IBM 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

72

ibm annual report 2004

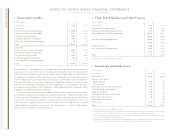

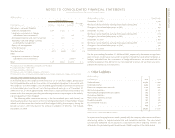

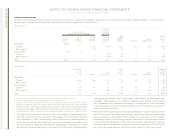

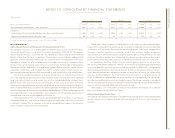

p. Ta x e s

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Income from continuing operations before

income taxes:

U.S. operations $«««5,280 $«««4,611 $«3,838

Non-U.S. operations 6,748 6,263 3,686

Total income from continuing operations

before income taxes $«12,028 $«10,874 $«7,524

The continuing operations provision for income taxes by geographic operations is as follows:

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

U.S. operations $«1,765 $«1,234 $««««934

Non-U.S. operations 1,815 2,027 1,256

Total continuing operations provision for

income taxes $«3,580 $«3,261 $«2,190

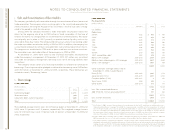

The components of the continuing operations provision for income taxes by taxing juris-

diction are as follows:

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

U.S. federal:

Current $«««(608) * $««««234 $««««287

Deferred 1,823* 339 (3)

1,215 573 284

U.S. state and local:

Current 50 46 184

Deferred 110 183 3

160 229 187

Non-U.S.:

Current 2,057 1,855 1,786

Deferred 148 604 (67)

2,205 2,459 1,719

Total continuing operations provision

for income taxes 3,580 3,261 2,190

Provision for social security, real estate,

personal property and other taxes 3,347 3,277 2,789

Total continuing operations provision for taxes $«6,927 $«6,538 $«4,979

*Included in the U.S. federal current and deferred tax provisions are a benefit of $848 million and a charge of $848 mil-

lion, respectively, due to the Internal Revenue Service settlement noted on page 73.

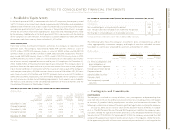

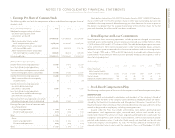

A reconciliation of the company’s continuing operations effective tax rate to the statutory

U.S. federal tax rate is as follows:

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Statutory rate 35% 35% 35%

Foreign tax differential (5) (5) (7)

State and local 111

Other (1) (1) —

Effective rate 30% 30% 29%

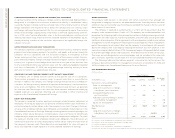

The effect of tax law changes on deferred tax assets and liabilities did not have a material

impact on the company’s effective tax rate.

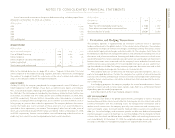

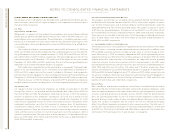

The significant components of activities that gave rise to deferred tax assets and liabil-

ities that are recorded in the Consolidated Statement of Financial Position were as follows:

deferred tax assets

(Dollars in millions)

AT DECEMBER 31: 2004 2003

Retirement benefits $«««3,908 $«««3,566

Capitalized research and development 1,794 1,907

Employee benefits 1,168 1,021

Bad debt, inventory and warranty reserves 1,050 1,092

Alternative minimum tax credits 1,032 1,344

Deferred income 612 598

Infrastructure reduction charges 333 440

Foreign tax loss carryforwards 298 311

Capital loss carryforwards 220 195

State and local tax loss carryforwards 95 205

General business credits —884

Other 2,266 2,253

Gross deferred tax assets 12,776 13,816

Less: valuation allowance 603 722

Net deferred tax assets $«12,173 $«13,094