Lenovo 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

40 Lenovo Group Limited 2014/15 Annual Report

MANAGEMENT’S DISCUSSION & ANALYSIS

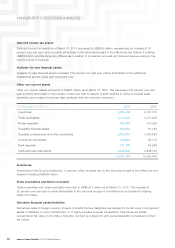

At March 31, 2015, the Group’s outstanding borrowings represented by the term bank loan of US$395 million

(2014: US$310 million), short-term bank loans of US$1,168 million (2014: US$145 million) and long term notes of

US$1,491 million (2014: Nil). When compared with total equity of US$4,106 million (2014: US$3,025 million), the

Group’s gearing ratio was 0.74 (2014: 0.15). The net debt position of the Group at March 31, 2015 is US$28 million

(2014 net cash position: US$3,498 million).

The Group is confident that all the facilities on hand can meet the funding requirements of the Group’s operations

and business development.

2015 2014

At March 31 US$ million US$ million

Bank deposits and cash and cash equivalents 3,026 3,953

Less: total borrowings (3,054) (455)

(28) 3,498

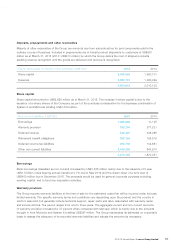

The Group adopts a consistent hedging policy for business transactions to reduce the risk of currency fluctuation

arising from daily operations. At March 31, 2015, the Group had commitments in respect of outstanding forward

foreign exchange contracts amounting to US$9,822 million (2014: US$6,513 million).

The Group’s forward foreign exchange contracts are either used to hedge a percentage of future transactions which

are highly probable, or used as fair value hedges for identified assets and liabilities.

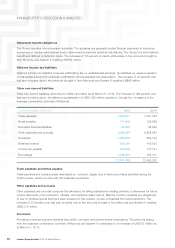

CONTINGENT LIABILITIES

The Group, in the ordinary course of its business, is involved in various claims, suits, investigations, and legal

proceedings that arise from time to time. Although the Group does not expect that the outcome in any of these

legal proceedings, individually or collectively, will have a material adverse effect on its financial position or results of

operations, litigation is inherently unpredictable. Therefore, the Group could incur judgments or enter into settlements

of claims that could adversely affect its operating results or cash flows in a particular period.

HUMAN RESOURCES

At March 31, 2015, the Group had a headcount of more than 60,000 worldwide.

The Group implements remuneration policy, bonus and long-term incentive schemes with reference to the

performance of the Group and individual employees. The Group also provides benefits such as insurance, medical

and retirement funds to employees to sustain competitiveness of the Group.