Lenovo 2015 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

187

2014/15 Annual Report Lenovo Group Limited

NOTES TO THE FINANCIAL STATEMENTS

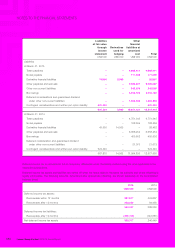

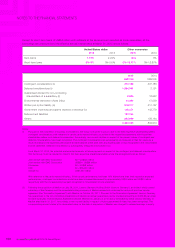

23 RECEIVABLES (continued)

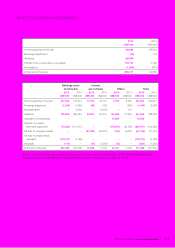

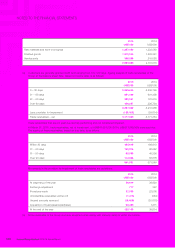

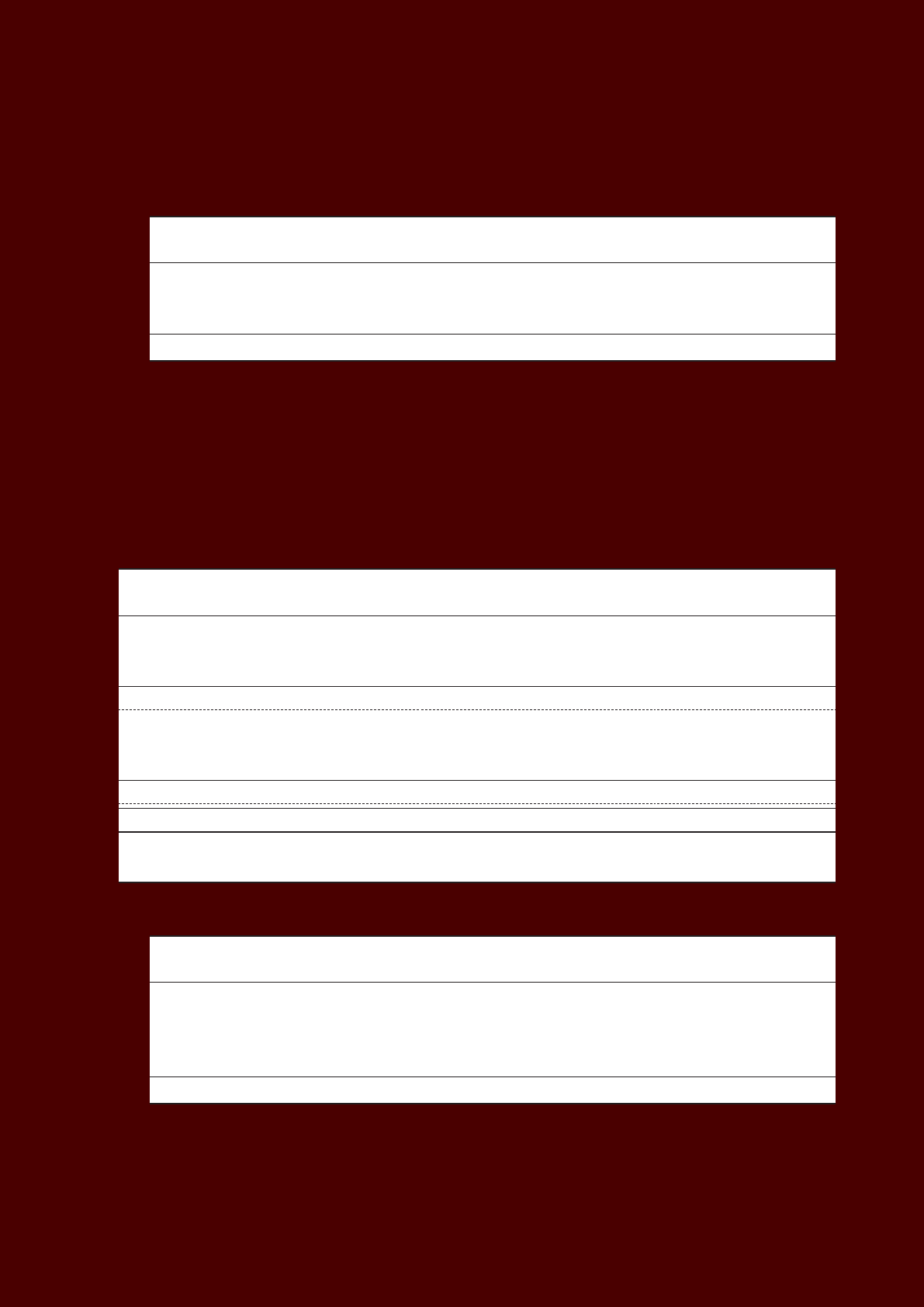

(c) Details of deposits, prepayments and other receivables are as follows:

2015 2014

US$’000 US$’000

Deposits 3,481 1,635

Other receivables (i) 2,322,355 1,937,679

Prepayments (ii) 1,246,179 1,061,512

3,572,015 3,000,826

Notes:

(i) Majority of other receivables of the Group are amounts due from subcontractors for part components sold in the ordinary course of

business.

(ii) The Group defers the cost of shipped products awaiting revenue recognition until the goods are delivered and revenue is

recognized. In-transit product shipments to customers of US$581 million as at March 31, 2015 (2014: US$413 million) are included

in prepayments.

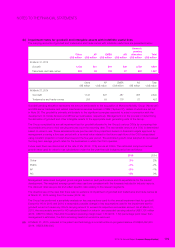

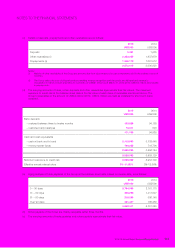

(d) The carrying amounts of trade, notes, deposits and other receivables approximate their fair values. The maximum

exposure to credit risk at the balance sheet date is the fair value of each class of receivable mentioned above. The

Group’s receivables in the amount of US$54 million (2014: US$14 million) are held as collateral for short-term loans

obtained.

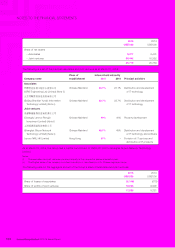

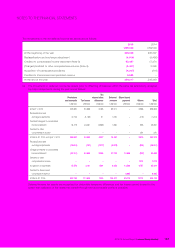

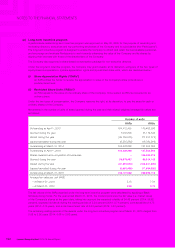

24 BANK DEPOSITS AND CASH AND CASH EQUIVALENTS

2015 2014

US$’000 US$’000

Bank deposits

– matured between three to twelve months 100,828 94,165

– restricted bank balances 70,311 820

171,139 94,985

Cash and cash equivalents

– cash at bank and in hand 2,110,990 3,138,440

– money market funds 744,233 719,704

2,855,223 3,858,144

3,026,362 3,953,129

Maximum exposure to credit risk 3,026,362 3,953,129

Effective annual interest rates 0%-11.60% 0%-12.36%

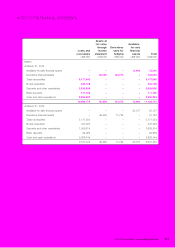

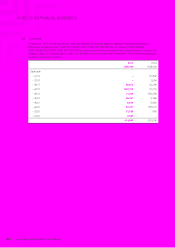

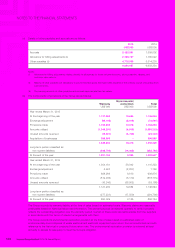

25 PAYABLES

(a) Aging analysis of trade payables of the Group at the balance sheet date, based on invoice date, is as follows:

2015 2014

US$’000 US$’000

0 – 30 days 3,764,369 2,761,170

31 – 60 days 358,296 1,217,547

61 – 90 days 218,299 586,145

Over 90 days 321,447 186,483

4,662,411 4,751,345

(b) Notes payable of the Group are mainly repayable within three months.

(c) The carrying amounts of trade payables and notes payable approximate their fair value.