Lenovo 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

2014/15 Annual Report Lenovo Group Limited

NOTES TO THE FINANCIAL STATEMENTS

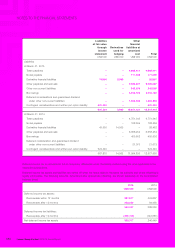

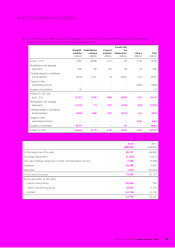

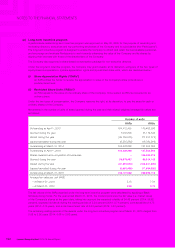

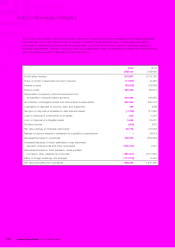

28 OTHER NON-CURRENT LIABILITIES (continued)

Notes: (continued)

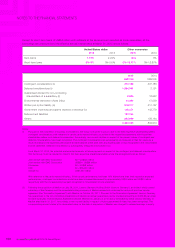

(iii) Pursuant to the joint venture agreement entered into between the Company and Compal Electronics, Inc. (“Compal”) to establish a joint

venture company (“JV Co”) to manufacture notebook computer products and related parts, the Company and Compal are respectively

granted call and put options which entitle the Company to purchase from Compal and Compal to sell to the Company the 49% Compal’s

interests in the JV Co. The call and put options will be exercisable at any time after October 1, 2019 and October 1, 2017 respectively.

The exercise price for the call and put options will be determined in accordance with the joint venture agreement, and up to a maximum

of US$750 million.

The financial liability that may become payable under the put option is initially recognized at fair value within other non-current liabilities

with a corresponding charge directly to equity, as a put option written on non-controlling interest.

The put option liability shall be re-measured at its fair value resulting from the change in the expected performance of the JV Co at each

balance sheet date, with any resulting gain or loss recognized in the consolidated income statement. If the actual performance of JV Co

had been 10% higher/lower than its expected performances, the written put option liability would have been increased/decreased by

approximately US$4 million with the corresponding loss/gain recognized in consolidated income statement.

In the event that the put option lapses unexercised, the liability will be derecognized with a corresponding adjustment to equity.

(iv) Government incentives and grants received in advance by certain group companies included in other non-current liabilities are mainly

related to research and development projects and construction of property, plant and equipment. These group companies are obliged to

fulfill certain conditions under the terms of the government incentives and grants. The government incentive and grants are credited to

the income statement upon fulfillment of those conditions.

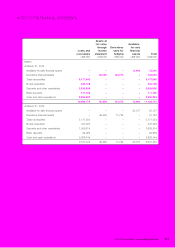

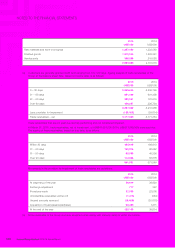

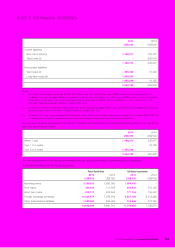

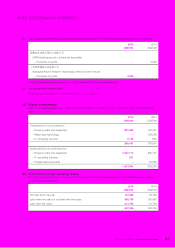

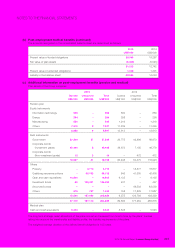

29 SHARE CAPITAL

2015 2014

Number of

shares US$’000

Number of

shares US$’000

Issued and fully paid:

Voting ordinary shares:

At the beginning of the year 10,406,375,509 1,650,101 10,439,152,059 33,465

Issue of ordinary shares 701,107,215 1,039,396 – –

Exercise of share options 1,172,000 385 18,277,450 816

Repurchase of shares – – (51,054,000) (164)

Transfer from share premium and share

redemption reserve (Note 30) – – –1,615,984

At the end of the year 11,108,654,724 2,689,882 10,406,375,509 1,650,101

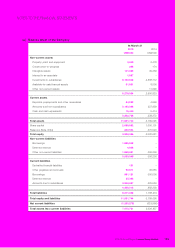

An entirely new Companies Ordinance (Cap.622) (“new CO”) that came into effect on March 3, 2014. The new CO abolishes

authorized share capital, par value, share premium, and share redemption reserve, in respect of the share capital of Hong

Kong companies. As a result, the amounts of share premium and share redemption reserve of the Company were transferred

to the share capital.