Lenovo 2015 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

204 Lenovo Group Limited 2014/15 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

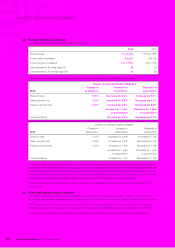

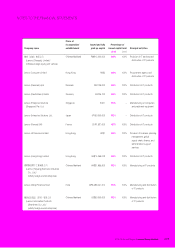

35 RETIREMENT BENEFIT OBLIGATIONS (continued)

(c) Additional information on post-employment benefits (pension and medical) (continued)

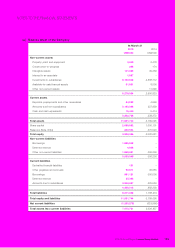

The amounts recognized in the consolidated income statement are as follows:

Pension Medical

2015 2014 2015 2014

US$’000 US$’000 US$’000 US$’000

Current service cost 14,272 15,850 455 495

Past service cost (1,542) (695) –(34)

Interest cost 10,845 9,689 676 685

Interest income (6,150) (5,965) (146) (160)

Curtailment losses 5,205 2,920 (1,870) (494)

Total expense recognized in the

consolidated income statement 22,630 21,799 (885) 492

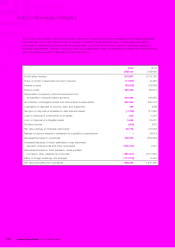

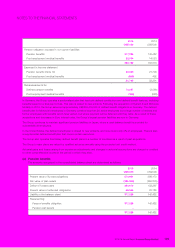

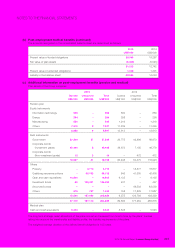

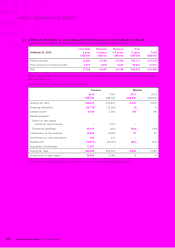

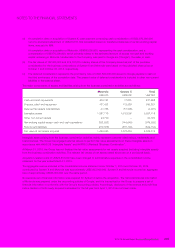

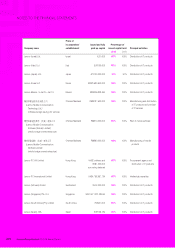

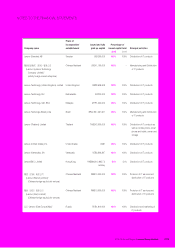

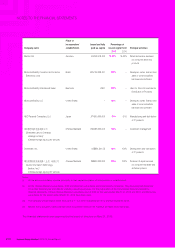

36 BUSINESS COMBINATIONS

During the year, the Group completed two business combination activities aiming at expanding the Group’s existing scale of

operations and to enlarge the Group’s market share.

On October 1, 2014, the Group acquired certain assets and assumed certain liabilities in connection with System X. The

acquisition provides the Group with end-to-end capabilities to serve enterprise customers and explore new growth segments

in the enterprise hardware market. It also offers a comprehensive and competitive portfolio of server products including

towers, racks, blades and converged systems, as well as associated maintenance services.

On October 30, 2014, the Group acquired 100% of the issued and outstanding equity interests in Motorola. Motorola

is principally engaged in the business of developing, manufacturing, distributing and selling mobile devices, particularly

smartphones based on the Android operating system, and their related products. The acquisition provides the Group with

immediate access to key assets, technology and personnel to accelerate the Group’s entry into mature geographies for

smartphones, including those based on the popular Android operating system under its strong relationships with retailers and

carriers.

The estimated total consideration for the business combination activities completed during the year is approximately US$5,232

million, including cash, the Company’s shares as consideration shares, deferred consideration and share-based compensation

obligation assumed by the Company.

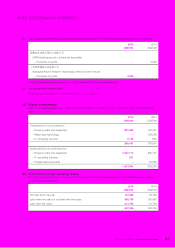

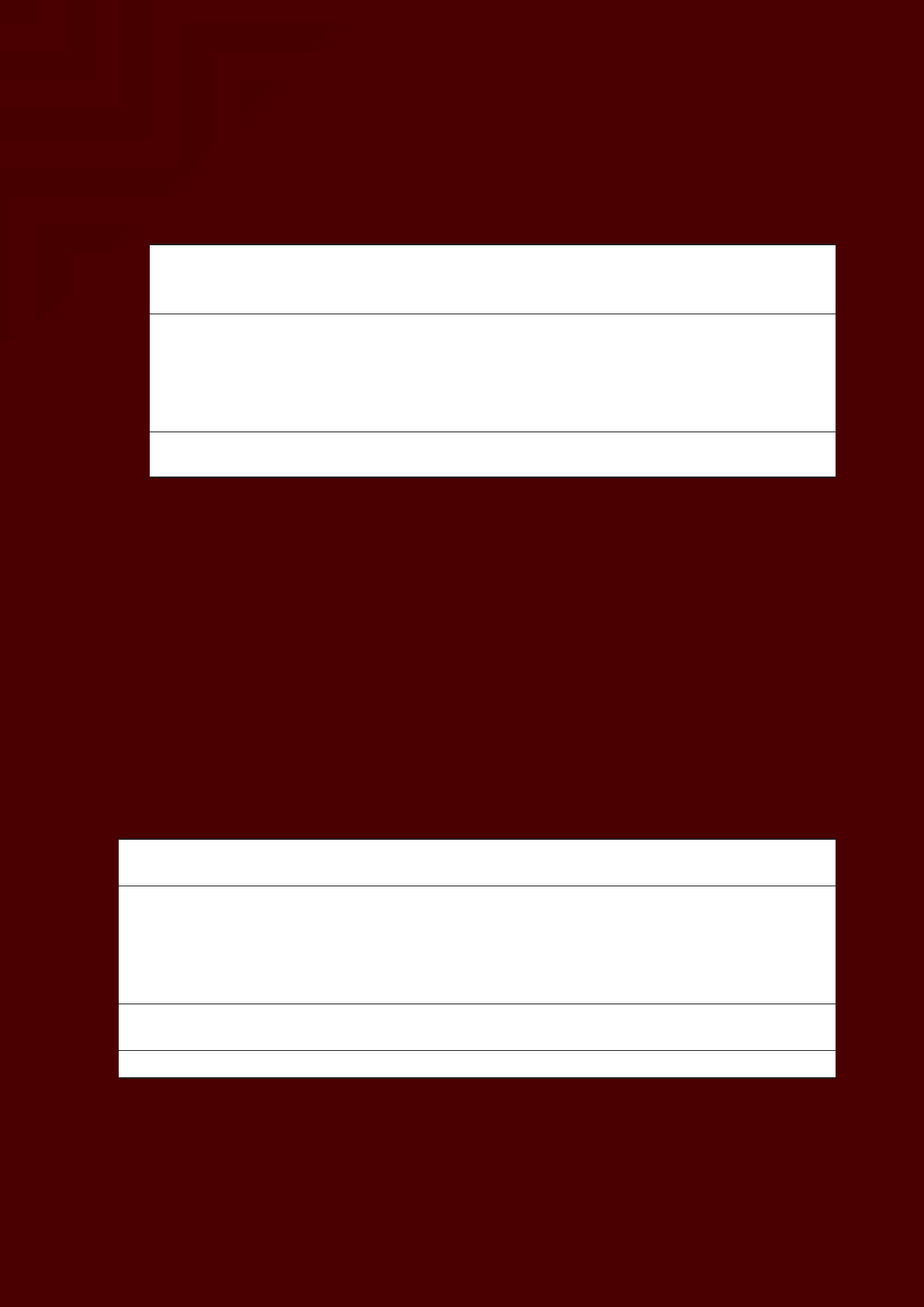

Set forth below is the preliminary calculation of goodwill:

Motorola System X Total

US$’000 US$’000 US$’000

Purchase consideration:

– Cash paid less cash to be refunded (a) 836,306 1,859,188 2,695,494

– Fair value of consideration shares (b) 768,482 270,914 1,039,396

– Present value of deferred consideration (c) 1,376,230 –1,376,230

– Share-based compensation obligation assumed 114,922 6,330 121,252

Total purchase consideration 3,095,940 2,136,432 5,232,372

Less: Fair value of net assets acquired (1,436,665) (1,072,453) (2,509,118)

Goodwill (Note 17(a)) 1,659,275 1,063,979 2,723,254