IBM 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

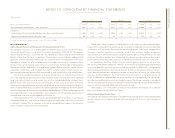

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

86

ibm annual report 2004

The benefit obligation was determined by applying the terms of medical, dental and

life insurance plans, including the effects of established maximums on covered costs,

together with relevant actuarial assumption.

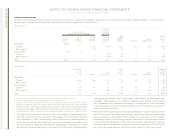

WEIGHTED-AVERAGE DISCOUNT RATE

ASSUMPTIONS USED TO DETERMINE: 2004 2003 2002

The year-end benefit obligation at December 31 «««5.75% «««6.0% «««6.75%

The net periodic post-retirement benefit costs

for years ended December 31 6.0% 6.75% 7.0%

For the years ended December 31, 2004, 2003 and 2002, the plan assets of $50 million,

$14 million and $10 million, respectively, were invested in short-term highly liquid fixed

income securities, and as a result, the expected long-term return on plan assets and the

actual return on those assets were not material for those years.

The company evaluates its actuarial assumptions on an annual basis and considers

changes in these long-term factors based upon market conditions and the requirements

of SFAS No. 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions.”

The discount rate changes did not have a material effect on net postretirement benefit

cost for the years ended December 31, 2004, 2003 and 2002.

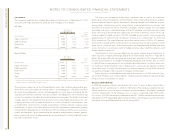

ASSUMED HEALTH CARE COST TREND RATES AT DECEMBER 31: 2004 2003

Health care cost trend rate assumed for next year 10.0% 8.9%

Rate to which the cost trend rate is assumed to decline

(the ultimate trend rate) 5.0% 4.5%

Number of years to ultimate trend rate 54

The health care cost trend rate has an insignificant effect on plan costs and obliga-

tions. A one-percentage-point change in the assumed health care cost trend rate would

have the following effects as of December 31, 2004:

(Dollars in millions)

One-Percentage- One-Percentage-

Point Increase Point Decrease

Effect on total service and interest cost NM NM

Effect on postretirement benefit obligation $«3 $«(5)

NM— Not Meaningful as the impact would be less than $1 million.

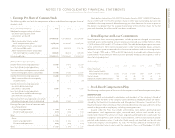

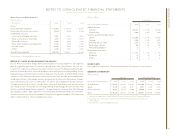

plan assets

The company’s nonpension postretirement benefit plan assets at December 31, 2004 and

2003 are comprised of short-term fixed-income investments.

This plan is not funded. The company makes payments from company funds as they

become due and also maintains a nominal, highly liquid fund balance to ensure payments

are made timely.

recently enacted legislation

The Medicare Prescription Drug Improvement and Modernization Act of 2003 (the

Medicare Act) was signed into law on December 8, 2003. The Act introduces a prescription

drug benefit under Medicare (Medicare Part D) as well as a federal subsidy to sponsors of

retiree health care benefit plans that provide a prescription drug benefit that is at least

actuarially equivalent to Medicare Part D.

The method of determining whether a sponsor’s plan will qualify for actuarial equiva-

lency was issued in January 2005 by the U.S. Department of Health and Human Services

(HHS). While the company is currently evaluating the guidance provided by HHS, based on

the current interpretation of the guidance and in relation to the company’s current plan

design, any savings to the company are expected to be immaterial.

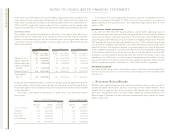

FSP No. 106-2, “Accounting and Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act of 2003,” issued in the second

quarter of 2004, provides guidance on the accounting for the effects of the Medicare Act,

including the accounting for and disclosure of any federal subsidy provided by the

Medicare Act.

The enactment of the Medicare Act was not a “significant event” as defined by SFAS

No. 106 for the company’s nonpension postretirement benefit plans (the Plans) and there-

fore, the company did not remeasure plan assets and obligations. As discussed above, any

federal subsidy related to prescription drug benefits provided under the Plans is expected

to be immaterial, based on the current interpretation of the Medicare Act. As a result, the

company’s accumulated postretirement benefit obligations as of December 31, 2004 and

the net periodic postretirement benefit costs for the year ended December 31, 2004, were

not impacted by the Medicare Act. The company will be required to reflect any changes

to participation rates and other health care cost assumptions, as a result of the Medicare

Act, at the company’s next measurement date in 2005. The impact of any such change is not

expected to have a material impact on the company’s Consolidated Financial Statements.