Lenovo 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160 Lenovo Group Limited 2014/15 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

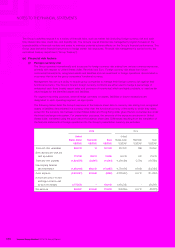

3 FINANCIAL RISK MANAGEMENT

The Group’s activities expose it to a variety of financial risks, such as market risk (including foreign currency risk and cash

flow interest rate risk), credit risk, and liquidity risk. The Group’s overall financial risk management program focuses on the

unpredictability of financial markets and seeks to minimize potential adverse effects on the Group’s financial performance. The

Group uses derivative financial instruments to hedge certain risk exposures. Financial risk management is carried out by the

centralized treasury department (“Group Treasury”).

(a) Financial risk factors

(i) Foreign currency risk

The Group operates internationally and is exposed to foreign currency risk arising from various currency exposures,

primarily with respect to United States dollar, Renminbi and Euro. Foreign currency risk arises from future

commercial transactions, recognized assets and liabilities and net investment in foreign operations denominated in

a currency that is not the group companies’ functional currency.

Management has set up a policy to require group companies to manage their foreign currency risk against their

functional currency. The Group’s forward foreign currency contracts are either used to hedge a percentage of

anticipated cash flows (mainly export sales and purchase of inventories) which are highly probable, or used as fair

value hedges for the identified assets and liabilities.

For segment reporting purposes, external hedge contracts on assets, liabilities or future transactions are

designated to each operating segment, as appropriate.

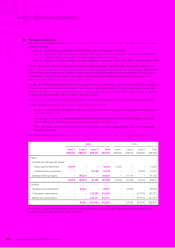

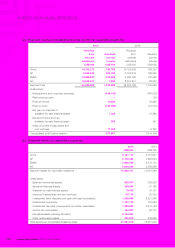

The following tables detail the Group’s exposure at the balance sheet date to currency risk arising from recognized

assets or liabilities denominated in a currency other than the functional currency of the entity to which they relate,

except for the currency risk between United States dollar and Hong Kong dollar given the two currencies are under

the linked exchange rate system. For presentation purposes, the amounts of the exposure are shown in United

States dollar, translated using the spot rate at the balance sheet date. Differences resulting from the translation of

the financial statements of foreign operations into the Group’s presentation currency are excluded.

2015 2014

United

States dollar Renminbi Euro

United

States dollar Renminbi Euro

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Trade and other receivables 262,319 14 167,002 237,972 868 134,557

Bank deposits and cash and

cash equivalents 112,198 38,411 10,286 94,725 942 23,513

Trade and other payables (1,224,378) (22,997) (14,541) (1,288,099) (2,739) (167,550)

Intercompany balances

before elimination (1,683,160) 388,212 (172,687) (1,784,195) 43,639 (305,352)

Gross exposure (2,533,021) 403,640 (9,940) (2,739,597) 42,710 (314,832)

Notional amounts of forward

exchange contracts used

as economic hedges 2,775,878 –128,162 2,480,232 –230,954

Net exposure 242,857 403,640 118,222 (259,365) 42,710 (83,878)