Lexmark 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$125.9 million and $150.7 million at December 31, 2012 and 2011, respectively. The decrease in 2013 was largely driven by the

divestiture of inkjet-related technology and assets.

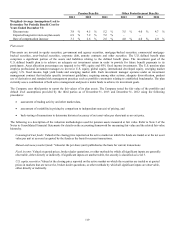

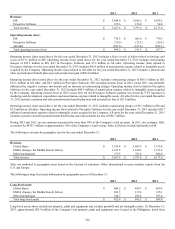

The following is revenue by product category for the year ended December 31:

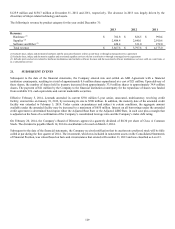

2013 2012 2011

Revenue:

Hardware (1) $ 762.8 $ 826.5 $ 990.4

Supplies (2) 2,484.4 2,640.1 2,910.6

Software and Other (3) 420.4 331.0 272.0

Total revenue $ 3,667.6 $ 3,797.6 $ 4,173.0

(1) Includes laser, inkjet, and dot matrix hardware and the associated features sold on a unit basis or through a managed service agreement

(2) Includes laser, inkjet, and dot matrix supplies and associated supplies services sold on a unit basis or through a managed service agreement

(3) Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold on a unit basis or

as a subscription service

21. SUBSEQUENT EVENTS

Subsequent to the date of the financial statements, the Company entered into and settled an ASR Agreement with a financial

institution counterparty, resulting in a total of approximately 0.6 million shares repurchased at a cost of $21 million. Upon delivery of

these shares, the number of shares held in treasury increased from approximately 33.8 million shares to approximately 34.4 million

shares. The payment of $21 million by the Company to the financial institution counterparty for the repurchase of shares was funded

from available U.S. cash equivalents and current marketable securities.

Effective February 5, 2014, Lexmark amended its current $350 million 5-year senior, unsecured, multicurrency revolving credit

facility, entered into on January 18, 2012, by increasing its size to $500 million. In addition, the maturity date of the amended credit

facility was extended to February 5, 2019. Under certain circumstances and subject to certain conditions, the aggregate amount

available under the amended facility may be increased to a maximum of $650 million. Interest on all borrowings under the amended

credit agreement is determined based upon either the Adjusted Base Rate or the Adjusted LIBO Rate, in each case plus a margin that

is adjusted on the basis of a combination of the Company’s consolidated leverage ratio and the Company’s index debt rating.

On February 20, 2014, the Company’s Board of Directors approved a quarterly dividend of $0.30 per share of Class A Common

Stock. The dividend is payable March 14, 2014 to stockholders of record on March 3, 2014.

Subsequent to the date of the financial statements, the Company received notification that its auction rate preferred stock will be fully

called at par during the first quarter of 2014. The investment, which was included in noncurrent assets on the Consolidated Statements

of Financial Position, was valued based on facts and circumstances that existed at December 31, 2013 and was classified as Level 3.

129