IBM 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

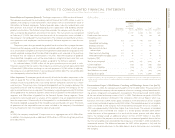

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

49

International Business Machines Corporation and Subsidiary Companies

a. Significant Accounting Policies

basis of presentation

On December 31, 2002, the International Business Machines Corporation (IBM and/or the

company) sold its hard disk drive (HDD) business to Hitachi, Ltd. (Hitachi). See note c,

“Acquisitions/Divestitures,” on pages 60 and 61. The HDD business was part of the com-

pany’s Systems and Technology Group reporting segment. The HDD business was

accounted for as a discontinued operation under accounting principles generally accepted

in the United States of America (GAAP) and therefore, the HDD results of operations and

cash flows have been removed from the company’s results of continuing operations and

cash flows for all periods presented in this document. The financial results reported as

discontinued operations include the external original equipment manufacturer (OEM) HDD

business and charges related to HDDs used in the company’s eServer and Storage prod-

ucts that were reported in the Systems and Technology Group segment. The discontinued

operations results do not reflect HDD shipments to the company’s internal customers.

principles of consolidation

The Consolidated Financial Statements include the accounts of IBM and its controlled

subsidiary companies, which in general are majority-owned. The accounts of variable

interest entities (VIEs) as defined by the Financial Accounting Standards Board (FASB)

Interpretation No. 46(R) (FIN 46(R)) (see note b, “Accounting Changes,” on page 56), are

included in the Consolidated Financial Statements, if applicable. Investments in business

entities in which the company does not have control, but has the ability to exercise signifi-

cant influence over operating and financial policies (generally 20-50 percent ownership),

are accounted for using the equity method. The accounting policy for other investments

in securities is described on page 54 within “Marketable Securities.” Other investments are

accounted for using the cost method.

use of estimates

The preparation of Consolidated Financial Statements in conformity with GAAP requires

management to make estimates and assumptions that affect the amounts that are reported

in the Consolidated Financial Statements and accompanying disclosures. Although these

estimates are based on management’s best knowledge of current events and actions that

the company may undertake in the future, actual results may be different from the estimates.

revenue

The company recognizes revenue when it is realized or realizable and earned. The com-

pany considers revenue realized or realizable and earned when it has persuasive evidence

of an arrangement, delivery has occurred, the sales price is fixed or determinable, and

collectibility is reasonably assured. Delivery does not occur until products have been

shipped or services have been provided to the client, risk of loss has transferred to the

client and client acceptance has been obtained, client acceptance provisions have lapsed,

or the company has objective evidence that the criteria specified in the client acceptance

provisions have been satisfied. The sales price is not considered to be fixed or determinable

until all contingencies related to the sale have been resolved.

The company reduces revenue for estimated client returns, stock rotation, price pro-

tection, rebates and other similar allowances. (See Schedule II, ”Valuation and Qualifying

Accounts and Reserves” included in the company’s Annual Report on Form 10-K). Revenue

is recognized only if these estimates can be reliably determined and if the client has eco-

nomic substance apart from the company. The company bases its estimates on historical

results taking into consideration the type of client, the type of transaction and the specifics

of each arrangement. Payments made under cooperative marketing programs are recog-

nized as an expense only if the company receives from the client an identifiable benefit

sufficiently separable from the product sale whose fair value can be reasonably estimated.

If the company does not receive an identifiable benefit sufficiently separable from the

product sale whose fair value can be reasonably estimated, such payments are recorded

as a reduction of revenue.

In addition to the aforementioned general policies, the following are the specific rev-

enue recognition policies for multiple-element arrangements and for each major category

of revenue.

Multiple-Element Arrangements

The company enters into multiple-element revenue arrangements, which may include any

combination of services, software, hardware and/or financing. To the extent that a deliver-

able(s) in a multiple-element arrangement is subject to specific guidance (like software

that is subject to the American Institute of Certified Public Accountants (AICPA) Statement

of Position (SOP) No. 97-2, “Software Revenue Recognition”—see “Software” on pages 50

and 51) on whether and/or how to separate multiple-deliverable arrangements into sep-

arate units of accounting (separability) and how to allocate value among those separate

units of accounting (allocation), that deliverable(s) is accounted for in accordance with

such specific guidance. For all other deliverables in multiple-element arrangements, the

guidance below is applied for separability and allocation. A multiple-element arrangement

is separated into more than one unit of accounting if all of the following criteria are met.

•The delivered item(s) has value to the client on a standalone basis.

•There is objective and reliable evidence of the fair value of the undelivered item(s).

•If the arrangement includes a general right of return relative to the delivered item(s),

delivery or performance of the undelivered item(s) is considered probable and

substantially in the control of the company.

ibm annual report 2004