IBM 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

38

ibm annual report 2004

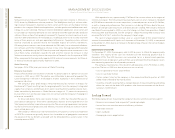

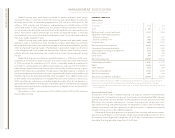

Sales of equipment, which are primarily sourced from equipment returned at end of

lease, represented 36.6 percent of Global Financing’s revenue in 2004 and 40.5 percent

in 2003. The decrease was driven primarily by lower external used equipment sales, due

to a decline in sales to business partners. The gross margin on these sales was 34.6 per-

cent and 30.2 percent in 2004 and 2003, respectively. The increase in gross margin was

primarily due to the improved profitability of internal equipment sales. In addition to sell-

ing assets sourced from end of lease, Global Financing optimizes the recovery of residual

values by leasing used equipment to new customers or extending leasing arrangements

with current customers. The following table presents the recorded amount of unguaran-

teed residual value for sales-type and operating leases at December 31, 2003 and 2004.

In addition, the table presents the residual value as a percentage of the original amount

financed, and a run out of the unguaranteed residual value over the remaining lives of

these leases at December 31, 2004. In addition to the unguaranteed residual value below,

on a limited basis, Global Financing will obtain guarantees of the future value of the equip-

ment scheduled to be returned at end of lease. These third-party guarantees are used in

the determination of lease classifications for the covered equipment and provide protec-

tion against risk of loss arising from declines in equipment values for these assets. The

aggregate asset value associated with the guarantees was $700 million and $615 million

for financing transactions originated during the years ended December 31, 2004 and

2003, respectively. The associated aggregate guaranteed future value at the scheduled

end of lease was $36 million and $26 million for financing transactions originated during

the same time periods, respectively. The cost of guarantees was $4.7 million for each year.

Residual Value

(Dollars in millions)

Total Amortization of 2004 Balance

2008 and

2003 2004 2005 2006 2007 Beyond

Sales-type leases $««««««845 $««««««836 $«262 $«269 $«248 $«57

Operating leases 164 164 78 46 36 4

Total unguaranteed

residual value $«««1,009 $«««1,000 $«340 $«315 $«284 $«61

Related original

amount financed $«27,820 $«25,982

Percentage 3.6% 3.8%

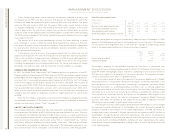

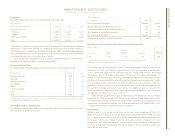

Debt

AT DECEMBER 31: 2004 2003

Debt to equity ratio 6.9x6.9x

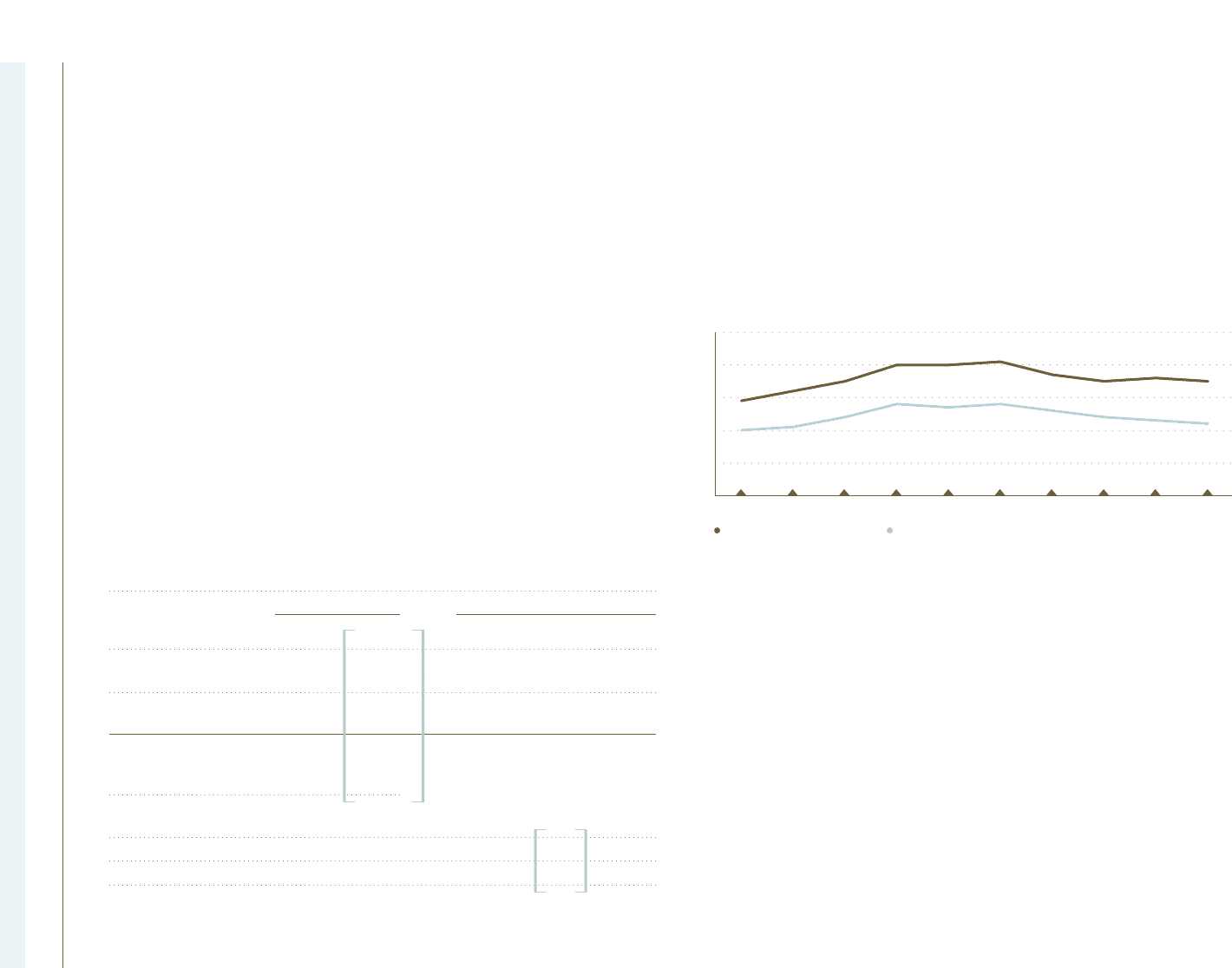

Global Financing funds its operations primarily through borrowings using a debt to equity

ratio of approximately 7 to 1. The debt is used to fund Global Financing assets. The debt

is composed of intercompany loans and external debt. The terms of the intercompany

loans are set by the company to substantially match the term and currency underlying the

receivable. The inter-company loans are based on arm’s-length pricing. The following table

illustrates the correlation between Global Financing Assets and Global Financing Debt.

Both assets and debt are presented in the Global Financing Balance Sheet on page 36.

Global Financing Assets and Debt

(Dollars in millions)

Global Financing Assets Global Financing Debt

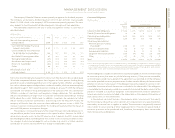

The company’s Global Financing business provides funding predominantly for the com-

pany’s external customers but also provides intercompany financing for the company

(internal), as described in the “Description of Business” on page 35. As previously stated,

the company manages and measures Global Financing as if it were a standalone entity

and accordingly, interest expense relating to debt supporting Global Financing’s external

customer and internal business is included in the “Global Financing Results of Operations”

on page 35 and in note x, “Segment Information,” on pages 87 through 91.

In the company’s Consolidated Statement of Earnings on pages 40 and 41, however,

the interest expense supporting Global Financing’s internal financing to the company is

reclassified from Cost of financing to Interest expense.

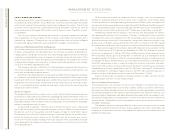

Liquidity and Capital Resources

Global Financing is a segment of the company and as such, is supported by the company’s

liquidity position and access to capital markets. Cash generated from operations in 2004

was deployed to reduce debt and pay dividends to the company in order to maintain an

appropriate debt to equity ratio.

$