IBM 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

85

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

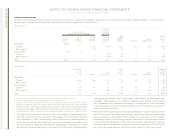

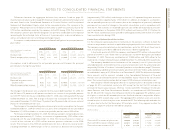

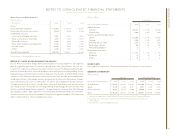

expected benefit payments

The following table reflects the total expected benefit payments to plan participants.

These payments have been estimated based on the same assumptions used to measure

the company’s BO at year-end and include benefits attributable to estimated future com-

pensation increases.

(Dollars in millions)

Total

U.S. Plans U.S. Plans Non-U.S. Plans Non-U.S. Plans Expected

Qualified Non-qualified Qualified Non-qualified Benefit

Payments Payments Payments Payments Payments

2005 $««2,907 $««68 $«1,532 $«««301 $««4,808

2006 2,914 70 1,577 304 4,865

2007 2,952 73 1,655 307 4,987

2008 2,999 76 1,698 305 5,078

2009 3,053 80 1,757 290 5,180

2010–2014 16,315 473 9,520 1,449 27,757

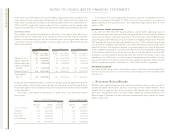

nonpension postretirement benefits

The total cost of the company’s nonpension postretirement benefits for the years ended

December 31, 2004, 2003 and 2002, was $372 million, $335 million and $353 million,

respectively. The company has a defined benefit postretirement plan that provides med-

ical and dental benefits as well as life insurance for U.S. retirees and eligible dependents.

The total cost of this plan for the years ended December 31, 2004, 2003 and 2002, was

$327 million, $294 million and $324 million, respectively. The changes in the benefit obli-

gation and plan assets for this plan are presented in the following table. Effective July 1,

1999, the company established a “Future Health Account” (FHA) for employees who were

more than five years away from retirement eligibility. Employees who were within five years

of retirement eligibility are covered under the company’s prior retiree health benefits

arrangements. Under either the FHA or the prior retiree health benefit arrangements, there

is a maximum cost to the company for retiree health benefits. For employees who retired

before January 1, 1992, that maximum became effective in 2001. For all other employees,

the maximum is effective upon retirement. Effective January 1, 2004, the company amended

its postretirement plan to provide that new hires will no longer be eligible for company-

subsidized benefits.

Certain of the company’s non-U.S. subsidiaries have similar plans for retirees. How-

ever, most of the retirees outside the United States are covered by government-sponsored

and administered programs. The total cost of these plans for the years ended December 31,

2004, 2003 and 2002, was $45 million, $41 million and $29 million, respectively. At

December 31, 2004 and 2003, Retirement and nonpension postretirement benefit obliga-

tions in the Consolidated Statement of Financial Position include non-U.S. postretirement

benefit liabilities of $322 million and $270 million, respectively.

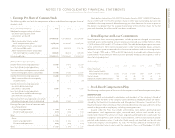

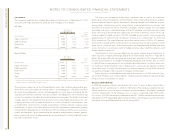

The net periodic postretirement benefit cost for the U.S. plan for the years ended

December 31 includes the following components:

(Dollars in millions)

2004 2003 2002

Service cost $«««40 $«««36 $«««49

Interest cost 337 382 421

Amortization of prior service costs (62) (130) (147)

Recognized actuarial losses 12 630

Divestiture —— (29)

Net periodic postretirement benefit cost $«327 $«294 $«324

The changes in the benefit obligation and plan assets of the U.S. plan for 2004 and 2003

are as follows:

(Dollars in millions)

2004 2003

Change in benefit obligation:

Benefit obligation at beginning of year $««6,181 $««5,882

Service cost 40 36

Interest cost 337 382

Actuarial losses/(gains) (146) 419

Direct benefit payments (518) (538)

Benefit obligation at end of year 5,894 6,181

Change in plan assets:

Fair value of plan assets at beginning of year 14 10

Actual return on plan assets ——

Employer contributions 35 —

Participant contributions 187 153

Benefits paid from trust (186) (149)

Fair value of plan assets at end of year 50 14

Benefit obligation in excess of plan assets (5,844) (6,167)

Unrecognized net actuarial losses 846 1,004

Unrecognized prior service costs (301) (363)

Accrued postretirement benefit liability recognized

in the Consolidated Statement of Financial Position $«(5,299) $«(5,526)