts in the Consolidated Statements of Comprehensive Earnings, displaying the combination of reclassification

adjustments and other changes as a single amount. Reclassification adjustments, including related tax amounts, are disclosed in Note

15 of the Notes to Consolidated Financial Statements. For any item required under U.S. GAAP to be reclassified to net income in its

entirety in the same reporting period, the affected line item(s) on the Consolidated Statements of Earnings are provided. For other

amounts not required to be reclassified to net income in their entirety, such as pension-related amounts, the Company provides in Note

15 a cross-reference to related footnote disclosures.

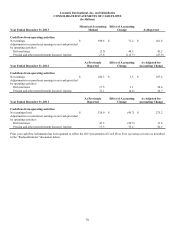

Recent Accounting Pronouncements:

Accounting Standards Updates Recently Issued and Effective

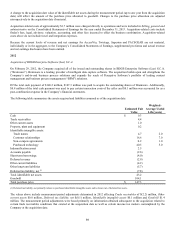

In December 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-11,

Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”). ASU 2011-11 amends the

disclosure requirements on offsetting financial instruments, requiring entities to disclose both gross information and net information

about instruments and transactions eligible for offset in the statement of financial position and instruments and transactions subject to

an agreement similar to a master netting arrangement. ASU 2011-11 does not change the existing offsetting eligibility criteria or the

permitted balance sheet presentation for those instruments that meet the eligibility criteria. The amendments were effective for the

Company starting in the first quarter of fiscal 2013 and required retrospective application. In January 2013, the FASB issued ASU

No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities (“ASU 2013-

01”). ASU 2013-01 clarifies that the scope of ASU 2011-11 should apply only to derivatives, repurchase agreements, and securities

lending transactions and was also effective for the Company starting in the first quarter of fiscal 2013. ASU 2011-11 and ASU 2013-

01 did not have a material impact on the Company’s financial statements or its disclosures.

In July 2012, the FASB issued ASU No. 2012-02, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible

Assets for Impairment (“ASU 2012-02”). The amendments in ASU 2012-02 allow an entity the option to first assess qualitatively

whether it is more likely than not (a likelihood of more than 50 percent) that an indefinite-lived intangible asset is impaired as a basis

for determining whether it is necessary to perform the quantitative impairment test under the pre-existing guidance. The amendments

in ASU 2012-02 were effective for the Company’s 2013 fiscal year and required prospective application. The amendments in ASU

2012-02 did not have a material impact on the Company’s financial statements as the Company elected to perform the quantitative

impairment test during the fourth quarter of 2013 when the Company’s indefinite-lived trade names and trademarks became subject to

amortization. Refer to Note 11 of the Notes to Consolidated Financial Statements for more information.

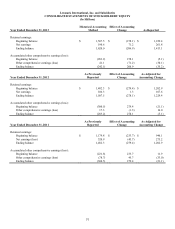

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income (“ASU 2013-02”). ASU 2013-02 requires an entity to provide information in one location

about amounts reclassified out of accumulated other comprehensive income by component and their corresponding effect on net

income if the amount reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting

period. For other amounts not required to be reclassified to net income in their entirety, such as pension-related amounts, an entity is

required to cross-reference to related footnote disclosures. The amendments in ASU 2013-02 were effective prospectively for the

Company starting in the first quarter of fiscal 2013. The disclosures required by ASU 2013-02 have been included in Note 15 of the

Notes to Consolidated Financial Statements.

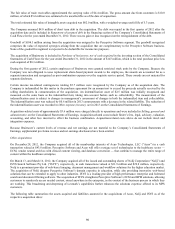

Accounting Standards Updates Recently Issued But Not Yet Effective

In February 2013, the FASB issued ASU No. 2013-04, Liabilities (Topic 405): Obligations Resulting from Joint and Several Liability

Arrangements for Which the Total Amount of the Obligation is Fixed at the Reporting Date (“ASU 2013-04”). ASU 2013-04 provides

guidance for the recognition, measurement, and disclosure of obligations resulting from joint and several liability arrangements for

which the total amount of the obligation is fixed at the reporting date, excluding certain obligations addressed within existing

80