Lenovo 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

2014/15 Annual Report Lenovo Group Limited

DIRECTORS’ REPORT

RETIREMENT SCHEME ARRANGEMENTS (continued)

Defined Contribution Plans (continued)

Canada – Defined Contribution Pension Plan

Canadian regular, full-time and part-time employees are eligible to participate in the Defined Contribution Pension Plan, which is a

tax-qualified defined contribution plan. The Company contributes 3% to 6% of the employee’s eligible compensation, depending on

years of service. All contributions are made in cash, in accordance with the participants’ investment elections.

Hong Kong – Mandatory Provident Fund

The Group operates a Mandatory Provident Fund Scheme for all qualified employees employed in Hong Kong. They are required

to contribute 5% of their compensation (subject to the ceiling under the requirements set out in the Mandatory Provident Fund

legislation). The employer’s contribution will increase from 5% to 7.5% and 10% respectively after completion of five and ten years

of service by the relevant employees.

FACILITY AGREEMENT WITH COVENANT ON CONTROLLING SHAREHOLDER

The Company entered into a facility agreement with a syndicate of banks on February 2, 2011 (the “Facility Agreement”) for a term

loan facility of up to US$500 million (the “Facility”). The final maturity date of the Facility will fall on the date which is 60 months

after February 2, 2011. The Facility Agreement includes, inter alia, terms to the effect that it will be an event of default if Legend

Holdings Corporation (formerly known as Legend Holdings Limited), the controlling shareholder of the Company: (i) is not or ceases

to be the direct or indirect beneficial owner of 20% or more of the issued share capital of the Company; or (ii) is not or ceases to

be the single largest shareholder in the Company.

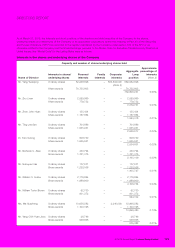

CONTINUING CONNECTED TRANSACTIONS

Continuing connected transactions with NEC and its associates

On January 27, 2011, the Company entered into a Business Combination Agreement with, amongst others, NEC Corporation

(“NEC”, together with its subsidiaries the “NEC Group”), pursuant to which the Company and NEC agreed to establish Lenovo NEC

Holdings B.V. (“JVCo”, together with its subsidiaries the “JVCo Group”) to own and operate their respective personal computer

businesses in Japan.

At or prior to closing of the Business Combination Agreement on July 1, 2011 (“the “Closing Date”), NEC or other members of

the NEC Group entered into various agreements (the “CCT Agreements”) with the Company, the JVCo or other members of the

JVCo Group in respect of the provision of certain services and products to or by the JVCo Group to facilitate the operation of its

personal computer business in Japan. Details of the CCT Agreements are set out in the announcement dated April 21, 2011 and

the circular issued by the Company to the shareholders on May 11, 2011. The continuing connected transactions under the NEC

Mobiling Agreement ceased subsequently in June 2013 following NEC’s disposal of the shares in NEC Mobiling, Ltd..

Upon the Closing Date, JVCo became an indirect non wholly-owned subsidiary of the Company. As NEC is a substantial

shareholder of the JVCo and therefore, a connected person of the Company, the transactions contemplated under the CCT

Agreements constitute continuing connected transactions for the Company under Chapter 14A of the Listing Rules. The CCT

Agreements were approved by the independent shareholders at an extraordinary general meeting of the Company on May 27,

2011 and are subject to reporting requirements under the Listing Rules.

On January 20, 2014, it was proposed to revise the annual cap on the transaction amount of transactions contemplated under the

Supply Agreement and the NEC Patent License Agreement, both of which form part of the CCT Agreements, for the three financial

years ending March 31, 2014, 2015 and 2016 and for the period from April 1, 2016 and ending on July 1, 2016 (the “Revised

Annual Caps”) given the continued business growth and improving market conditions. Details of the Revised Annual Caps are set

out in the announcement dated January 20, 2014 and the circular issued by the Company to the shareholders on February 24,

2014. The Revised Annual Caps were approved by independent shareholders at an extraordinary general meeting of the Company

on March 18. 2014 and are subject to reporting requirements under the Listing Rules.

On October 7, 2014, the relevant parties entered into various amendment agreements to the Business Combination Agreement,

the relevant shareholders’ agreement and certain agreements governing the existing continuing connected transactions to reflect

the extension of the term of the joint venture beyond 5 years. Details are set out in the announcement dated October 7, 2014.