Lenovo 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Lenovo Group Limited 2014/15 Annual Report

MANAGEMENT’S DISCUSSION & ANALYSIS

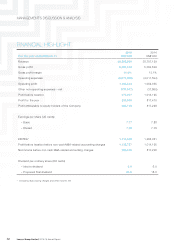

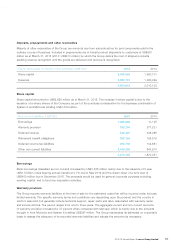

Operating expenses for the year increased by 39% as compared with last year. This is principally attributable to

the operating expenses of US$1,433 million recorded by System X and Motorola following the completion of the

respective acquisitions on October 1 and October 30, 2014. Key expenses by nature comprise:

2015 2014

For the year ended March 31 US$’000 US$’000

Depreciation of property, plant and equipment and amortization

of prepaid lease payments (127,516) (74,472)

Amortization of intangible assets (287,877) (127,163)

Employee benefit costs, including (2,997,614) (2,332,675)

– long-term incentive awards (99,062) (80,274)

Rental expenses under operating leases (88,774) (75,922)

Net foreign exchange loss (189,550) (79,242)

Advertising and promotional expenses (675,760) (554,415)

Others (1,206,208) (767,705)

(5,573,299) (4,011,594)

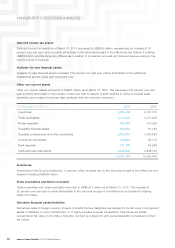

Depreciation and amortization charges increased by US$214 million which is attributable to the increase in

the business activities of the Group as well as the amounts brought in by System X and Motorola. Additional

amortization of intangible assets in connection with the acquisition of System X and Motorola for the year totaled

US$127 million. The increase in employee benefit costs is in line with the increased headcount as a result of the two

acquisitions and the continuous expanding business operations of the Group. The impact of currency fluctuations

during the year present a challenge, the Group recorded a net exchange loss of US$190 million (2014: US$79

million) for the year.

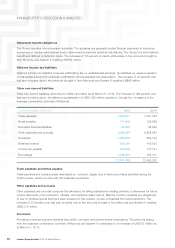

Other non-operating expenses (net) for the year ended March 31, 2015 and 2014 comprise:

2015 2014

For the year ended March 31 US$’000 US$’000

Finance income 30,902 33,893

Finance costs (185,504) (80,974)

Share of profits of associates and joint ventures 17,055 9,221

(137,547) (37,860)

Finance income mainly represents interest on bank deposits.

Finance costs for the year increased by 129 percent as compared with last year. This is mainly attributable to

interest expense of US$65 million in relation to the 5-Year US$1.5 billion notes, issued in May 2014, bearing annual

interest at 4.7% due in May 2019; an increase in factoring costs of US$30 million; and US$17 million interest

expense in relation to promissory note issued to Google Inc.

Share of profits of associates and joint ventures represents operating income arising from principal business

activities of respective associates and joint ventures.