Lenovo 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

93

2014/15 Annual Report Lenovo Group Limited

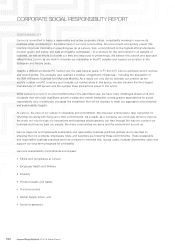

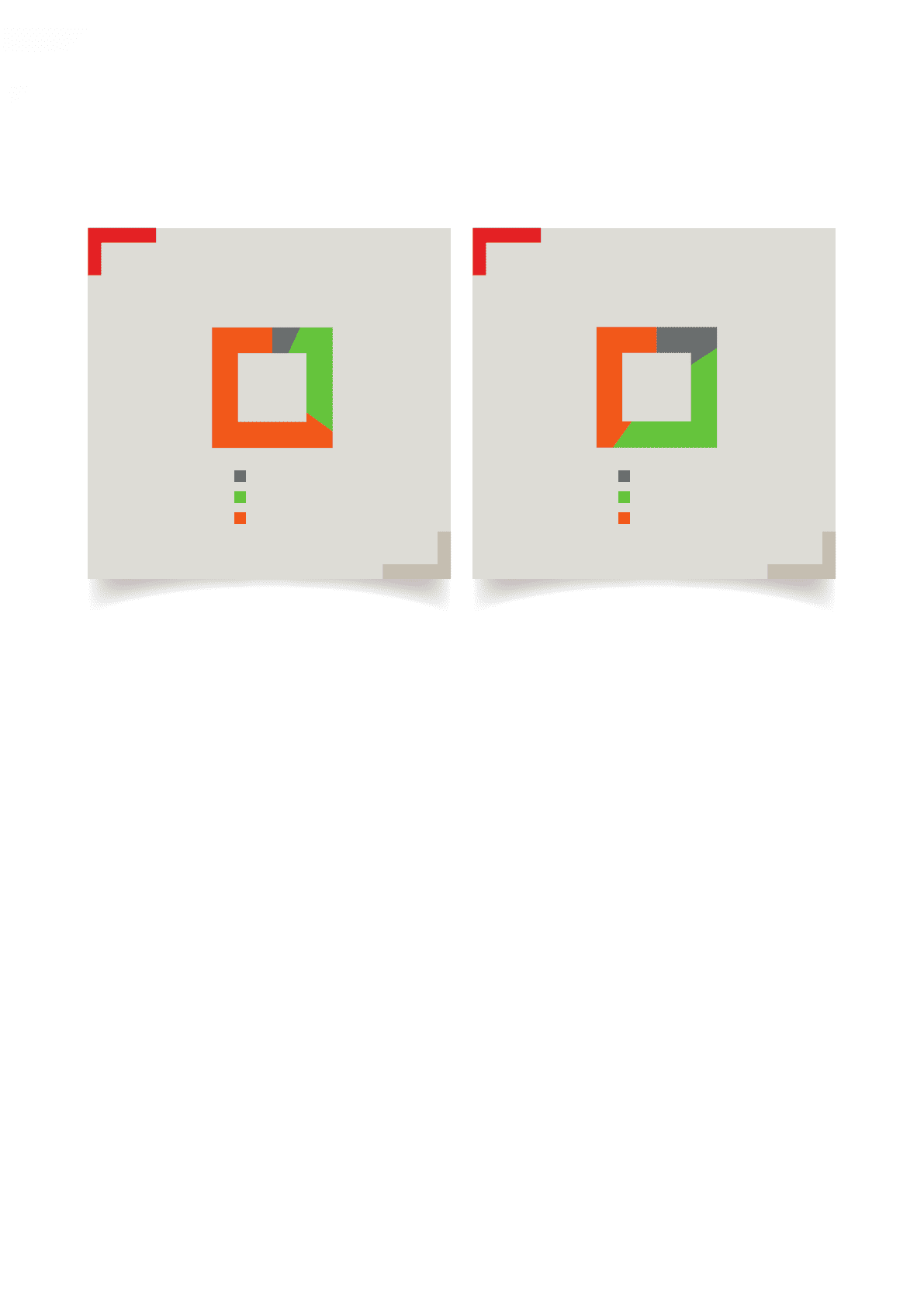

The Chairman/CEO Pay Mix chart reflects FY2014/15 emoluments disclosed in note 11. The Senior Management

Pay Mix chart reflects average FY2014/15 emoluments including LTI that were awarded in June 2014.

Chairman/CEO Pay Mix Senior Management Pay Mix (Average)

Performance Bonus

Base

LTI

Performance Bonus

Base

LTI

7% 16%

28%

65%

44%

40%

Fixed Compensation

Fixed compensation includes base salary, allowances and benefits-in-kind (e.g. medical, dental and life insurance,

etc.). Base salary and allowances are set and reviewed annually for each position, reflecting competitive market

positioning for comparable positions, market practices, as well as the Company’s performance and individual

contribution to the business. Allowances are provided to facilitate temporary and permanent staff relocations.

Benefits-in-kind are reviewed regularly taking into consideration relevant industry and local market practices.

Performance Bonus

The Chairman/CEO and senior management are eligible to receive performance bonuses. The amounts paid

under the plan are based on the performance of the Company using select financial and non-financial metrics, its

subsidiaries, relevant performance groups and/or geographies as appropriate, as well as individual performance.

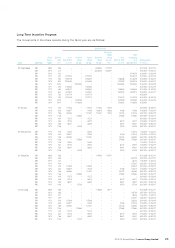

Long-Term Incentive Program (“LTI Program”)

The Company operates a LTI Program which was adopted by the Company on May 26, 2005. The purpose of the

LTI Program is to attract, retain, reward and motivate executive and non-executive directors, senior management

and selected top-performing employees of the Company and its subsidiaries.

Under the LTI Program, the Company maintains two types of equity-based compensation vehicles: (i) share

appreciation rights, and (ii) restricted share units. These vehicles are described in more detail below.

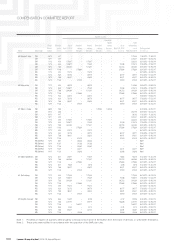

(i) Share Appreciation Rights (“SARs”)

SARs entitle the holder to receive the appreciation in value of the Company’s share price above a predetermined

level. SARs are typically subject to a vesting schedule of up to four years.

(ii) Restricted Share Units (“RSUs”)

RSU is equivalent to the value of one ordinary share of the Company. Once vested, RSU is converted to an

ordinary share, or its cash equivalent. RSUs are typically subject to a vesting schedule of up to four years.

Dividends are typically not paid on RSUs.