Lenovo 2015 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

2014/15 Annual Report Lenovo Group Limited

NOTES TO THE FINANCIAL STATEMENTS

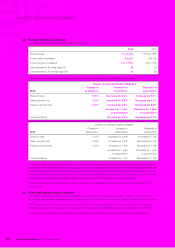

36 BUSINESS COMBINATIONS (continued)

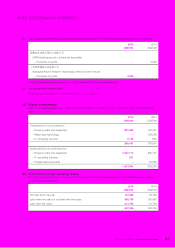

(a) At completion date on acquisition of System X, cash payment comprising cash consideration of US$2,070,000,000

net of a downward adjustment of US$210,811,622 calculated based on transferred balances of certain working capital

items, was paid to IBM.

At completion date on acquisition of Motorola, US$660,000,000, representing the cash consideration, and a

compensation of US$176,306,000, which primarily relates to the estimated amount of excess net cash and working

capital remaining in Motorola transferrable to the Company, was paid to Google Inc.(“Google”), the seller, in cash.

(b) The fair values of 182,000,000 and 519,107,215 ordinary shares of the Company issued as part of the purchase

consideration for the business combinations of System X and Motorola were based on the published share price on

October 1 and October 30, 2014, respectively.

(c) The deferred consideration represents the promissory note of US$1,500,000,000 issued to Google payable in cash on

the third anniversary of the completion date. The present value of deferred consideration is included in other non-current

liabilities in the balance sheet.

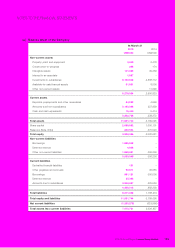

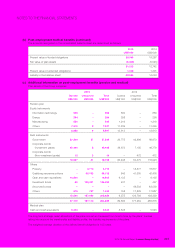

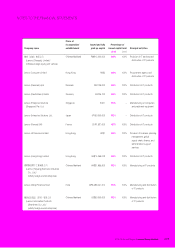

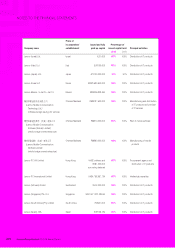

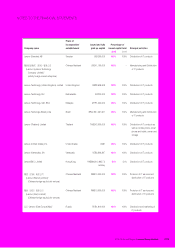

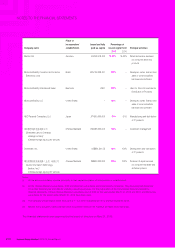

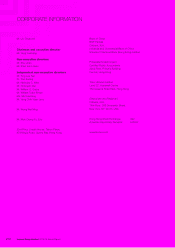

The major components of assets and liabilities arising from the business combination activities are as follows:

Motorola System X Total

US$’000 US$’000 US$’000

Cash and cash equivalents 404,157 17,801 421,958

Property, plant and equipment 477,432 113,429 590,861

Deferred tax assets less liabilities 47,358 (51,405) (4,047)

Intangible assets 1,587,718 1,510,000 3,097,718

Other non-current assets 24,720 –24,720

Net working capital except cash and cash equivalents (832,692) (146,646) (979,338)

Non-current liabilities (272,028) (370,726) (642,754)

Fair value of net assets acquired 1,436,665 1,072,453 2,509,118

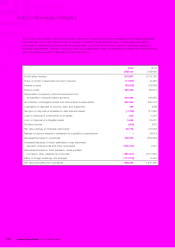

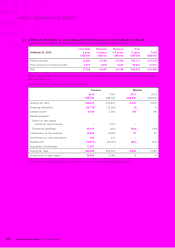

Intangible assets arising from the business combination activities mainly represent customer relationships, trademarks and

brand licenses. The Group has engaged external valuers to perform fair value assessments on these intangible assets in

accordance with HKAS 38 “Intangible Assets” and HKFRS 3 (Revised) “Business Combination”.

At March 31, 2015, the Group has not finalized the fair value assessments for net assets acquired (including intangible assets)

from the business combination activities. The relevant fair values of net assets stated above are on a provisional basis.

Acquisition-related costs of US$26,813,000 have been charged to administrative expenses in the consolidated income

statement for the year ended March 31, 2015.

The aggregate revenue included in the consolidated income statement since October 1, 2014 and October 30, 2014

contributed by System X and Motorola was approximately US$5,603,000,000. System X and Motorola incurred an aggregate

loss of approximately US$63,000,000 over the same period.

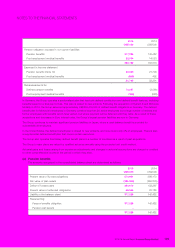

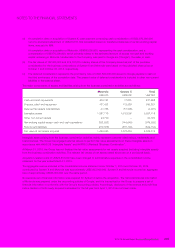

No separate set of financial information was prepared for System X before the acquisition. The historical financial information

of Motorola was prepared under the accounting policies of Google, and it is impractical for the Group to prepare a set of

financial information in conformity with the Group’s accounting policies. Accordingly, disclosure of the revenue and profit/loss

before taxation of both newly acquired businesses for the full year from April 1, 2014 has not been made.