IBM 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

64

ibm annual report 2004

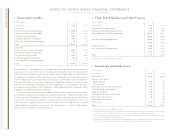

j. Sale and Securitization of Receivables

The company periodically sells receivables through the securitization of loans, leases and

trade receivables. The company retains servicing rights in the securitized receivables for

which it receives a servicing fee. Any gain or loss incurred as a result of such sales is recog-

nized in the period in which the sale occurs.

During 2004, the company renewed its trade receivables securitization facility that

allows for the ongoing sale of up to $500 million of trade receivables. At the time of

renewal, the facility was changed from an uncommitted to a committed facility. This facility

was originally put in place in 2001 primarily to provide backup liquidity and can be

accessed on three days’ notice. The company did not have any amounts outstanding under

the trade receivables securitization facility in 2004 or 2003. In addition, the company has

a securitization program to sell loans receivable from state and local government clients.

This program was established in 1990 and has been used from time to time since then.

No receivables were sold under either of these programs in 2004 or 2003.

At December 31, 2004, there were no state and local receivables securitized and

under the company’s management. At December 31, 2003, $21 million was securitized

and under the company’s management. Servicing assets net of servicing liabilities were

insignificant.

The company utilizes certain of its financing receivables as collateral for nonrecourse

borrowings. Financing receivables pledged as collateral for borrowings were $249 million

and $153 million at December 31, 2004 and 2003, respectively. These borrowings are

included in note k, “Borrowings,” below.

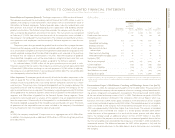

k. Borrowings

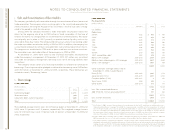

short-term debt

(Dollars in millions)

AT DECEMBER 31: 2004 2003

Commercial paper $«3,151 $«2,349

Short-term loans 1,340 1,124

Long-term debt—current maturities 3,608 3,173

Total $«8,099 $«6,646

The weighted-average interest rates for commercial paper at December 31, 2004 and

2003, were 2.2 percent and 1.0 percent, respectively. The weighted-average interest

rates for short-term loans were 1.5 percent and 2.5 percent at December 31, 2004 and

2003, respectively.

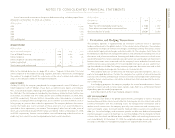

long-term debt

Pre-Swap Activity

(Dollars in millions)

Maturities 2004 2003

U.S. Dollars:

Debentures:

5.875% 2032 $««««««600 $««««««600

6.22% 2027 469 500

6.5% 2028 313 319

7.0% 2025 600 600

7.0% 2045 150 150

7.125% 2096 850 850

7.5% 2013 532 550

8.375% 2019 750 750

3.43% convertible notes*2007 278 309

Notes: 5.9% average 2006–2013 2,724 3,034

Medium-term note program: 4.5% average 2005–2018 3,627 4,690

Other: 3.0% average** 2005–2010 1,555 508

12,448 12,860

Other currencies (average interest rate at

December 31, 2004, in parentheses):

Euros (5.0%)2005–2009 1,095 1,174

Japanese yen (1.2%)2005–2015 3,435 4,363

Canadian dollars (7.8%)2005–2011 9201

Swiss francs (1.5%)2008 220 —

Other (5.5%)2005–2014 513 770

17,720 19,368

Less: Net unamortized discount 49 15

Add: SFAS No. 133 fair value adjustment+765 806

18,436 20,159

Less: Current maturities 3,608 3,173

Total $«14,828 $«16,986

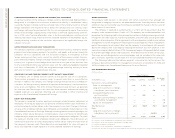

*On October 1, 2002, as part of the purchase price consideration for the PwCC acquisition, as addressed in note c,

“Acquisitions/Divestitures,” on pages 59 and 60, the company issued convertible notes bearing interest at a stated

rate of 3.43 percent with a face value of approximately $328 million to certain of the acquired PwCC partners. The

notes are convertible into 4,764,543 shares of IBM common stock at the option of the holders at any time after the

first anniversary of their issuance based on a fixed conversion price of $68.81 per share of the company’s common

stock. As of December 31, 2004, a total of 720,034 shares had been issued under this provision.

**Includes $249 million and $153 million of debt collateralized by financing receivables at December 31, 2004 and

2003, respectively. See note j, “Sale and Securitization of Receivables” above for further details.

+In accordance with the requirements of SFAS No. 133, the portion of the company’s fixed rate debt obligations that

is hedged is reflected in the Consolidated Statement of Financial Position as an amount equal to the sum of the debt’s

carrying value plus an SFAS No. 133 fair value adjustment representing changes recorded in the fair value of the hedged

debt obligations attributable to movements in market interest rates and applicable foreign currency exchange rates.