IBM 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

30

ibm annual report 2004

Given the declining interest rate environment, the company reduced its discount rate

assumption for the PPP by 25 basis points to 5.75 percent on December 31, 2004. The

company will keep the expected long-term return on PPP assets at 8 percent. The actual

return on PPP plan assets in 2004 was 13 percent. With similar overall trends in these

assumptions worldwide, as well as the impact of the recent years’ changes in the market

value of plan assets, the year-to-year impact from retirement related plans on pre-tax

income in 2005 will be approximately $1.0 billion higher as compared to 2004, excluding

the 2004 one-time charge of $320 million related to the partial settlement of certain legal

claims against the PPP.

The amount of IP and custom development income has been declining in recent

years. Although it was flat in 2004, the overall declining trend may continue as the com-

pany does not expect it to be a contributor to growth. The overall level of IP is dependent

on several factors: divestitures, industry consolidation, economic conditions and the tim-

ing of new patent development.

In the normal course of business, the company expects that its effective tax rate will

approximate 30 percent. The rate will change year-to-year based on nonrecurring events

(such as the tax effect of the pension claims settlement in 2004 or a possible repatriation

charge in 2005 as described in note p, “Taxes” on page 73) as well as recurring factors

including the geographic mix of income before taxes, the timing and amount of foreign

dividends, state and local taxes, and the interaction of various global tax strategies.

american jobs creation act of 2004

In 2001, the World Trade Organization (WTO) determined that tax provisions of the FSC

Repeal and Extraterritorial Income (ETI) Exclusion Act of 2000 constituted an export subsidy

prohibited by the WTO Agreement on Subsidies and Countervailing Measures Agreement.

As a result, the U.S. enacted the American Jobs Creation Act of 2004 (the “Act”) in October

2004. The Act repeals the ETI export subsidy for transactions after 2004 with two years of

transition relief (2005–2006). The Act also provides a nine-percent deduction for income

from qualified domestic production activities which will be phased in over 2005–2010.

While the net impact of certain legislative provisions has not been fully evaluated, the

company does not expect this legislation to affect its ongoing effective tax rate for 2005

or 2006.

Also, the Act includes a temporary incentive for the company to repatriate earnings

accumulated outside the U.S. The current status of the company’s evaluation and potential

impacts are discussed in note p, “Taxes,” on page 73.

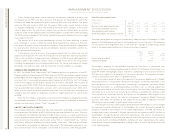

liquidity and capital resources

The company generates strong cash flow from operations, providing a source of funds

ranging between $8.8 billion and $15.4 billion per year over the past five years. The com-

pany provides for additional liquidity through several sources— a sizable cash balance,

access to global funding sources, a committed global credit facility and in 2004, the com-

pany converted a receivables securitization facility from an “uncommitted” to a “commit-

ted” facility, adding an additional source of liquidity. (See note j, “Sale and Securitization

of Receivables” on page 64 for additional information.) The table below provides a sum-

mary of these major sources of liquidity as of the end of fiscal years 2000 through 2004.

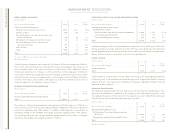

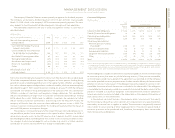

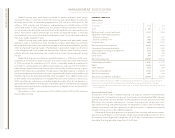

Cash Flow and Liquidity Trends

(Dollars in billions)

AT DECEMBER 31: 2004 2003 2002 2001 2000

Net cash from operating activities $«15.4 $«14.6 $«13.8 $«14.0 $«««8.8

Cash and marketable securities 10.6 7.6 6.0 6.4 3.7

Size of global credit facilities 10.0 10.0 12.0 12.0 10.0

Trade receivables securitization facility 0.5 ————

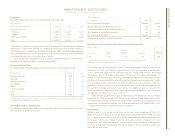

The major rating agencies’ ratings on the company’s debt securities at December 31, 2004

appear in the table below and remain unchanged over the past five years. The company

has no contractual arrangements that, in the event of a change in credit rating, would

result in a material adverse effect on its financial position or liquidity.

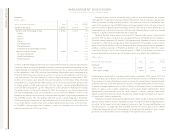

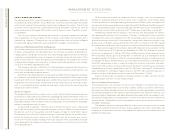

Standard Moody’s

and Investors Fitch

Poor’s Service Ratings

Senior long-term debt A+A1 AA-

Commercial paper A-1 Prime-1 f-1+

The company prepares its Consolidated Statement of Cash Flows in accordance with

Statement of Financial Accounting Standards (SFAS) No. 95, “Statement of Cash Flows,” on

pages 44 and 45 and highlights causes and events underlying sources and uses of cash in

that format on page 24. For purposes of running its business, the company manages,

monitors and analyzes cash flows in a different format.

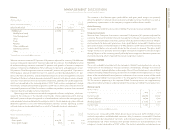

As discussed on page 35, one of the company’s two primary objectives of its Global

Financing business is to generate strong return-on-equity. Increasing receivables is the

basis for growth in a financing business. Accordingly, management considers Global

Financing receivables as a profit-generating investment — not as working capital that

should be minimized for efficiency. After classifying the Cash from/(for) Global Financing

receivables as an investment, the remaining net cash flow is viewed by the company as the

Cash available for investment and for distribution to shareholders. With respect to the

company’s cash flow analysis for internal management purposes, Global Financing

accounts receivables are combined with Global Financing debt to represent the Net

Global Financing receivables (a profit-generating investment).

Over the past five years, the company generated over $59.4 billion in Cash available

for investment and for distribution to shareholders. As a result, during the period the

company invested in $21.4 billion of net capital expenditures, invested $8.0 billion in

strategic acquisitions, received $1.4 billion from divestitures and returned $33.0 billion to

shareholders through dividends and share repurchases. The amount of prospective

Returns to shareholders in the form of dividends and share repurchases will vary based

upon several factors including affordability, namely each year’s operating results, capital

expenditures, research and development, and acquisitions, as well as the factors discussed

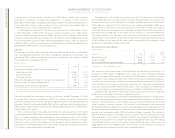

in the following table.