Lenovo 2015 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

199

2014/15 Annual Report Lenovo Group Limited

NOTES TO THE FINANCIAL STATEMENTS

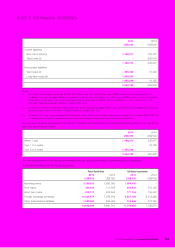

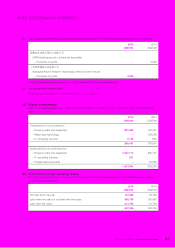

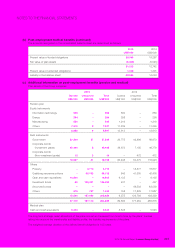

35 RETIREMENT BENEFIT OBLIGATIONS

2015 2014

US$’000 US$’000

Pension obligation included in non-current liabilities

Pension benefits 377,228 142,482

Post-employment medical benefits 22,554 14,033

399,782 156,515

Expensed in income statement

Pension benefits (Note 10) 22,630 21,799

Post-employment medical benefits (885) 492

21,745 22,291

Remeasurements for:

Defined pension benefits 70,267 (3,060)

Post-employment medical benefits (180) (928)

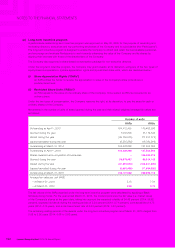

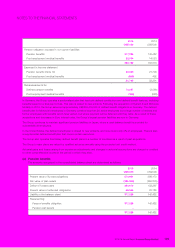

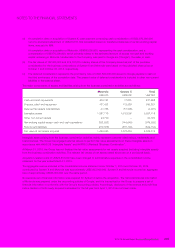

In Germany, the Group operates a sectionalised plan that has both defined contribution and defined benefit features, including

benefits based on a final pay formula. This plan is closed to new entrants. Following the acquisition of System X and Motorola

Mobility in 2014, the Group assumed approximately US$239,419,000 of defined benefit obligations in Germany. The defined

benefit plan for Motorola’s employees in Germany contains less than 20 active employees but a large number of retirees and

former employees with benefits which have vested, but where payment will be deferred until they retire. As a result of these

acquisitions and decreases in Euro interest rates, the Group’s largest pension liabilities are now in Germany.

The Group continues to maintain significant pension liabilities in Japan, where a cash balance benefit is provided for

substantially all employees.

In the United States, the defined benefit plan is closed to new entrants, and now covers only 2% of employees. There is also

a supplemental defined benefit plan that covers certain executives.

The Group also operates final salary defined benefit plans in a number of countries as a result of past acquisitions.

The Group’s major plans are valued by qualified actuaries annually using the projected unit credit method.

Actuarial gains and losses arising from experience adjustments and changes in actuarial assumptions are charged or credited

to other comprehensive income in the period in which they arise.

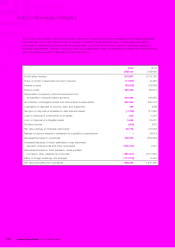

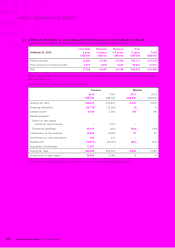

(a) Pension benefits

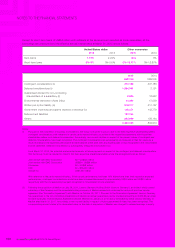

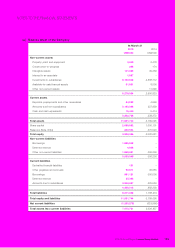

The amounts recognized in the consolidated balance sheet are determined as follows:

2015 2014

US$’000 US$’000

Present value of funded obligations 574,901 389,172

Fair value of plan assets (284,229) (266,875)

Deficit of funded plans 290,672 122,297

Present value of unfunded obligations 86,556 20,185

Liability in the balance sheet 377,228 142,482

Representing:

Pension benefits obligation 377,228 142,482

Pension plan assets ––

377,228 142,482