IBM 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

79

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

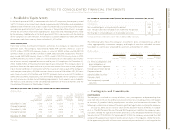

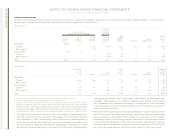

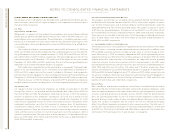

(Dollars in millions)

U.S. Non-U.S. Total

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002 2004 2003 2002 2004 2003 2002

Total retirement-related plans—cost /(income) $«827 $««««67 $«(154) $«617 $«295 $«(17) $«1,444 $«362 $«(171) *

Comprise:

Defined benefit and contribution pension plans— cost/(income) $«500 $«(227) $«(478) $«572 $«254 $«(46) $«1,072 $«««27 $«(524)

Nonpension postretirement benefits— cost 327 294 324 45 41 29 372 335 353

*Includes amount for discontinued operations cost of $77 million for 2002.

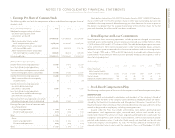

accounting policy

Defined Benefit Pension and Nonpension Postretirement Benefit Plans

The company accounts for its defined benefit pension plans and its nonpension post-

retirement benefit plans using actuarial models required by SFAS No. 87, “Employers’

Accounting for Pensions,” and SFAS No. 106, “Employers’ Accounting for Postretirement

Benefits Other Than Pensions,” respectively. These models use an attribution approach that

generally spreads individual events over the service lives of the employees in the plan.

Examples of “events” are plan amendments and changes in actuarial assumptions such as

discount rate, rate of compensation increases and mortality. The principle underlying this

required attribution approach is that employees render service over their service lives on

a relatively smooth basis and therefore, the income statement effects of pensions or non-

pension postretirement benefit plans are earned in, and should follow, the same pattern.

One of the principal components of the net periodic pension cost/(income) calcula-

tion is the expected long-term rate of return on plan assets. The required use of expected

long-term rates of return on plan assets may result in recognized pension income that is

greater or less than the actual returns of those plan assets in any given year. Over time,

however, the expected long-term returns are designed to approximate the actual long-term

returns and therefore result in a pattern of income and expense recognition that more closely

matches the pattern of the services provided by the employees. Differences between actual

and expected returns are recognized in the calculation of net periodic pension cost/

(income) over five years as provided for in SFAS No. 87.

These expected returns on plan assets are developed by the company in conjunction

with external advisors, and take into account long-term expectations for future returns and

investment strategy. This assumption is tested for reasonableness against the historical

return average, usually over a ten-year period.

The discount rate assumptions used for pension and nonpension postretirement bene-

fit plan accounting reflect the prevailing rates available on high-quality, fixed-income debt

instruments with maturities that match the benefit obligation. The rate of compensation

increase is another significant assumption used in the actuarial model for pension

accounting and is determined by the company, based upon its long-term plans for such

increases. For retiree medical plan accounting, the company reviews external data and its

own historical trends for health care costs to determine the health care cost trend rates.

As required by SFAS No. 87, for instances in which pension plan assets are less than

the accumulated benefit obligation (ABO) as of the end of the reporting period (defined

as an unfunded ABO position), a minimum liability equal to this difference is recognized in

the Consolidated Statement of Financial Position. The ABO is the present value of the actu-

arially determined company obligation for pension payments assuming no further salary

increases for the employees. The offset to the minimum liability is a charge to equity, net

of tax. In addition, any prepaid pension asset in excess of unrecognized prior service cost

must be reversed through a net-of-tax charge to equity. The charge to equity is included in

the Accumulated gains and (losses) not affecting retained earnings section of Stockholders’

equity in the Consolidated Statement of Financial Position.

The company uses a December 31 measurement date for the majority of its pension

plans and nonpension postretirement plans.

Defined Contribution Pension Plans

The company records pension expense for defined contribution plans when the employee

renders service to the company, essentially coinciding with the cash contributions to

the plans.