IBM 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

91

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

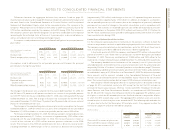

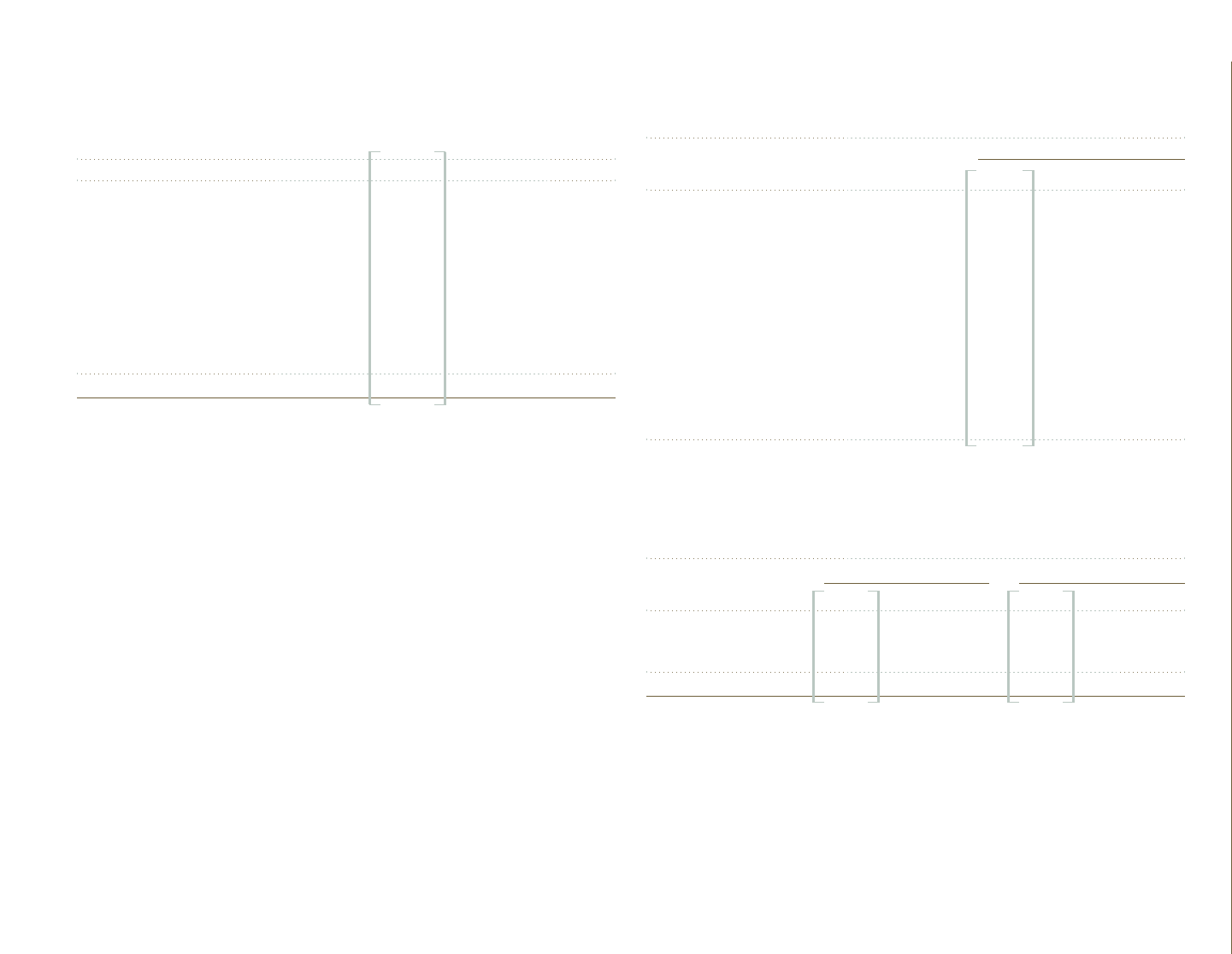

Reconciliations to IBM as Reported

(Dollars in millions)

AT DECEMBER 31: 2004 2003*2002*

Assets:

Total reportable segments $«««69,667 $«««67,995 $«63,387

Elimination of internal transactions (5,814) (5,596) (4,993)

Unallocated amounts:

Cash and marketable securities 9,421 6,523 4,568

Notes and accounts receivable 3,872 3,334 3,553

Deferred tax assets 4,899 6,486 6,631

Plant, other property and equipment 3,522 3,380 3,239

Pension assets 20,381 18,416 15,996

Other 3,235 3,919 4,103

Total IBM consolidated $«109,183 $«104,457 $«96,484

*Reclassified to conform with 2004 presentation.

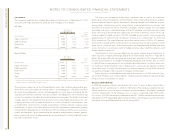

revenue by classes of similar products or services

For the Personal Systems Group, Software and Global Financing segments, the segment

data on page 88 represents the revenue contributions from the products that are con-

tained in the segments and that are basically similar in nature. The following table provides

external revenue for similar classes of products within the Systems and Technology Group,

Global Services and Enterprise Investments segments. The Systems and Technology Group

segment’s OEM hardware comprises revenue primarily from the sale of semiconductors

and display devices. Technology services comprise the Systems and Technology Group’s

circuit design business for its OEM clients as well as the component design services,

strategic outsourcing of clients’ design team work, and technology and manufacturing

consulting services associated with the Engineering & Technology Services Division. The

Systems and Technology Group segment’s storage comprises revenue from TotalStorage

disk storage systems, tape subsystems and networking hardware. Enterprise Investments

software revenue is primarily from product life-cycle management products. The following

table is presented on a continuing operations basis.

(Dollars in millions)

Consolidated

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Global Services:

Services $«40,517 $«37,178 $«31,290

Maintenance 5,696 5,457 5,070

Systems and Technology Group:

Servers $«12,460 $«11,148 $«10,047

Storage 2,898 2,849 2,581

Microelectronics OEM «««2,131 «««2,142 «««3,226

Technology services 424 325 323

Networking products 3518

Enterprise Investments:

Software $«««1,131 $««««««981 $««««««916

Hardware 37 72 95

Others 12 12 11

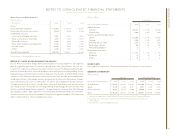

major clients

No single client represents 10 percent or more of the company’s total revenue.

geographic information

(Dollars in millions)

Revenue*Long-Lived Assets**+

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002 2004 2003++ 2002++

United States $«35,637 $«33,762 $«32,759 $«29,780 $«29,929 $«28,064

Japan 12,295 11,694 10,939 2,701 2,738 2,814

Other countries 48,361 43,675 37,488 20,600 16,373 13,027

Total $«96,293 $«89,131 $«81,186 $«53,081 $«49,040 $«43,905

*Revenues are attributed to countries based on location of client and are for continuing operations.

** Includes all non-current assets except non-current financial instruments and deferred tax assets.

+At December 31

++ Reclassified to conform with 2004 presentation.