Lenovo 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

36 Lenovo Group Limited 2014/15 Annual Report

MANAGEMENT’S DISCUSSION & ANALYSIS

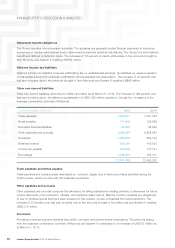

Deferred income tax assets

Deferred income tax assets as at March 31, 2015 amounted to US$530 million, representing an increase of 36

percent over last year, which is partly attributable to the amounts brought in from Motorola and System X totalling

US$82 million, and the temporary differences in relation to provisions, accruals and deferred revenue arising in the

normal course of business.

Available-for-sale financial assets

Available-for-sale financial assets increased 109 percent over last year, mainly attributable to the additional

investments and fair value gain during the year.

Other non-current assets

Other non-current assets amounted to US$41 million as at March 31, 2015. The decrease of 63 percent over last

year is mainly attributable to the transfer of land use right in respect of staff quarters in China to prepaid lease

payments upon receipt of land use right certificate from the authority concerned.

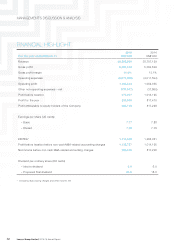

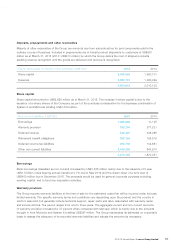

Current assets (US$’000) 2015 2014

Inventories 2,995,389 2,701,015

Trade receivables 5,177,840 3,171,354

Notes receivable 334,738 447,325

Derivative financial assets 184,534 61,184

Deposits, prepayments and other receivables 3,572,015 3,000,826

Income tax recoverable 136,857 65,715

Bank deposits 171,139 94,985

Cash and cash equivalents 2,855,223 3,858,144

15,427,735 13,400,548

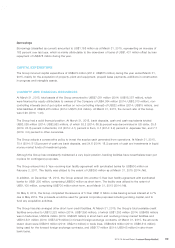

Inventories

Inventories of the Group increased by 11 percent, which is mainly due to the amounts brought in from Motorola and

System X totalling US$499 million.

Trade receivables and Notes receivable

Trade receivables and notes receivable amounted to US$5,513 million as at March 31, 2015. The increase of

52 percent over last year is mainly attributable to the amounts brought in from Motorola and System X totalling

US$2,319 million.

Derivative financial assets/liabilities

Derivatives relate to foreign currency forward contracts that are designated as hedges for the fair value of recognized

assets or liabilities or a firm commitment, or of highly probable forecast transactions. Derivatives are initially

recognized at fair value on the date a derivative contract is entered into and are subsequently re-measured at their

fair values.