IBM 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

27

ibm annual report 2004

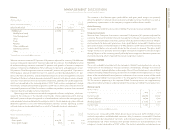

continuing operations

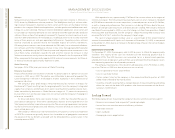

The increase in the company’s 2003 Income from continuing operations and diluted

earnings per share from continuing operations as compared to 2002 was due to:

•The results of the company’s productivity and efficiency initiatives, including the

benefits from the 2002 Microelectronics and productivity restructuring actions

•Stronger demand associated with the improving economy (especially during the

fourth quarter) and continued market share gains

•The charges recorded in 2002 for the 2002 actions (See note s, “2002 Actions” on

pages 73 through 76 for additional information.)

•Favorable impact of currency translation, partly offset by related hedging activities

The increase in revenue in 2003 as compared to 2002 was due to:

•Stronger demand associated with the improving economy (especially during the

fourth quarter) and continued market share gains

•The impact of the fourth quarter 2002 acquisition of PricewaterhouseCoopers’ con-

sulting business (PwCC) and the first quarter 2003 acquisition of Rational, partially

offset by decreases in revenue due to Systems and Technology Group divestitures

•The favorable impact of currency translation, which contributed 7.0 points of the

9.8 percent revenue increase

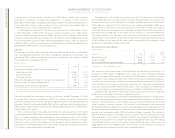

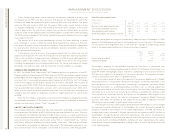

Revenue for all industry sectors increased in 2003 on an as-reported basis, which has

been reclassified to conform with the 2004 presentation. The Financial Services sector

(12.5 percent), Public sector (14.3 percent), and Industrial sector (14.8 percent) were

among the strongest, with continued growth (12.5 percent) in the Small & Medium

Business sector. These results reflect the company’s go-to-market strategy of designing

industry-specific solutions.

Full-year geographic revenue increased across all geographies. In the Americas

revenue increased 5 percent. U.S. (3 percent) and Canada (13 percent) revenue grew as

did Latin America (6 percent), notably in Brazil (26 percent). In Europe/Middle East/Africa,

revenue increased 20 percent and was highest in the U.K. (17 percent), Central Europe and

Middle East and Africa. In Asia Pacific revenue increased 13 percent, while 2003 revenue

for Japan, which is about 60 percent of the region’s revenue, increased 7 percent com-

pared with 2002. Australia/New Zealand (32 percent) also achieved strong performance

within Asia Pacific.

While OEM revenue, representing three percent of the company’s revenue, declined,

the decline was smaller than the prior year decline. The year-to-year percent change in

revenue (a decline of 21.4 percent) reflects, in large part, the company’s exit from its inter-

connect products business in 2002, as well as sluggish demand from certain OEM clients.

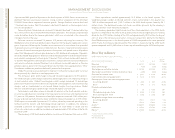

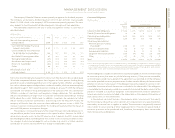

The following is an analysis of external segment results.

Global Services

Global Services revenue increased 17.3 percent (9.3 percent at constant currency) in 2003

versus 2002. SO revenue increased 14.2 percent in 2003 primarily driven by new signings.

SO continued to demonstrate its competitive advantage in delivering on demand solutions

by leveraging its business transformation skills and its scale during 2003. e-business

Hosting Services, an offering that provides Web infrastructure and application manage-

ment as an Internet-based service, continued its strong pattern of revenue growth. BCS

revenue increased 37.5 percent in 2003 due to the acquisition of PwCC in the fourth quarter

of 2002. ITS revenue increased 3.3 percent due to the favorable impact of currency move-

ments. During 2003, the company changed its reporting for certain OEM hardware sales

to the company’s clients from gross to net revenue treatment based upon a review of the

terms of these sales. The company determined that the agent-like characteristics of

these transactions were more appropriately recorded on a net revenue basis. Due to the

amounts involved, the prior year amounts were not adjusted. As a result of this change in

2003, revenue and costs for ITS were lower by $279 million in 2003 as compared to 2002,

partially offsetting the currency impact discussed above. This change had no impact on

the company’s gross profit dollars, net income or cash flows. The company signed $55 bil-

lion of services contracts in 2003, an increase of $2 billion versus 2002. The estimated

services backlog at December 31, 2003, was $120 billion.

Hardware Segments

Systems and Technology Group revenue increased 1.7 percent (decreased 4.2 percent at

constant currency) in 2003 versus 2002. xSeries server products revenue increased 16.8 per-

cent due to growth in sales of high-volume servers supported by strong growth in blades.

The pSeries server revenues increased 12.5 percent due to strong demand for the 64-bit

POWER systems across both the low-end and high-end server offerings. Revenue from the

zSeries servers increased 7.4 percent. The total delivery of zSeries computing power as

measured in MIPS increased more than 28 percent in 2003 as compared to 2002. This

increase was offset by lower average price per MIPS in 2003 of 19 percent versus 2002.

Revenue from the iSeries servers increased in all four quarters of 2003 when compared to

2002. Storage Systems revenue increased 9.8 percent due to growth in external disk and

tape products.

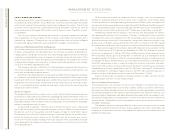

Microelectronics revenue declined 31.6 percent in 2003 versus 2002 driven by actions

taken in 2002 to refocus and redirect its business to high-end foundry, ASICs and standard

products. These actions included the divestiture of multiple non-core businesses. There

was also sluggish demand from certain OEM clients that contributed to this decline.

Personal Systems Group revenue increased 3.1 percent (down 2.5 percent at constant

currency) in 2003 versus 2002. Revenue from mobile personal computers increased

(10.9 percent) due to strong demand and was offset by lower desktop personal computer

revenue (4.0 percent). The decreased desktop revenue primarily reflects the fact that

increased volume gains were not enough to offset a reduction in price due to decreasing

commodity costs.