Lenovo 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Lenovo Group Limited 2014/15 Annual Report

MANAGEMENT’S DISCUSSION & ANALYSIS

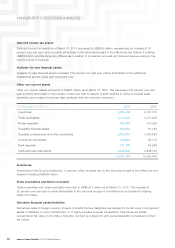

Retirement benefit obligations

The Group operates various pension schemes. The schemes are generally funded through payments to insurance

companies or trustee-administered funds, determined by periodic actuarial calculations. The Group has both defined

benefit and defined contribution plans. The increase of 155 percent is mainly attributable to the amounts brought in

from Motorola and System X totalling US$183 million.

Deferred income tax liabilities

Deferred income tax liabilities comprise withholding tax on undistributed earnings, tax liabilities on upward valuation

of intangibles arising from business combination and accelerated tax depreciation. The increase of 40 percent over

last year is largely due to the amounts brought in from Motorola and System X totalling US$86 million.

Other non-current liabilities

Other non-current liabilities amounted to US$2,440 million as at March 31, 2015. The increase of 189 percent over

last year is mainly due to the deferred consideration of US$1,393 million payable to Google Inc. in respect of the

business combination activities of Motorola.

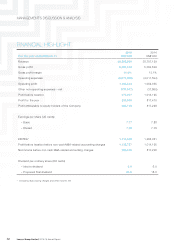

Current liabilities (US$’000) 2015 2014

Trade payables 4,662,411 4,751,345

Notes payable 171,049 108,559

Derivative financial liabilities 80,897 58,462

Other payables and accruals 9,066,487 6,658,254

Provisions 1,203,547 852,154

Deferred revenue 640,161 410,330

Income tax payable 168,536 177,741

Borrowings 1,168,274 445,477

17,161,362 13,462,322

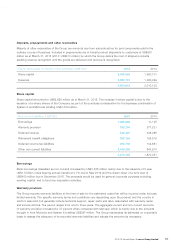

Trade payables and Notes payable

Trade payables and notes payable decreased by 1 percent, largely due to fewer purchases activities during the

fourth quarter, which is in line with the business projections.

Other payables and accruals

Other payables and accruals comprise the allowance for billing adjustments relating primarily to allowance for future

volume discounts, price protection, rebates, and customer sales returns. Majority of other payables are obligations

to pay for finished goods that have been acquired in the ordinary course of business from subcontractors. The

increase of 36 percent over last year is mainly due to the amounts brought in from Motorola and System X totalling

US$3,013 million.

Provisions

Provisions comprise warranty liabilities (due within one year) and environmental restorations. The amounts arising

from the business combination activities of Motorola and System X contributed to an increase of US$373 million as

at March 31, 2015.