IBM 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

52

ibm annual report 2004

Other (Income) and Expense

Other (income) and expense includes interest income (other than from the company’s

Global Financing external business transactions), gains and losses from securities and

other investments, realized gains and losses from certain real estate activity, and foreign

currency transaction gains and losses, and gains and losses from the sale of businesses.

Certain special actions discussed in note s, “2002 Actions” on pages 73 through 76 are

also included in Other (income) and expense.

depreciation and amortization

Plant, rental machines and other property are carried at cost and depreciated over their

estimated useful lives using the straight-line method. Asset retirement obligations (ARO)

liabilities are legal obligations associated with the retirement of long-lived assets. These

liabilities are initially recorded at fair value and the carrying amount of the related assets

is increased by the same amount. These incremental carrying amounts are depreciated

over the useful lives of the related assets.

The estimated useful lives of depreciable properties generally are as follows: buildings,

50 years; building equipment, 20 years; land improvements, 20 years; plant, laboratory

and office equipment, 2 to 15 years; and computer equipment, 1.5 to 5 years.

Capitalized software costs incurred or acquired after technological feasibility has

been established are amortized over periods up to three years. Capitalized costs for inter-

nal-use software are amortized on a straight-line basis over 2 years. (See “Software Costs”

on page 55 for additional information.) Other intangible assets are amortized over peri-

ods up to 7 years.

retirement-related benefits

See note w, “Retirement-Related Benefits,” on pages 78 through 86 for the company’s

accounting policy for retirement-related benefits.

stock-based compensation

The company applies Accounting Principles Board (APB) Opinion No. 25, “Accounting for

Stock Issued to Employees,” and related interpretations in accounting for its stock-based

compensation plans. Accordingly, the company records expense for grants of employee

stock-based compensation awards equal to the excess of the market price of the underly-

ing IBM shares at the date of grant over the exercise price of the stock-related award, if any

(known as the intrinsic value). Generally, all employee stock options are issued with an

exercise price equal to or greater than the market price of the underlying IBM shares at the

grant date and therefore, no compensation expense is recorded. In addition, no compen-

sation expense is recorded for purchases under the Employees Stock Purchase Plan (ESPP)

in accordance with APB Opinion No. 25. This plan is described on page 78. The intrinsic

value of restricted stock units and certain other stock-based compensation issued to

employees as of the date of grant is amortized to compensation expense over the vesting

period of the grant. To the extent awards contain performance criteria that could result in

an employee receiving more or fewer (including zero) shares than the number of units

granted, the unamortized compensation expense is remeasured during the performance

period based upon the intrinsic value at the end of each reporting period.

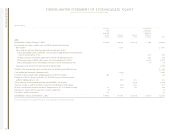

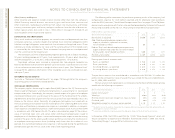

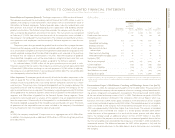

The following table summarizes the pro forma operating results of the company, had

compensation expense for stock options granted and for employee stock purchases

under the ESPP (see note v, “Stock-Based Compensation Plans” on pages 77 and 78), been

determined in accordance with the fair value method prescribed by Statement of Financial

Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation.”

(Dollars in millions except per share amounts)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Net income as reported $«8,430 $«7,583 $«3,579

Add: Stock-based employee compensation

expense included in reported net income,

net of related tax effects 129 76 112

Deduct: Total stock-based employee compensation

expense determined under the fair value method

for all awards, net of related tax effects 1,080 1,101 1,315

Pro forma net income $«7,479 $«6,558 $«2,376

Earnings per share of common stock:

Basic— as reported $«««5.03 $«««4.40 $«««2.10

Basic— pro forma $«««4.47 $«««3.81 $«««1.40

Assuming dilution— as reported $«««4.93 $«««4.32 $«««2.06

Assuming dilution— pro forma $«««4.38 $«««3.74 $«««1.39

The pro forma amounts that are disclosed in accordance with SFAS No. 123 reflect the

portion of the estimated fair value of awards that was earned for the years ended Decem-

ber 31, 2004, 2003 and 2002.

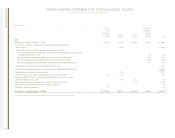

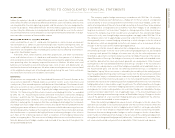

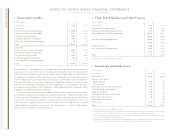

The fair value of stock option grants is estimated using the Black-Scholes option-pricing

model with the following assumptions:

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Option term (years)*555

Volatility** 37.8% 39.9% 40.4%

Risk-free interest rate (zero coupon U.S. treasury note) 3.5% 2.9% 2.8%

Dividend yield 0.8% 0.7% 0.7%

Weighted-average fair value per option granted $«««34 $«««30 $«««28

*The Option term is the number of years that the company estimates, based upon history, that options will be out-

standing prior to exercise or forfeiture.

** To determine volatility, the company measures the daily price changes of the stock over the option term.

In December 2004, the FASB issued SFAS No. 123(R), “Share-based Payment,” which will

require companies to expense costs related to share-based awards in 2005. See note b,

“Accounting Changes” on page 55 for further discussion.