Lexmark 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

Table of contents

-

Page 1

-

Page 2

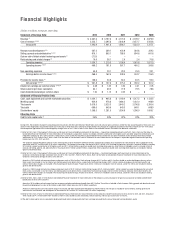

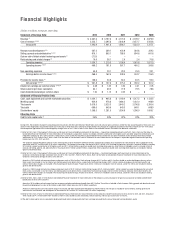

... 2013. Refer to Part II, Item 8, Note 20 of the Notes to Consolidated Financial Statements for more information on the Company's reportable segment Revenue and Operating income (loss) for 2013, 2012 and 2011. The Company acquired Perceptive Software in the second quarter of 2010. Perceptive Software...

-

Page 3

...accuracy and timely completion of business processes while simultaneously enhancing productivity and delivering hard and soft cost savings. We're accelerating our solutions growth with the synergies we're creating between the Imaging Solutions and Services (ISS) and Perceptive Software units. ISS is...

-

Page 4

... unique solutions to support their evolving business. Customers for Life is at the heart of everything we do. It drives all of us, and is what makes Lexmark a better partner for our customers than any of our competitors. To our customers, our shareholders, our business partners and our employees...

-

Page 5

...One Lexmark Centre Drive 740 West New Circle Road Lexington, Kentucky

(Address of principal executive offices)

40550

(Zip Code)

(859) 232-2000

(Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange...

-

Page 6

... DISCLOSURE CONTROLS AND PROCEDURES OTHER INFORMATION PART III

Item 10. Item 11. Item 12. Item 13. Item 14.

DIRECTORS, EXECUTIVE GOVERNANCE EXECUTIVE COMPENSATION

OFFICERS

AND

CORPORATE

135 135 135 136 136

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER...

-

Page 7

... without limitation, the factors set forth under the title "Risk Factors" in Item 1A of this report. The information referred to above should be considered by investors when reviewing any forward-looking statements contained in this report, in any of the Company's public filings or press releases or...

-

Page 8

... capture, search and web-based document imaging and workflow software solutions and services. Lexmark develops and owns most of the technology for its printing and imaging products and its software related to MPS and content and process management solutions. The Company acquired Perceptive Software...

-

Page 9

... distributed laser printing and imaging market opportunity was approximately $70 billion in 2013, including printing hardware, supplies and related services. This opportunity includes printers and multifunction devices as well as a declining base of copiers and fax machines that are increasingly...

-

Page 10

...in order to improve productivity and cost. Strategy Lexmark's strategy is based on a business model of investing in technology to develop and sell printing and imaging and content and process management solutions, including printers, multifunction devices and software solutions with the objective of...

-

Page 11

... investing in technology, hardware and software products and solutions to secure high value product installations and capture profitable supplies, software subscriptions, and maintenance and service annuities in content-intensive industries and business processes. Lexmark's ISS segment continues...

-

Page 12

... specific and back office solutions. These services are tailored to meet each customer's unique needs to ensure their mission-critical business processes run smoothly. Lexmark Customer Support Services are comprised of authorized maintenance and repair, technical support, warranty support and parts...

-

Page 13

... laser supplies products sold commercially in 2013 were sold through the ISS network of Lexmark-authorized supplies distributors and resellers, who sell directly to end-users, or to independent office supply dealers. Inkjet supplies are primarily sold through large office superstores, discount store...

-

Page 14

...and business processes, protect data integrity throughout its lifecycle and access precise content in the context of the users' everyday business processes. These components are developed and maintained by Perceptive Software. In 2013, Perceptive Software acquired four new software product companies...

-

Page 15

... process and search suites, Perceptive Software offers industry specific solutions of varying levels of functionality and sophistication across target industries - healthcare, higher education, government, and financial services - as well as select back office functions - accounting, human resources...

-

Page 16

...with laser printing, fleet management, connectivity, document management, ECM/BPM/DOM software, intelligent data capture, enterprise search, healthcare VNA and other customer facing solutions. Lexmark also develops related applications and tools that enable the Company to efficiently provide a broad...

-

Page 17

...Chief Executive Officer of Perceptive Software Vice President of Asia Pacific and Latin America Vice President of Human Resources Vice President, General Counsel and Secretary Vice President, ISS and Corporate Finance

Mr. Rooke has been a Director of the Company since October 2010. Since April 2011...

-

Page 18

... applications cover aspects of the Company's current and potential future products, manufacturing processes, business methods and related technologies. The Company is developing a portfolio of patents that protects its product lines and offers the possibility of entering into licensing agreements...

-

Page 19

... the Company's acquisition of Perceptive Software in June 2010, the Company's strategy has been based on becoming an end-to-end solutions provider of imaging and content, process and output management solutions, enabling businesses to capture, manage and access critical unstructured information in...

-

Page 20

... financial, marketing and/or technological resources than the Company. Perceptive Software could lose market share if its competitors introduce new products and services, add functionality to existing products, or reduce prices on their products and services. If such competitors lower prices with...

-

Page 21

... pricing programs, any disruption in the supply of new or existing products as well as the costs of any product recall or increased warranty, repair or replacement costs due to quality issues, the reaction of competitors to any such new products or programs, the life cycles of the Company's products...

-

Page 22

... the Company's cloud-based offerings and services and store and process increasingly large amounts of the Company's customers' confidential information and data and host or manage parts of the Company's customers' businesses in cloud-based IT environments, especially in customer sectors involving...

-

Page 23

... of additional competitors that are focused on imaging solutions and services could further intensify competition in the laser printer market and could have a material adverse impact on the Company's strategy and financial results. The Company acquired Perceptive Software in 2010 and has made...

-

Page 24

...qualified employees, the Company must offer a competitive compensation package, including cash, cash-based incentive awards and share-based incentive awards, such as restricted stock units. Because the cash-based and share-based incentive awards are dependent upon the performance conditions relating...

-

Page 25

... Lexington, Kentucky. Perceptive Software's headquarters is located in Shawnee, Kansas. At December 31, 2013, the Company owned or leased approximately 5.0 million square feet of administrative, sales, service, research and development, warehouse and manufacturing facilities worldwide. Approximately...

-

Page 26

... 1-31, 2013 Total

Total Number of Shares Purchased (2) 479,955 79,416 - 559,371

$

$

Average Price Paid per Share (2) 35.42 37.78 - 35.75

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (2) 479,955 79,416 - 559,371

(1) Information regarding the Company's share...

-

Page 27

... Graph The following graph compares cumulative total stockholder return on the Company's Class A Common Stock with a broad performance indicator, the S&P Composite 500 Stock Index, and an industry index, the S&P 500 Information Technology Index, for the period from December 31, 2008, to December...

-

Page 28

... made under the Lexmark International, Inc. Broad-Based Employee Stock Incentive Plan (the "Broad-Based Plan"), an equity compensation plan which had not been approved by the Company's stockholders. On February 24, 2011, the Company's Board of Directors terminated the Broad-Based Plan and cancelled...

-

Page 29

... 2013. Refer to Part II, Item 8, Note 20 of the Notes to Consolidated Financial Statements for more information on the Company's reportable segment Revenue and Operating income (loss) for 2013, 2012 and 2011. The Company acquired Perceptive Software in the second quarter of 2010. Perceptive Software...

-

Page 30

... in Selling, general and administrative.

(3)

Refer to Part II, Item 8, Note 17 of the Notes to Consolidated Financial Statements for more information on the Company's asset and actuarial net gain (loss) on pension and other postretirement benefit plans for 2013, 2012 and 2011. Amounts in 2010...

-

Page 31

..., device management, MPS, document workflow and, more recently, business process and content management solutions. The Company operates in the office printing and imaging, ECM, BPM, DOM, intelligent data capture and search software markets. Lexmark's products include laser printers and multifunction...

-

Page 32

... distributed laser printing and imaging market opportunity was approximately $70 billion in 2013, including printing hardware, supplies and related services. This opportunity includes printers and multifunction devices as well as a declining base of copiers and fax machines that are increasingly...

-

Page 33

...so; Continued convergence between printers, scanners, copiers and fax machines into single, integrated multifunction and all-inone devices; Increasing ability of multi-function printing devices and mobile devices to integrate into business process workflow solutions and enterprise content management...

-

Page 34

... Lexmark's strategy is based on a business model of investing in technology to develop and sell printing and imaging and content and process management solutions, including printers, multifunction devices and software solutions with the objective of growing its installed base of hardware devices...

-

Page 35

...in technology, hardware and software products and solutions to secure high value product installations and capture profitable supplies, software subscription, and maintenance and service annuities in document-intensive industries and business processes; Target and capture business customers, markets...

-

Page 36

... warranty services, and separately priced maintenance services. These bundled arrangements typically involve capital or operating leases, or upfront purchases of hardware or software products with services and supplies provided per contract terms or as needed. The Company uses its best estimate...

-

Page 37

... company-specific intentions. Warranty Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The amounts accrued for product warranties are based on the quantity of units sold under warranty, estimated product failure rates, and material usage and service...

-

Page 38

... assumptions, such as plan participants' life expectancy. Prior service cost or credit will continue to be accumulated in other comprehensive earnings and amortized over the estimated future service period of active plan participants. For the years ended December 31, 2013, 2012, and 2011, the asset...

-

Page 39

...scanners, printers and multifunction devices) alleging the copyright owners are entitled to compensation because these devices enable reproducing copyrighted content. Other countries are also considering imposing fees on certain devices. The amount of fees would depend on the number of products sold...

-

Page 40

... long-lived assets for impairment. The Company uses third parties to report the fair values of its marketable securities and pension plan assets, though the responsibility remains with the Company's management. The Company utilizes various sources of pricing as well as trading and other market data...

-

Page 41

... on changes in its own cash flow projections as well as changes in the regulatory and economic environment that may indicate that selling a security is advantageous to the Company. Historically, the Company has incurred a low amount of realized losses from sales of marketable securities.

37 37

-

Page 42

... and certain market-based measurements. For its estimation of the fair value of the ISS reporting unit, the Company used a discounted cash flow analysis. Goodwill recognized by the Company at December 31, 2013 was $456.0 million and was allocated to the Perceptive Software and ISS reporting units in...

-

Page 43

... are not related to the operations of Lexmark's reportable segments. See "CRITICAL ACCOUNTING POLICIES AND ESTIMATES" in Item 7 for additional information. The following table summarizes the results of the Company's operations for the years ended December 31, 2013, 2012 and 2011: 2013 (Dollars in...

-

Page 44

... services sold on a unit basis or through a managed service agreement Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold on a unit basis or as a subscription service

ISS For the year ended December 31, 2013...

-

Page 45

... costs in connection with the Company's restructuring activities, $20.4 million of pre-tax acquisition-related adjustments, and a pension and other postretirement benefit plan net loss of $21.0 million. Gross profit for 2011 includes the first full year of Perceptive Software financial results...

-

Page 46

...Company's 2012 restructuring actions. Restructuring and related charges increased YTY primarily in the ISS segment and in All other and were driven by the Company's latest restructuring actions announced in 2012 related to the Company's exiting of the development and manufacture of inkjet technology...

-

Page 47

...the gain on sale of inkjet-related technology and assets and other divestiture costs. Pension and other postretirement benefit plan net (gain) loss 2013 2012 2011 83.0) 21.8 94.7 $ (83.0) $ 21.8 $ 94.7

(Dollars in millions) ISS Perceptive Software All other Total

Restructuring charges and project...

-

Page 48

...'s inkjet technology, with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply chain, marketing and sales as well as other support functions. The Company will continue to provide service, support and aftermarket supplies for its inkjet installed base...

-

Page 49

... of 2013, the Company sold its inkjet-related technology and assets. Refer to Part II, Item 8, Note 4 of the Notes to Consolidated Financial Statements for more information. The 2012 Restructuring Actions are expected to impact about 2,063 positions worldwide, including 300 manufacturing positions...

-

Page 50

... and $0.7 million in Perceptive Software. The Company incurred restructuring charges and project costs related to the Other Restructuring Actions of $0.8 million in ISS and $1.9 million in All other. Impact to 2011 Financial Results For the year ended December 31, 2011, the Company incurred charges...

-

Page 51

... presented on the balance sheet of the acquired company. These intangible assets consist primarily of purchased technology, customer relationships, trade names, in-process research and development and non-compete agreements. Subsequent to the acquisition date, some of these intangible assets begin...

-

Page 52

... pre-tax benefit costs related to Lexmark's pension and other postretirement plans for the years 2013, 2012, and 2011. These amounts reflect the Company's 2013 change in accounting policy for pension and other postretirement benefit plan asset and actuarial gains and losses. Refer to Part II, Item...

-

Page 53

... Department to develop a new yield curve to discount pension obligations for determining the funded status of a plan when calculating the funding requirements. Refer to Part II, Item 8, Note 17 of the Notes to Consolidated Financial Statements for additional information relating to the Company...

-

Page 54

... inventory levels due to exit of inkjet business. Refer to the contractual cash obligations table that follows for additional information regarding items that will likely impact the Company's future cash flows. The $20.3 million increase in cash flow from operating activities from 2011 to 2012...

-

Page 55

... investing activities during 2012 compared to that of 2011 was driven by the $204.0 million increase in business acquisitions. The Company's business acquisitions, marketable securities and capital expenditures are discussed below. Business acquisitions In 2013, cash flow used to acquire businesses...

-

Page 56

...Brainware is a leading provider of intelligent data capture software which builds upon and strengthens Lexmark's unique, industry-leading end-to-end products, solutions and services with a broader range of software that enables customers to capture, manage and access information and business process...

-

Page 57

... executed during the period. As of December 31, 2013, there was approximately $169 million of remaining share repurchase authority from the Board of Directors. This repurchase authority allows the Company, at management's discretion, to selectively repurchase its stock from time to time in the open...

-

Page 58

... fundamental changes to its structure and business. Additional information related to the amended credit facility can be found in the Form 8-K report that was filed with the SEC by the Company on February 6, 2014. As of December 31, 2013 and December 31, 2012, there were no amounts outstanding under...

-

Page 59

...obtain access to new financings in the future. The Company does not have any rating downgrade triggers that accelerate the maturity dates of its Facility or public debt. The Company was in compliance with all covenants and other requirements set forth in its debt agreements at December 31, 2013. The...

-

Page 60

... 2012 and 2011, respectively. The capital expenditures for 2013 principally related to building and improvements, infrastructure support (including internal-use software expenditures) and new product development. The Company expects capital expenditures to be approximately $150 million for full year...

-

Page 61

... At December 31, 2013, the fair value of the Company's senior notes was estimated at $745.1 million based on the prices the bonds have recently traded in the market as well as the overall market conditions on the date of valuation, stated coupon rates, the number of coupon payments each year and the...

-

Page 62

... SUPPLEMENTARY DATA

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS For the years ended December 31, 2013, 2012, and 2011 (In Millions, Except Per Share Amounts) 2013 Revenue: Product Service Total Revenue Cost of revenue: Product Service Restructuring-related costs...

-

Page 63

... $3.5 in 2013, $(0.6) in 2012, and $5.8 in 2011) Recognition of pension and other postretirement benefit plans prior service credit, net of (amortization) (net of tax benefit (liability) of $(0.8) in 2013, $0.1 in 2012, and $1.4 in 2011) Net unrealized (loss) gain on OTTI* marketable securities (net...

-

Page 64

... assets: Cash and cash equivalents Marketable securities Trade receivables, net of allowances of $24.7 in 2013 and $23.6 in 2012 Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Marketable securities Goodwill Intangibles, net Other assets...

-

Page 65

... activities: Purchases of property, plant and equipment Purchases of marketable securities Proceeds from sales of marketable securities Proceeds from maturities of marketable securities Purchase of businesses, net of cash acquired Proceeds from sale of facilities Proceeds from sale of inkjet-related...

-

Page 66

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY For the years ended December 31, 2013, 2012, and 2011 (In Millions)

Class A and B Common Stock Shares 78.6 Amount $ 0.9 Accumulated Other Comprehensive Total Earnings Stockholders' (Loss) Equity $ 11.9 $ 1,...

-

Page 67

... solutions. The Company operates in the office printing and imaging, and enterprise content and business process management ("ECM and BPM"), document output management ("DOM"), intelligent data capture and search software markets. Lexmark's products include laser printers and multifunction devices...

-

Page 68

... observable market data is lacking, the Company uses valuation techniques consistent with the income approach whereby future cash flows are converted to a single discounted amount. The Company uses multiple sources of pricing as well as trading and other market data in its process of reporting fair...

-

Page 69

... for developing, purchasing, or otherwise acquiring software for internal use. These software costs are included in Property, plant and equipment, net, on the Consolidated Statements of Financial Position and are amortized over the estimated useful life of the software, generally three to five years...

-

Page 70

... as certain market-based measurements, including multiples developed from prices paid in observed market transactions of comparable companies. In estimating the fair value of its Perceptive Software reporting unit, the Company used an equally-weighted measure based on a discounted cash flow analysis...

-

Page 71

.... ISS offers a broad portfolio of monochrome and color laser printers and laser multifunction products as well as a wide range of supplies and services covering its printing products and technology solutions. Perceptive Software offers a complete suite of ECM, BPM, DOM, intelligent data capture and...

-

Page 72

... at the time of sale. Lexmark also records estimated reductions to revenue for price protection, which it provides to substantially all of its distributors and reseller customers. Printing Services Revenue from support or maintenance contracts, including extended warranty programs, is recognized...

-

Page 73

... of new products and enhancements to its existing products. The Company's research and development activity is focused on laser devices and associated supplies, features and related technologies as well as software. Refer to Software Development Costs earlier in this note for information related to...

-

Page 74

... benefit plan costs related to active employees whose wages are directly or indirectly allocated to the current production of inventory and capitalized software, as required under U.S. GAAP. As retrospective application of this change did not have a material impact on previously reported Inventories...

-

Page 75

... of Accounting Change

Year Ended December 31, 2013 Revenue: Product Service Total Revenue Cost of revenue: Product Service Restructuring-related costs Total Cost of revenue Gross profit Research and development Selling, general and administrative Gain on sale of inkjet-related technology and assets...

-

Page 76

... Share Amounts) As Previously Reported Effect of Accounting Change As Adjusted for Accounting Change

Year Ended December 31, 2012 Revenue: Product Service Total Revenue Cost of revenue: Product Service Restructuring-related costs Total Cost of revenue Gross profit Research and development Selling...

-

Page 77

... Share Amounts) As Previously Reported Effect of Accounting Change As Adjusted for Accounting Change

Year Ended December 31, 2011 Revenue: Product Service Total Revenue Cost of revenue: Product Service Restructuring-related costs Total Cost of revenue Gross profit Research and development Selling...

-

Page 78

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS (In Millions) Historical Accounting Method 190.6 Effect of Accounting Change $ 71.2 $

Year Ended December 31, 2013

As Reported 261.8

Net earnings $ Other comprehensive earnings (loss): Foreign currency ...

-

Page 79

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (In Millions) Historical Accounting Method $ 1,620.0 (242.1) As Previously Reported $ 1,507.5 (283.2) Effect of Accounting Change $ (206.9) 206.9 $

As of December 31, 2013 Retained earnings Accumulated other ...

-

Page 80

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS (In Millions) Historical Accounting Method Effect of Accounting Change

Year Ended December 31, 2013

As Reported

Cash flows from operating activities: Net earnings $ Adjustments to reconcile net earnings to net cash...

-

Page 81

Lexmark International, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In Millions) Historical Accounting Method Effect of Accounting Change

Year Ended December 31, 2013 Retained earnings: Beginning balance Net earnings Ending balance Accumulated other comprehensive earnings ...

-

Page 82

... estimated future service period of active plan participants. Stock-Based Compensation: Equity Classified Share-based payments to employees, including grants of stock options, are recognized in the financial statements based on their grant date fair value. The fair value of the Company's stock-based...

-

Page 83

... to benefits provided in prior restructuring activities. Specifically for termination benefits under a one-time benefit arrangement, the timing of recognition and related measurement of a liability depends on whether employees are required to render service until they are terminated in order to...

-

Page 84

... fiscal year and required prospective application. The amendments in ASU 2012-02 did not have a material impact on the Company's financial statements as the Company elected to perform the quantitative impairment test during the fourth quarter of 2013 when the Company's indefinite-lived trade names...

-

Page 85

... Service revenue includes extended warranties and professional services performed under MPS arrangements, as well as software subscriptions, maintenance and support, and other software-related services. Product revenue includes all hardware, parts, supplies and license revenue. Restructuring-related...

-

Page 86

... 2013 Based on Quoted prices in active Markets Fair value Assets measured at fair value on a recurring basis: Cash equivalents (1) Money market funds U.S. government and agency securities Corporate debt securities Available-for-sale marketable securities Government & agency debt securities Corporate...

-

Page 87

... information demonstrating that the prices were observable in the market during the periods shown.

Of the realized and unrealized losses included in earnings during the year ended December 31, 2012, none were related to Level 3 securities held by the Company at December 31, 2012. Transfers 2013...

-

Page 88

... are converted to a single discounted amount. Marketable Securities - Valuation Process The Company uses third-party pricing information to report the fair values of the securities in which Lexmark is invested, though the responsibility of valuation remains with the Company's management. For most...

-

Page 89

... securities are categorized as Level 3 when there is higher variability in the pricing data, a low number of pricing sources, or the Company is otherwise unable to gather supporting information to conclude that the price can be transacted upon in the market at the reporting date. Money market funds...

-

Page 90

... are based on the prices the bonds have recently traded in the market, as well as the overall market conditions on the date of valuation, stated coupon rates, the number of coupon payments each year, and the maturity dates. The fair value of the debt is not recorded on the Company's Consolidated...

-

Page 91

.... On October 3, 2013 the Company acquired PACSGEAR, Inc. ("PACSGEAR"). PACSGEAR is a leading provider of connectivity solutions for healthcare providers to capture, manage and share medical images and related documents and integrate them with existing picture archiving and communication systems and...

-

Page 92

...are complementary to the Perceptive Software business. The total estimated fair value of intangible assets acquired was $85.7 million, with a weighted-average useful life of 6.8 years. The purchase of Saperion is included in Purchase of businesses, net of cash acquired in the Consolidated Statements...

-

Page 93

... 29, 2012, the Company acquired all of the issued and outstanding shares in BDGB Enterprise Software (Lux) S.C.A. ("Brainware"). Brainware is a leading provider of intelligent data capture software. The acquisition builds upon and strengthens the Company's end-to-end business process solutions and...

-

Page 94

... of high performance enterprise and federated search and document filtering software. The acquisition of ISYS strengthens Perceptive Software's ECM and BPM solutions, allowing customers to seamlessly access needed content, stored anywhere in the enterprise, in the context of the business process in...

-

Page 95

... useful life of 5.2 years. The intangible assets subject to amortization are being amortized on a straight-line basis over their estimated useful lives as of the respective acquisition dates. The goodwill recognized in the acquisitions of Acuo, Nolij and ISYS was assigned to the Perceptive Software...

-

Page 96

...-compete agreements Purchased technology In-process technology (2) Accounts payable Short-term borrowings Deferred revenue Other liabilities Long-term debt Deferred tax liability, net (3) Total identifiable net assets Goodwill Total purchase price

$

(1) The estimated useful life of the trade names...

-

Page 97

... services on the Consolidated Statements of Cash Flows for the year ended December 31, 2013.

5.

RESTRUCTURING CHARGES

2012 Restructuring Actions General As part of Lexmark's ongoing strategy to increase the focus of its talent and resources on higher usage business platforms, the Company...

-

Page 98

... hardware, with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply chain, marketing and sales as well as other support functions. The Company will continue to provide service, support and aftermarket supplies for its inkjet installed base. The Company...

-

Page 99

..., supply chain and sales support, marketing and sales management, and consolidating of the Company's research and development programs. In the fourth quarter of 2013 employee termination benefit charges were incurred for actions that were not a part of an announced plan. The Other Restructuring...

-

Page 100

... to revisions in assumptions. For the years ended December 31, 2013, 2012, and 2011, the Company incurred restructuring charges in connection with the Other Restructuring Actions in the Company's segments as follows: 2013 ISS All other Perceptive Software Total charges Liability Rollforward The...

-

Page 101

... shares of Class A Common Stock have been authorized for these stock incentive plans. The Company also grants cash-based longterm incentive awards based on the Company's relative total shareholder return. For the years ended December 31, 2013, 2012 and 2011, the Company incurred pre-tax stock-based...

-

Page 102

...the date of grant. No stock options were granted during 2013, 2012, or 2011. A summary of the status of the Company's stock-based compensation plans as of December 31, 2013 and the change during the year is presented below: Weighted Average Weighted Remaining Aggregate Average Options Exercise Price...

-

Page 103

.... The fair values of the Company's available-for-sale marketable securities are based on quoted market prices or other observable market data, discount cash flow analyses, or in some cases, the Company's amortized cost which approximates fair value. Money market funds included in Cash and cash...

-

Page 104

... of OTTI requires that credit related OTTI on debt securities be recognized in earnings while noncredit related OTTI of debt securities not expected to be sold be recognized in other comprehensive income. For the years ended December 31, 2013, 2012, and 2011, the Company incurred no OTTI on its...

-

Page 105

... $ (1.5) $ 100.4 $ (1.6)

Auction rate securities Corporate debt securities Asset-backed and mortgage-backed securities Government and agency Total

The following table provides information, at December 31, 2012, about the Company's marketable securities with gross unrealized losses for which other...

-

Page 106

... speeds, default rates, and current loan status. These drivers are used to apply specific assumptions to each security and are further divided in order to separate the underlying collateral into distinct groups based on loan performance characteristics. For instance, more weight is placed on higher...

-

Page 107

....0 million in 2013, 2012 and 2011, respectively. Leased products refers to hardware leased by Lexmark to certain customers as part of the Company's ISS operations. The cost of the hardware is amortized over the life of the contracts, which have been classified as operating leases based on the terms...

-

Page 108

arrangements. The accumulated depreciation related to the Company's leased products was $89.7 million and $76.5 million at yearend 2013 and 2012, respectively. The Company accounts for its internal-use software, an intangible asset by nature, in Property, plant and equipment, net on the Consolidated...

-

Page 109

... lived asset until completion or abandonment of the associated research and development efforts. The Company begins amortizing its in-process technology assets upon completion of the projects. The Company reevaluated the indefinite useful life assumption for its Perceptive Software trade name...

-

Page 110

...million legal accrual related to a legal resolution, refer to Note 19 of the Notes to Consolidated Financial Statements for additional information, and approximately $39.6 million related to incentive based compensation accruals, due to improved Company performance. Changes in the Company's warranty...

-

Page 111

... liability due to favorable market conditions. Refer to Note 17 of the Notes to Consolidated Financial Statements for more information related to pension and other postretirement plans.

13.

DEBT

Senior Notes - Long-term Debt In March 2013, the Company completed a public debt offering of $400...

-

Page 112

... 18, 2012, by increasing its size to $500 million. Refer to Note 21 of the Notes to Consolidated Financial Statements for additional information regarding the Company's amended credit facility agreement. Short-term Debt Lexmark's Brazilian operation has a short-term, uncommitted line of credit...

-

Page 113

... U.S. research and experimentation tax credit in 2013 for the 2012 tax year. The effective income tax rate was 33.8% for the year ended December 31, 2012. The 15.1 percentage point increase of the effective tax rate from 2011 to 2012 was due primarily to a geographic shift in earnings toward higher...

-

Page 114

... loss carryforwards Credit carryforwards Inventories Restructuring Pension and postretirement benefits Warranty Equity compensation Other compensation Foreign exchange Other Deferred tax liabilities: Property, plant and equipment Intangible assets Foreign exchange Valuation allowances Net deferred...

-

Page 115

... Class A Common Stock. At December 31, 2013, there were 804.2 million shares of authorized, unissued Class A Common Stock. Of this amount, approximately 16.3 million shares of Class A Common Stock have been reserved under employee stock incentive plans and nonemployee director plans. There were also...

-

Page 116

... were no outstanding ASR Agreements as of December 31, 2013. Under the terms of the ASR Agreements, the Company paid an agreed upon amount targeting a certain number of shares based on the closing price of the Company's Class A Common Stock on the date of each agreement. The Company took delivery of...

-

Page 117

... unrealized gain (loss) on marketable securities Net unrealized gain (loss) on cash flow hedge Total other comprehensive earnings (loss) $ 14.7 0.2 (0.6) 2.6 (0.9) 16.0 $ (0.6) 0.1 0.4 (0.6) 0.5 (0.2) $ 15.3 0.1 (1.0) 3.2 (1.4) 16.2

$

$

$

Year Ended December 31, 2011 Change, Tax benefit Change...

-

Page 118

... African rand. The primary drivers of the favorable change in 2012 were increases in the exchange rate values of approximately 7% in the Philippine peso, 8% in the Mexican peso and 2% in the Euro. The primary drivers of the unfavorable change in 2011 were decreases in the exchange rate values of...

-

Page 119

... of the basic and diluted EPS calculations for the years ended December 31: 2013 Numerator: Net earnings Denominator: Weighted average shares used to compute basic EPS Effect of dilutive securities - Employee stock plans Weighted average shares used to compute diluted EPS Basic net EPS Diluted net...

-

Page 120

... additional information regarding restricted stock awards with a performance condition. The Company executed four accelerated share repurchase agreements with financial institution counterparties in 2013, resulting in a total of 2.7 million shares repurchased at a cost of $82 million during the year...

-

Page 121

... status at December 31: Pension Benefits 2013 2012 Change in Benefit Obligation: Benefit obligation at beginning of year Service cost Interest cost Contributions by plan participants Actuarial (gain) loss Benefits paid Foreign currency exchange rate changes Plan amendments and adjustments Settlement...

-

Page 122

... fiscal year is $0.7 million. Assumptions: Pension Benefits 2013 2012 Weighted-Average Assumptions Used to Determine Benefit Obligations at December 31: Discount rate Rate of compensation increase Other Postretirement Benefits 2013 2012

4.6 3.0

% %

3.9 3.1

% %

3.9 4.0

% %

3.5 4.0

% %

118

-

Page 123

... to report the fair values of its plan assets. The Company tested the fair value of the portfolio and default level assumptions provided by the third parties as of December 31, 2013 and December 31, 2012 using the following procedures assessment of trading activity and other market data, assessment...

-

Page 124

... based upon a percentage of employees' contributions. The Company's expense under these plans was $28.3 million, $26.0 million and $25.6 million in 2013, 2012 and 2011, respectively. Additional Information Other postretirement benefits: For measurement purposes, a 7.4% annual rate of increase...

-

Page 125

Related to Lexmark's acquisition of the Information Products Corporation from IBM in 1991, IBM agreed to pay for its pro rata share (currently estimated at $13.2 million) of future postretirement benefits for all the Company's U.S. employees based on prorated years of service with IBM and the ...

-

Page 126

... at their fair value. Fair values for Lexmark's derivative financial instruments are based on pricing models or formulas using current market data, or where applicable, quoted market prices. On the date the derivative contract is entered into, the Company designates the derivative as a fair value...

-

Page 127

... circumstances. In addition, the Company uses credit insurance for specific obligors to limit the impact of nonperformance. Lexmark sells a large portion of its products through third-party distributors and resellers and original equipment manufacturer ("OEM") customers. If the financial condition...

-

Page 128

... ordinary course of business. In addition, various governmental authorities have from time to time initiated inquiries and investigations, some of which are ongoing, including concerns regarding the activities of participants in the markets for printers and supplies. The Company intends to continue...

-

Page 129

... in such damages. On November 17, 2010, the trial court Judge partially granted the Company's motion for a new trial solely as to the argument that current employees are not entitled to any damages. On March 7, 2011 the trial court Judge reduced the original award to $7.8 million. On October 28...

-

Page 130

... Trademark Office in Munich the Company asserted that all claims for levies on single function printers sold by the Company in Germany should be dismissed. On February 22, 2011 the arbitration board issued a partial decision finding that the claims of VG Wort for the years 2001 through 2005 are time...

-

Page 131

... and Perceptive Software. ISS offers a broad portfolio of monochrome and color laser printers and laser multifunction products as well as a wide range of supplies and services covering its printing products and technology solutions. In August 2012, the Company announced it will exit the development...

-

Page 132

...Sales are attributed to geographic areas based on the location of customers. Other International revenue includes exports from the U.S. and Europe. The following is long-lived asset information by geographic area as of December 31: 2013 Long-lived assets: United States EMEA (Europe, the Middle East...

-

Page 133

... (2) Includes laser, inkjet, and dot matrix supplies and associated supplies services sold on a unit basis or through a managed service agreement (3) Includes parts and service related to hardware maintenance and includes software licenses and the associated software maintenance services sold on...

-

Page 134

...share Stock prices: High Low $

37.91 33.07

$

33.24 24.86

$

27.75 16.77

$

25.61 20.73

The Company acquired Brainware in February of 2012, ISYS and Nolij in March of 2012, Acuo Technologies in December of 2012, AccessVia and Twistage in March of 2013, Saperion in September of 2013 and PACSGEAR...

-

Page 135

...acquisitions. Net earnings for the second quarter of 2013 included a $73.5 million pre-tax Gain on sale of inkjet-related technology and assets, $13.3 million of pre-tax restructuring charges and project costs in connection with the Company's restructuring plans, and $16.2 million of pre-tax charges...

-

Page 136

... which it accounts for pension and other postretirement benefit obligations, inventory costing and capitalization of internal-use software costs in 2013. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial...

-

Page 137

... and Executive Vice President and Chief Financial Officer have concluded that the Company's disclosure controls and procedures are effective in providing reasonable assurance that the information required to be disclosed by the Company in the reports that it files under the Securities Exchange Act...

-

Page 138

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected.

Item 9B. None

OTHER INFORMATION

134

-

Page 139

... of Business Conduct from: Lexmark International, Inc. Attention: Investor Relations One Lexmark Centre Drive 740 West New Circle Road Lexington, Kentucky 40550 (859) 232-5568 The New York Stock Exchange ("NYSE") requires that the Chief Executive Officer of each listed Company certify annually to...

-

Page 140

... "Related Person Transactions," "Executive Compensation" and "Director Compensation."

Item 14.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Information required by Part III, Item 14 of this Form 10-K is incorporated by reference from the Company's definitive Proxy Statement for its 2014 Annual Meeting...

-

Page 141

... Financial statements filed as part of this Form 10-K are included under Part II, Item 8. (2) Financial Statement Schedule: Report of Independent Registered Public Accounting Firm included in Part II, Item 8 For the years ended December 31, 2011, 2012 and 2013: Schedule II - Valuation and Qualifying...

-

Page 142

LEXMARK INTERNATIONAL, INC. AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS For the Years Ended December 31, 2011, 2012 and 2013 (In Millions)

(A) (B) Balance at Beginning of Period Charged to Costs and Expenses (C) Additions Charged to Other Accounts Balance at End of Period (D) ...

-

Page 143

... duly authorized in the City of Lexington, Commonwealth of Kentucky, on March 3, 2014. LEXMARK INTERNATIONAL, INC. By /s/ Paul A. Rooke Name: Paul A. Rooke Title: Chairman and Chief Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed...

-

Page 144

.... (the "Company") and Lexmark International Group, Inc. 3.1 3.2 4.1 Restated Certificate of Incorporation of the Company. Company By-Laws, as Amended and Restated April 25, 2013. Form of Indenture, dated as of May 22, 2008, by and between the Company and The Bank of New York Trust Company, N.A., as...

-

Page 145

... Purchase and Contribution Agreement, dated as of October 10, 2013, by and between the Company and Perceptive Software, LLC, as Sellers; and Lexmark Receivables Corporation, as Purchaser.

10-Q

9/30/13

10.1

11/7/13

10.9

10-Q

9/30/13

10.2

11/7/13

10.10 10.11

Company Stock Incentive Plan...

-

Page 146

... Directors.+ Master Inkjet Sale Agreement by and among the Company, Lexmark International Technology, S.A., and Funai Electric Company, Ltd., dated April 1, 2013. Form of Time-Based Restricted Stock Unit Award Agreement pursuant to the 2013 Equity Compensation Plan.+ Form of 3-Year Performance-Based...

-

Page 147

... Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Interactive Data Files pursuant to Rule 405 of Regulation S-T: (i) the Consolidated Statements of Earnings for the years ended December 31, 2013, 2012 and 2011, (ii) the...

-

Page 148

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 149

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 150

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 151

... solutions, including enterprise content management, business process management, document output management, intelligent data capture and search; inability to perform under managed print services contracts; increased competition in the aftermarket supplies business; fees on the company's products...

-

Page 152