IBM 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

58

ibm annual report 2004

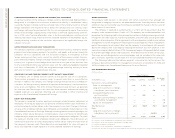

Other Acquisitions. The company acquired 12 other companies that are shown as other

acquisitions in the table on page 57. Seven of the acquisitions were for services-related

companies, which were integrated into the Global Services segment and five were for

software companies, which were integrated into the Software segment. The results of

operations of the acquired businesses were included in the company’s Consolidated

Financial Statements from their respective dates of acquisition. The purchase price alloca-

tions resulted in aggregate goodwill of $711 million, of which $329 million was assigned

to the Software segment and $382 million was assigned to the Services segment. These

assignments were based upon an analysis of the segments expected to benefit from the

acquisitions. The primary items that generated goodwill are the synergies between the

acquired businesses and the company and the premiums paid by the company for the

right to control the businesses acquired. None of the goodwill is deductible for tax pur-

poses. The overall weighted-average life of the intangible assets purchased is 4.8 years.

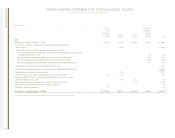

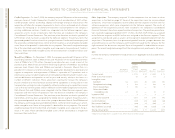

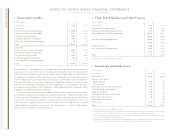

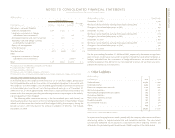

2003

In 2003, the company completed nine acquisitions at an aggregate cost of $2,536 million.

(Dollars in millions)

Rational

Original

Amount

Disclosed

Amortization in First Purchase Total Other

Life (in Years) Qtr. 2003 Adjustments*Allocation Acquisitions

Current assets $«1,179 $««51 $«1,230 $«««19

Fixed assets/non-current 83 28 111 2

Intangible assets:

Goodwill NA 1,365 40 1,405 335

Completed technology 3 229 — 229 12

Client relationships 7 180 — 180 1

Other identifiable

intangible assets 2–5 32 — 32 21

In-process R&D 9— 9—

Total assets acquired 3,077 119 3,196 390

Current liabilities (347) (81) (428) (28)

Non-current liabilities (638) 33 (605) 11

Total liabilities assumed (985) (48) (1,033) (17)

Total purchase price $«2,092 $««71 $«2,163 $«373

*Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

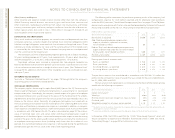

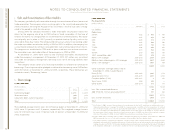

Candle Corporation. On June 7, 2004, the company acquired 100 percent of the outstanding

common shares of Candle Corporation (Candle) for cash consideration of $431 million.

Candle provides services to develop, deploy and manage enterprise infrastructure. The

acquisition will allow the company to provide its clients with an enhanced set of software

solutions for managing an on demand environment and complements the company’s

existing middleware solutions. Candle was integrated into the Software segment upon

acquisition and its results of operations from that date are included in the company’s

Consolidated Financial Statements. The purchase price allocation resulted in goodwill of

$295 million, which has been assigned to the Software segment. The primary items that

generated goodwill are the value of the synergies between Candle and the company and

the acquired assembled workforce, neither of which qualifies as an amortizable intangible

asset. None of the goodwill is deductible for tax purposes. The overall weighted-average

life of the identified amortizable intangible assets acquired in the purchase of Candle is

5.9 years. These identified intangible assets will be amortized on a straight-line basis over

their useful lives.

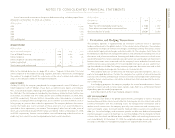

Maersk Data/DMdata. On December 1, 2004, the company purchased 100 percent of the

outstanding common stock of Maersk Data and 45 percent of the outstanding common

stock of DMdata for $792 million. No equity consideration was issued as part of the

purchase price. Maersk Data owned the remaining 55 percent of DMdata’s outstanding

common stock. Maersk Data and DMdata are located in Denmark. Maersk Data is a

provider of IT solutions and offers consultancy, application development, operation and

support to companies and organizations. DMdata is a provider of IT operations and its

core business areas include the operation of centralized and decentralized IT systems, net-

work establishment and operation as well as print and security solutions for clients in a

number of different industries. These acquisitions significantly increase the company’s

Business Performance Transformation Services (BPTS) capabilities in serving clients in the

transportation and logistics industry globally, while also enhancing its capabilities in areas

such as financial services, public sector, healthcare and the food and agriculture industries.

Both Maersk Data and DMdata were integrated into the Global Services segment upon

acquisition and their results of operations from that date are included in the company’s

Consolidated Financial Statements. The purchase price allocation resulted in goodwill of

$426 million, which has been assigned to the Global Services segment. The primary items

that generated goodwill are the value of the synergies between Maersk Data/DMdata and

the company and the acquired assembled workforce, neither of which qualify as an amorti-

zable intangible asset. None of the goodwill is deductible for tax purposes. The overall

weighted-average life of the identified amortizable intangible assets acquired in the pur-

chase is 4.7 years. These identified intangible assets will be amortized on a straight-line

basis over their useful lives.