Lenovo 2015 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188 Lenovo Group Limited 2014/15 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

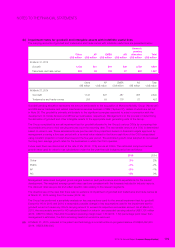

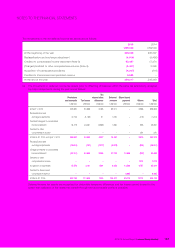

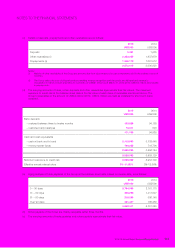

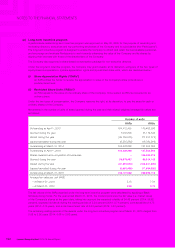

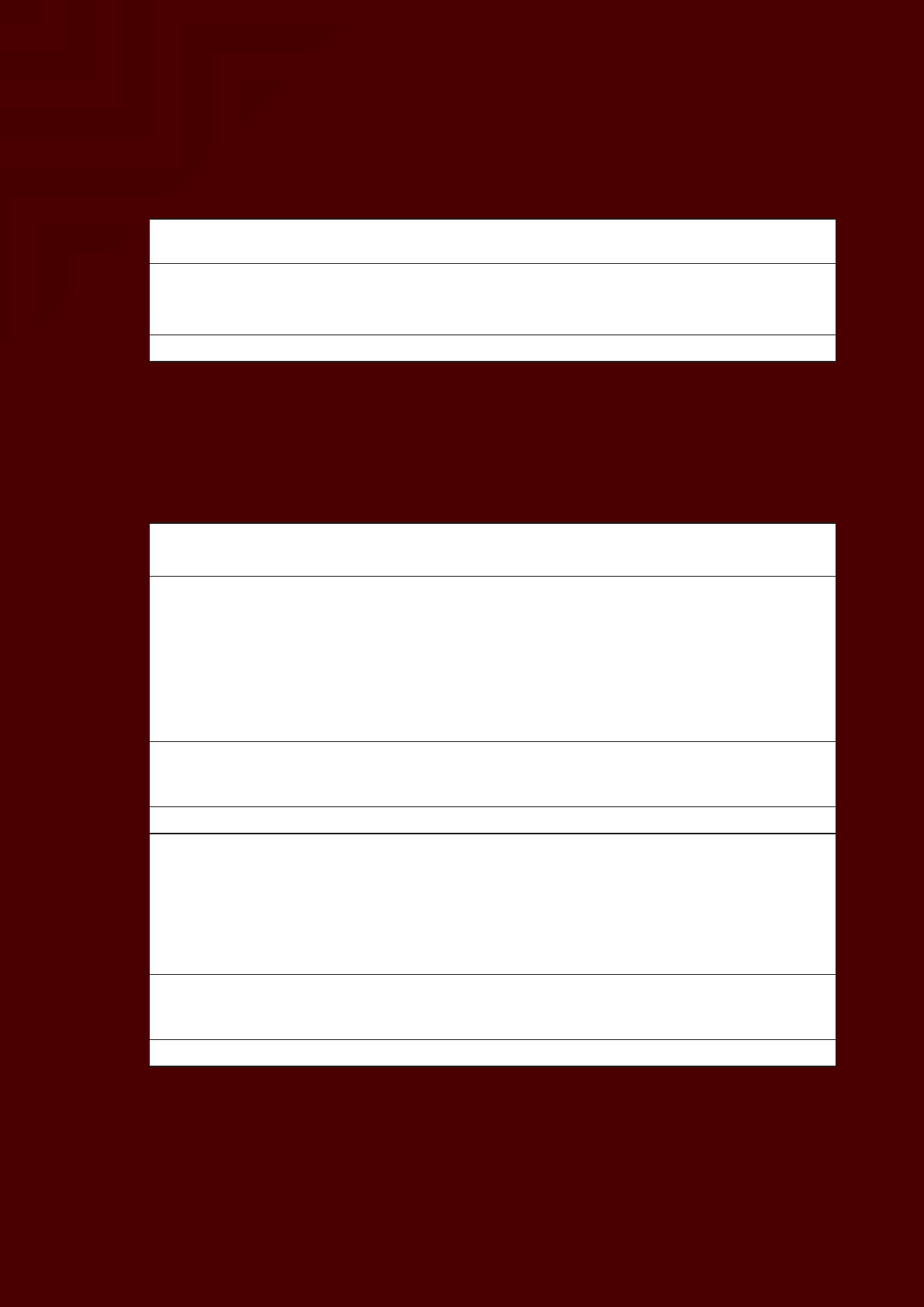

26 PROVISIONS, OTHER PAYABLES AND ACCRUALS

(a) Details of other payables and accruals are as follows:

2015 2014

US$’000 US$’000

Accruals 2,120,381 1,359,002

Allowance for billing adjustments (i) 2,169,767 1,785,022

Other payables (ii) 4,776,339 3,514,230

9,066,487 6,658,254

Notes:

(i) Allowance for billing adjustments relates primarily to allowances for future volume discounts, price protection, rebates, and

customer sales returns.

(ii) Majority of other payables are obligations to pay for finished goods that have been acquired in the ordinary course of business from

subcontractors.

(iii) The carrying amounts of other payables and accruals approximate their fair values.

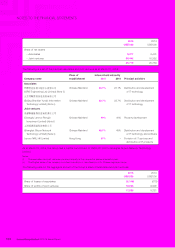

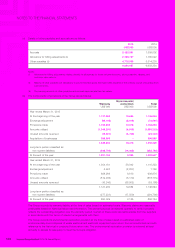

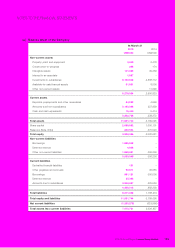

(b) The components of provisions of the Group are as follows:

Warranty

Environmental

restoration Total

US$’000 US$’000 US$’000

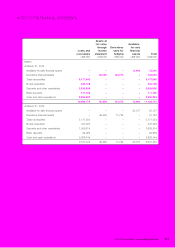

Year ended March 31, 2015

At the beginning of the year 1,127,260 19,684 1,146,944

Exchange adjustment (69,142) (2,919) (72,061)

Provisions made 1,153,855 10,378 1,164,233

Amounts utilized (1,049,291) (6,919) (1,056,210)

Unused amounts reversed (19,391) (3,749) (23,140)

Acquisition of businesses 396,563 –396,563

1,539,854 16,475 1,556,329

Long-term portion classified as

non-current liabilities (338,700) (14,082) (352,782)

At the end of the year 1,201,154 2,393 1,203,547

Year ended March 31, 2014

At the beginning of the year 1,054,181 56,042 1,110,223

Exchange adjustment 3,997 (2,837) 1,160

Provisions made 898,264 8,610 906,874

Amounts utilized (812,936) (5,179) (818,115)

Unused amounts reversed (16,246) (36,952) (53,198)

1,127,260 19,684 1,146,944

Long-term portion classified as

non-current liabilities (277,231) (17,559) (294,790)

At the end of the year 850,029 2,125 852,154

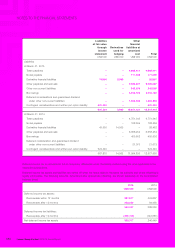

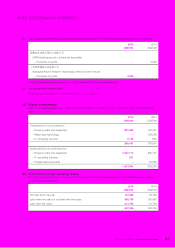

The Group records its warranty liability at the time of sales based on estimated costs. Warranty claims are reasonably

predictable based on historical failure rate information. The warranty accrual is reviewed quarterly to verify it properly

reflects the outstanding obligation over the warranty period. Certain of these costs are reimbursable from the suppliers

in accordance with the terms of relevant arrangements with them.

The Group records its environmental restoration provision at the time of sales based on estimated costs of

environmentally-sound disposal of waste electrical and electronic equipment upon return from end-customers and with

reference to the historical or projected future return rate. The environmental restoration provision is reviewed at least

annually to assess its adequacy to meet the Group’s obligation.