IBM 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

73

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

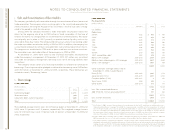

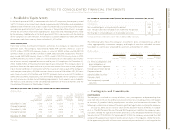

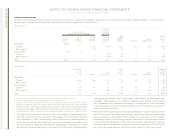

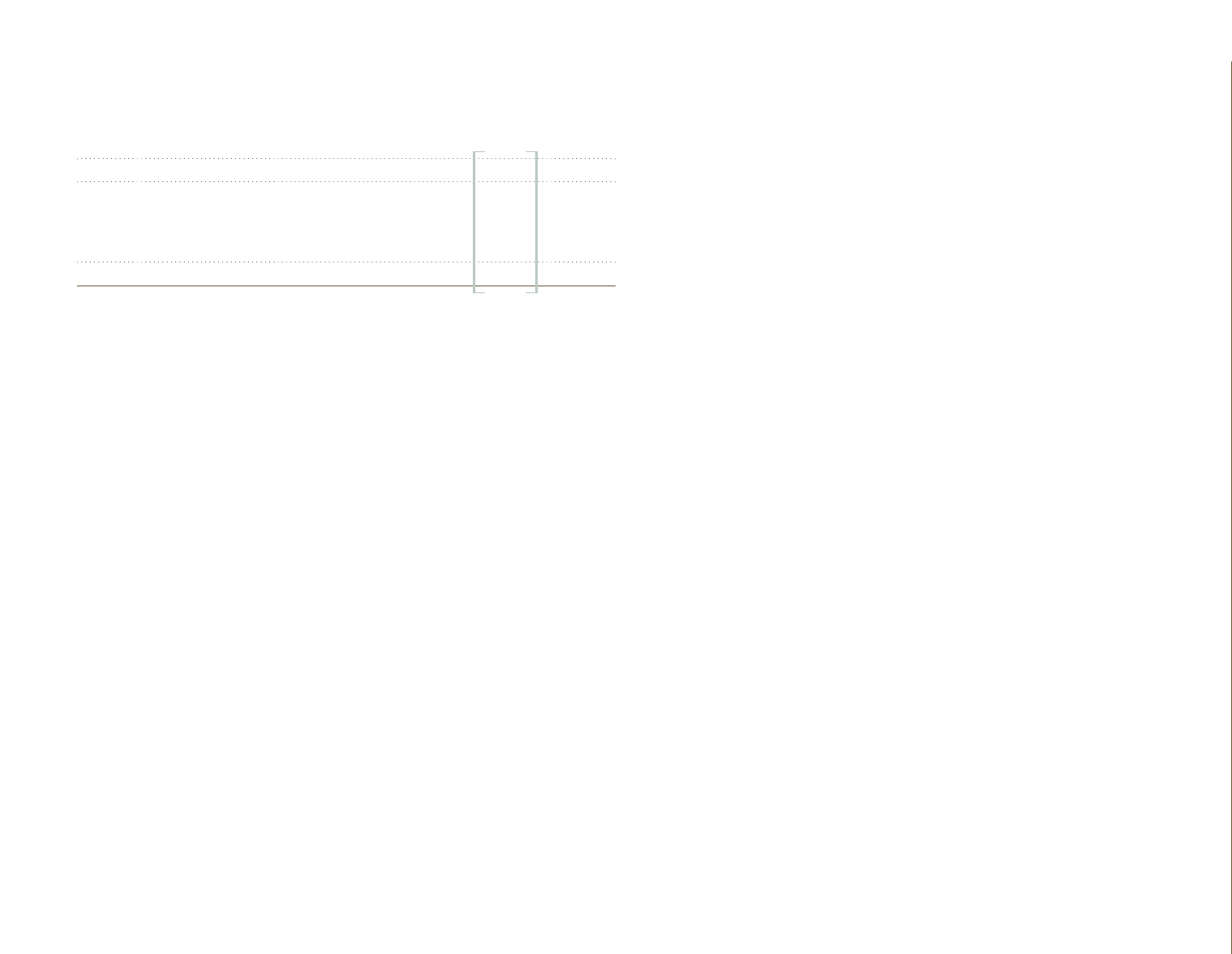

deferred tax liabilities

(Dollars in millions)

AT DECEMBER 31: 2004 2003

Retirement benefits $«7,057 $«6,644

Leases 622 693

Software development costs 381 285

Other 1,324 1,188

Gross deferred tax liabilities $«9,384 $«8,810

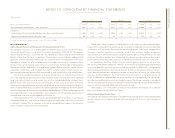

The valuation allowance at December 31, 2004, principally applies to capital loss carry-

forwards and certain foreign, and state and local loss carryforwards that, in the opinion of

management, are more likely than not to expire before the company can use them.

For tax return purposes, the company has available tax credit carryforwards of approxi-

mately $1,032 million, which have an indefinite carryforward period. The company also has

foreign, state and local, and capital loss carryforwards, the tax effect of which is $613 mil-

lion. Substantially all of these carryforwards are available for at least four years or have an

indefinite carryforward period.

During the fourth quarter of 2004, the Internal Revenue Service (IRS) and the company

resolved the tax audit of 1998-2000 which had commenced in 2003. The resolution of this

IRS audit resulted in the reduction of existing tax credit carryforwards as well as a payment

of $130 million, including tax and interest. The company was fully reserved for the matters

that were resolved.

The company anticipates that the IRS audit of 2001 through 2003 will commence early

in 2005. Although the outcome of tax audits is always uncertain, the company believes that

adequate amounts of tax and interest have been provided for any adjustments that are

expected to result for these years.

On October 22, 2004, the President signed the American Jobs Creation Act of 2004

(the “Act”). The Act creates a temporary incentive for the company to repatriate earnings

accumulated outside the U.S. by allowing the company to reduce its taxable income by 85

percent of certain eligible dividends received from non-U.S. subsidiaries by the end of

2005. In order to benefit from this incentive, the company must reinvest the qualifying

dividends in the U.S. under a domestic reinvestment plan approved by the chief executive

officer and board of directors. As discussed in note b, “Accounting Changes” on page 56,

the company has commenced an evaluation of the possible effects of the Act’s repatria-

tion provision and expects to complete this evaluation within a reasonable period of time

following the issuance of additional clarifying language and guidance from Congress and

the Treasury Department on key elements of the repatriation provision. It is reasonably

possible that the company may repatriate up to approximately $8 billion of the undistrib-

uted earnings noted below under the Act and the corresponding income tax expense may

be as much as approximately $550 million. The resulting income tax expense, if any, will

be provided in the company’s financial statements in the quarter in which the evaluation

and approvals have been completed.

The company has not provided deferred taxes on $19,664 million of undistributed

earnings of non-U.S. subsidiaries at December 31, 2004, as it is the company’s policy to

indefinitely reinvest these earnings in non-U.S. operations. However, the company peri-

odically repatriates a portion of these earnings to the extent that it does not incur an

additional U.S. tax liability. Quantification of the deferred tax liability, if any, associated with

indefinitely reinvested earnings is not practicable. Also, the company’s intention with

respect to the indefinite reinvestment of foreign earnings at December 31, 2004 does not

consider the possible distribution of such earnings under the favorable repatriation provi-

sion of the Act.

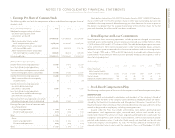

q. Advertising and Promotional Expense

Advertising and promotional expense, which includes media, agency and promotional

expense, was $1,335 million, $1,406 million and $1,427 million in 2004, 2003 and 2002,

respectively, and is recorded in SG&A expense in the Consolidated Statement of Earnings.

r. Research, Development and Engineering

RD&E expense was $5,673 million in 2004, $5,077 million in 2003 and $4,750 million in 2002.

The company incurred expense of $5,167 million in 2004, $4,609 million in 2003 and

$4,247 million in 2002 for scientific research and the application of scientific advances to

the development of new and improved products and their uses as well as services and their

application. Of these amounts, software-related expense was $2,546 million, $2,300 mil-

lion and $1,974 million in 2004, 2003 and 2002, respectively. Included in the expense

was a charge of $9 million and $4 million in 2003 and 2002, respectively, for acquired

in-process R&D.

Expense for product-related engineering was $506 million, $468 million and $503 mil-

lion in 2004, 2003 and 2002, respectively.

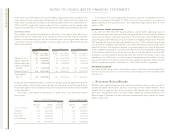

s. 2002 Actions

second quarter actions

During the second quarter of 2002, the company executed several actions in its

Microelectronics Division. The Microelectronics Division is within the company’s Systems and

Technology Group segment. These actions were the result of the company’s announced

intentions to refocus and direct its Microelectronics business to the high-end foundry,

Application Specific Integrated Circuits (ASICs) and standard products, while creating a

technology services business. A major part of the actions related to a significant reduction

in the company’s manufacturing capacity for aluminum-based semiconductor technology.