IBM 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

70

ibm annual report 2004

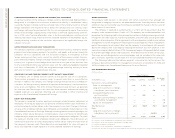

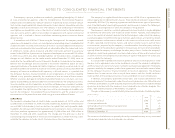

settlement of some claims, and a stipulated remedy on remaining claims if plaintiffs prevail

on appeal. Under the terms of the settlement, the judge will issue no further rulings on

remedies. This settlement, together with a previous settlement of a claim referred to as the

partial plan termination claim resulted in the company taking a one-time charge of $320 mil-

lion in the third quarter of 2004.

This agreement ends the litigation on all claims except the two claims associated with

IBM’s cash balance formula. The company will appeal the rulings on these claims. The com-

pany continues to believe that its pension plan formulas are fair and legal. The company

has reached this agreement in the interest of the business and the company shareholders,

and to allow for a review of its cash balance formula by the Court of Appeals. The com-

pany continues to believe it is likely to be successful on appeal.

The agreement stipulates that if the company is not successful on appeal of the two

remaining claims, the agreed remedy will be increased by up to $1.4 billion—$780 million

for the claim that the company’s cash balance formula is age discriminatory, and $620 mil-

lion for the claim that the method used to establish opening account balances during the

1999 conversion discriminated on the basis of age (referred to as the “always cash balance”

claim). The maximum additional liability the company could face in this case if it is not success-

ful on appeal is therefore capped at $1.4 billion.

In the coming months, class members will receive formal notice of the settlement and

the judge will hold a fairness hearing. Once the settlement is approved, IBM will appeal

the liability rulings for the cash balance claims. As a result, the entire process could take

up to two years before reaching final conclusion.

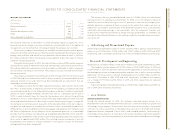

The company is the defendant in an action brought by Compuware in the District

Court for the Eastern District of Michigan in 2002, asserting causes of action for copyright

infringement, trade secret misappropriation, Sherman Act violations, tortious interference

with contracts and unfair competition under various state statutes. The company asserted

counterclaims for copyright infringement and patent infringement in the Michigan action.

The court ruled that the company’s patent claims against Compuware will be addressed in

a separate trial, which has not yet been scheduled, and granted Compuware’s motion to

dismiss the company’s copyright infringement claims on summary judgment. The court

granted in part and denied in part the company’s motion for summary judgment dismiss-

ing Compuware’s antitrust claims. Trial began during the week of February 14, 2005. The

company has also asserted patent infringement claims against Compuware in a separate

action that the company brought in the District Court for the Southern District of New York

in January 2004.

The company is a defendant in an action filed on March 6, 2003 in state court in Salt

Lake City, Utah by The SCO Group. The company removed the case to Federal Court in

Utah. Plaintiff is successor in interest to some of AT&T’s Unix IP rights, and alleges copyright

infringement, unfair competition, interference with contract and breach of contract with

regard to the company’s distribution of AIX and contribution of unspecified code to Linux.

The company has asserted counterclaims, including breach of contract, violation of the

Lanham Act, unfair competition, intentional torts, unfair and deceptive trade practices,

breach of the General Public License that governs open source distributions, patent

infringement, promissory estoppel and copyright infringement. Trial was scheduled for

November 1, 2005 but the scheduling order has been suspended and is under revision.

On June 2, 2003 the company announced that it received notice of a formal, nonpub-

lic investigation by the Securities and Exchange Commission (SEC). The SEC is seeking

information relating to revenue recognition in 2000 and 2001 primarily concerning certain

types of client transactions. The company believes that the investigation arises from a sep-

arate investigation by the SEC of Dollar General Corporation, a client of the company’s

Retail Stores Solutions unit, which markets and sells point-of-sale products.

On January 8, 2004, the company announced that it received a “Wells Notice” from

the staff of the SEC in connection with the staff’s investigation of Dollar General

Corporation, which as noted above, is a client of the company’s Retail Stores Solutions unit.

It is the company’s understanding that an employee in the company’s Sales & Distribution

unit also received a Wells Notice from the SEC in connection with this matter. The Wells

Notice notifies the company that the SEC staff is considering recommending that the SEC

bring a civil action against the company for possible violations of the U.S. securities laws

relating to Dollar General’s accounting for a specific transaction, by participating in and

aiding and abetting Dollar General’s misstatement of its 2000 results. In that transaction,

the company paid Dollar General $11 million for certain used equipment as part of a sale

of IBM replacement equipment in Dollar General’s 2000 fourth fiscal quarter. Under the

SEC’s procedures, the company responded to the SEC staff regarding whether any action

should be brought against the company by the SEC. The separate SEC investigation noted

above, relating to the recognition of revenue by the company in 2000 and 2001 primarily

concerning certain types of client transactions, is not the subject of this Wells Notice.

In January 2004, the Seoul District Prosecutors Office in South Korea announced it had

brought criminal bid rigging charges against several companies, including IBM Korea and

LG IBM (a joint venture between IBM Korea and LG Electronics) and had also charged

employees of some of those entities with, among other things, bribery of certain officials of

government-controlled entities in Korea, and bid rigging. IBM Korea and LG IBM cooper-

ated fully with authorities in these matters. A number of individuals, including former IBM

Korea and LG IBM employees, were subsequently found guilty and sentenced. IBM Korea

and LG IBM were also required to pay fines. IBM Korea has been debarred from doing busi-

ness directly with certain government controlled entities in Korea. The orders, imposed at

different times, cover a period of no more than a year from the date of issuance. The

orders do not prohibit IBM Korea from selling products and services to business partners

who sell to government controlled entities in Korea. In addition, the U.S. Department of

Justice and the SEC have both contacted the company in connection with this matter.