IBM 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

31

ibm annual report 2004

The company’s Board of Directors meets quarterly to approve the dividend payment.

The company announced a dividend payment of $0.18 per common share, payable

March 10, 2005, which is the company’s 357th consecutive quarterly payment. The com-

pany expects to fund the quarterly dividend payments through cash from operations.

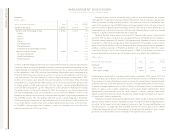

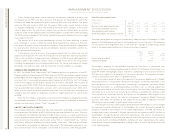

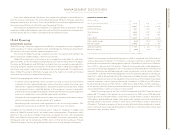

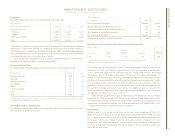

The table below represents the way in which management reviews its cash flow as

described above.

(Dollars in billions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002 2001 2000

Net cash from operating activities

(comprised of): $«15.4 $«14.6 $«13.8 $«14.0 $««8.8

Cash from/(for) Global Financing

accounts receivable $«««2.5 $«««1.9 $«««3.3 $«««2.0 $«(2.5)

Cash available for investment and

for distribution to shareholders 12.9 12.7 10.5 12.0 11.3

Net Global Financing receivables 0.7 (0.7) 0.2 0.9 (0.6)

Net capital expenditures (3.7) (3.9) (4.6) (4.9) (4.3)

Net divestitures/(acquisitions) (1.7) (1.7) (2.0) (0.9) (0.3)

Returns to shareholders (8.3) (5.4) (5.2) (6.5) (7.6)

Other 2.9 0.9 0.2 2.2 —

Net change in cash and

cash equivalents $«««2.8 $«««1.9 $««(0.9) $«««2.8 $«(1.5)

Events that could temporarily change the historical cash flow dynamics discussed on page

30 include unexpected adverse impacts from litigation or future pension funding during

periods of severe and prolonged downturn in the capital markets. Whether any litigation

has such an adverse impact will depend on a number of variables, which are more completely

described on page 71. With respect to pension funding, on January 19, 2005 the company

contributed $1.7 billion to the qualified portion of the company’s PPP. This contribution

fulfilled a number of short-term and long-term strategic objectives. This contribution

reduces the probability of large future U.S. pension contributions by building a funding

buffer above the current liability level. In addition, it positions the company to further

reduce volatility in pension contributions and earnings over the long term. Finally, the

company will benefit from the return on these additional pension assets in 2005. The

increase in pension income produced from this funding will partially offset the impact of

year-end 2004 pension assumptions changes.

The company is not quantifying any further impact from pension funding because it is

not possible to predict future movements in the capital markets. However, for 2005, if

actual returns on plan assets for the PPP were less than 1 percent, the PPP’s accumulated

benefit obligation (ABO) would be greater than its Plan assets (assuming no other assump-

tion change). As discussed on page 83, such a situation may result in a further voluntary

contribution of cash or stock to the PPP or a charge to stockholders’ equity.

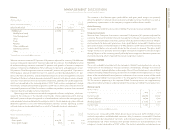

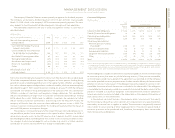

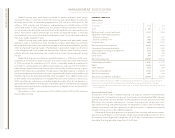

Contractual Obligations

(Dollars in millions)

Total

Contractual

Payment

Payments Due In

Stream 2005 2006-07 2008-09 After 2009

Long-term debt obligations $«17,664 $«3,175 $«4,396 $«2,614 $÷«7,479

Capital (Finance) lease obligations 56 46 8 1 1

Operating lease obligations 6,607 1,383 2,210 1,603 1,411

Purchase obligations 2,268 919 828 479 42

Other long-term liabilities:

Minimum pension funding

(mandated)*2,384 361 1,175 848 —

Executive compensation 782 95 121 141 425

Environmental liabilities 246282523170

Long-term termination benefits 2,406 344 483 334 1,245

Other 457 80 166 136 75

Total $«32,870 $«6,431 $«9,412 $«6,179 $«10,848

*These amounts represent future pension contributions that are mandated by local regulations or statute for retirees

receiving pension benefits. They are all associated with non-U.S. pension plans. The projected payments beyond 2009

are not currently determinable. See note w, “Retirement-related Benefits,” on pages 78 through 86 for additional infor-

mation on the non-U.S. plans’ investment strategies and expected contributions.

Purchase obligations include all commitments to purchase goods or services of either a fixed

or minimum quantity that meet any of the following criteria: (1) they are non-cancelable,

(2) the company would incur a penalty if the agreement was canceled, or (3) the company

must make specified minimum payments even if it does not take delivery of the contracted

products or services (“take-or-pay”). If the obligation to purchase goods or services is non-

cancelable, the entire value of the contract is included in the above table. If the obligation

is cancelable, but the company would incur a penalty if canceled, the dollar amount of the

penalty is included as a purchase obligation. Contracted minimum amounts specified in

take-or-pay contracts are also included in the above table as they represent the portion of

each contract that is a firm commitment.

In the ordinary course of business, the company enters into contracts that specify

that the company will purchase all or a portion of its requirements of a specific product,

commodity, or service from a supplier or vendor. These contracts are generally entered

into in order to secure pricing or other negotiated terms. They do not specify fixed or

minimum quantities to be purchased and, therefore, the company does not consider

them to be purchase obligations.