Lenovo 2015 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

200 Lenovo Group Limited 2014/15 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

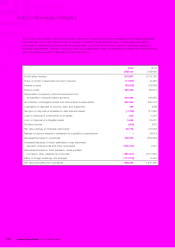

35 RETIREMENT BENEFIT OBLIGATIONS (continued)

(a) Pension benefits (continued)

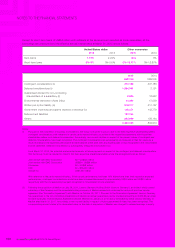

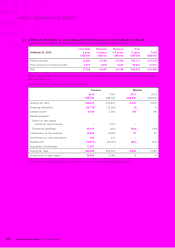

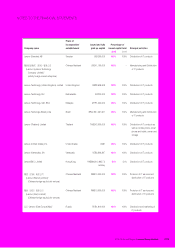

The principal actuarial assumptions used are as follows:

2015 2014

Discount rate 1%-2.75% 1.75%-3.75%

Future salary increases 0%-3% 0%-3%

Future pension increases 0%-1.75% 0%-1.75%

Life expectancy for male aged 60 24 23

Life expectancy for female aged 60 27 29

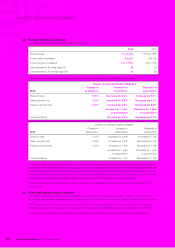

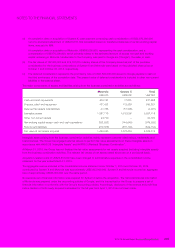

The sensitivity of the defined benefit obligation to changes in the weighted principal assumptions is:

Impact on defined benefit obligation

2015

Change in

assumption

Increase in

assumption

Decrease in

assumption

Discount rate 0.5% Decrease by 8.1% Increase by 9.1%

Salary growth rate 0.5% Increase by 0.8% Decrease by 0.7%

Pension growth rate 0.5% Increase by 3.0% Decrease by 2.3%

Increase by 1 year

in assumption

Decrease by 1 year

in assumption

Life expectancy Increase by 2.4% Decrease by 2.1%

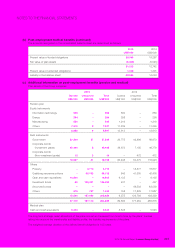

Impact on defined benefit obligation

2014

Change in

assumption

Increase in

assumption

Decrease in

assumption

Discount rate 0.5% Decrease by 6.6% Increase by 7.4%

Salary growth rate 0.5% Increase by 0.5% Decrease by 0.5%

Pension growth rate 0.5% Increase by 1.2% Decrease by 1.6%

Increase by 1 year

in assumption

Decrease by 1 year

in assumption

Life expectancy Increase by 1.7% Decrease by 1.6%

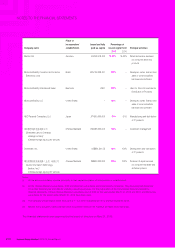

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant.

In practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the

sensitivity of the defined benefit obligation to significant actuarial assumptions the same method (present value of the

defined benefit obligation calculated with the projected unit credit method at the end of the reporting period) has been

applied as when calculating the pension liability recognised within the statement of financial position.

The methods and types of assumptions used in preparing the sensitivity analysis did not change compared to the

previous year.

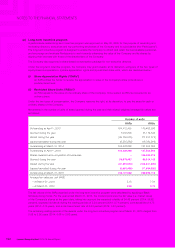

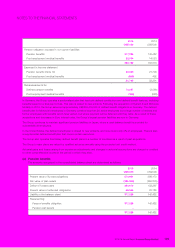

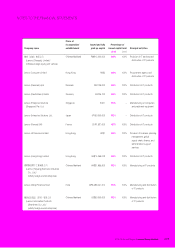

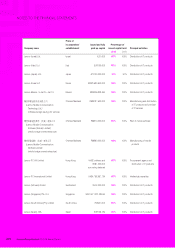

(b) Post-employment medical benefits

The Group operates a number of post-employment medical benefit schemes, principally in the US. The method of

accounting, assumptions and the frequency of valuations are similar to those used for defined benefit pension schemes.

The US plan (Lenovo Future Health Account and Retiree Life Insurance Program) is currently funded by a trust that

qualifies for tax exemption under US tax law, out of which benefits to eligible retirees and dependents will be made.

Changes in future medical cost trend rates has no effect on the liabilities for post-employment medical benefits.